What Is a Medical Billing Audit? A Complete Guide 2026

- Updated Date Jan 24, 2026

- Medical Audit & Reporting

- Follow

Medical billing audits help clinics and billing teams find errors before they turn into denied claims or lost revenue. By reviewing billing processes early, practices can reduce rework, improve accuracy, and lower compliance risk.

In this 2026 guide, you’ll learn what a medical billing audit is, what auditors review, the different types of audits, how the process works, and how to prepare your team for a successful audit.

What is a Medical Billing Audit?

A medical billing audit is a systematic review of a practice’s billing activities to ensure claims are accurate, complete, and compliant with payer and regulatory requirements. It involves examining billing records, supporting documentation, and the full claim workflow to identify errors, gaps, or patterns that could lead to denials, payment delays, or compliance issues.

What a medical billing audit reviews

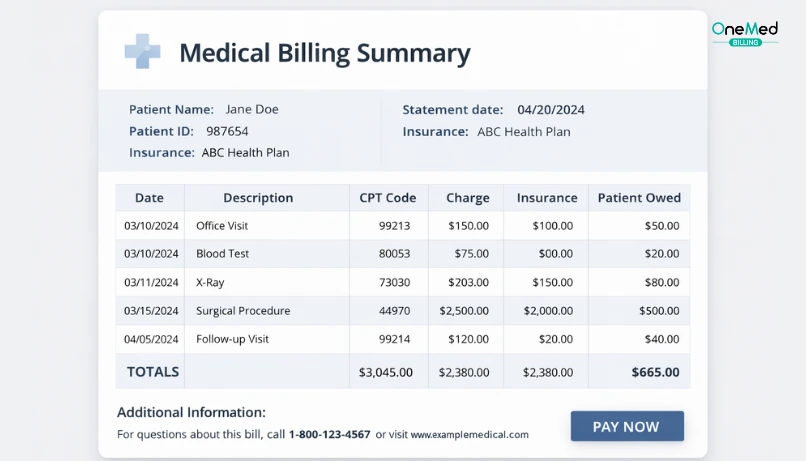

A medical billing audit reviews every key step in the billing process to make sure claims are created and processed correctly. This includes checking patient demographics and insurance information, verifying that services billed match the documentation, and confirming that claims were submitted to the correct payer. Audits also review payments, adjustments, denials, and follow-up activity to identify errors, missed revenue, or workflow gaps that need improvement.

What a medical billing audit is not

A medical billing audit is not just a review of codes or a one-time check of a few claims. It is broader than a coding audit and looks at the full billing process, not only whether codes were selected correctly. It is also not only for practices with serious problems. Many clinics use billing audits as a preventive step to catch small issues early, improve workflows, and avoid future denials or compliance risks.

Why Medical Billing Audits Matter?

Medical billing mistakes are easy to miss, but they can create big problems later. A billing audit helps you catch issues early, fix them faster, and keep claims moving without constant delays.

1. Reduce denials and rework

Billing audits help identify missing information, incorrect payer details, and workflow errors that often cause denials. Fixing these issues early reduces rework and saves time for billing teams.

2. Protect revenue and cash flow

By catching underbilling, overbilling, and missed charges, audits help ensure the practice is paid correctly and on time. This improves cash flow and reduces avoidable write-offs.

3. Support compliance and reduce risk

Audits help confirm that billing processes follow payer rules and documentation standards. This lowers the risk of repeated errors and supports compliance efforts across the practice.

4. Improve billing accuracy and efficiency

Reviewing billing workflows highlights gaps and inefficiencies. Addressing these issues leads to cleaner claims, faster processing, and more consistent results.

Types Of Medical Billing Audits

Medical billing audits can be done in different ways, depending on the goal of the review and the level of detail needed. Understanding the main types of billing audits helps practices choose the right approach and focus on the areas that need the most attention.

1) Internal vs External Medical Billing Audits

Internal audits are done by your own team. These are usually routine checks to make sure billing work stays accurate over time. Many practices use internal audits to spot common mistakes, train staff, and improve workflows before problems grow. Internal audits are also easier to run more often because you control the timing and process.

External audits are done by an outside expert or agency. They give you an objective review and often catch issues an internal team may miss. External audits are useful when denials keep increasing, revenue feels unstable, or leadership wants a clear picture of what is working and what is not. Practices also prefer external audits when they need a deeper review with less bias.

2) Pre-bill vs Post-bill Audits

A pre-bill audit happens before a claim is submitted. The goal is prevention. This type of audit checks whether the claim is complete and correct before it goes out, so errors do not turn into denials. Pre-bill audits are helpful for high-value claims, new providers, new services, or when a practice wants cleaner claims from day one.

A post-bill audit happens after the claim has already been submitted, and sometimes after payment is received. The goal here is to find patterns and fix root causes. Post-bill audits help you understand why denials are happening, where money is getting stuck, and which mistakes repeat across the team. This type is useful for improving long-term billing performance, not just fixing one claim.

3) Focused (Targeted) Billing Audits

A focused or targeted audit is when you audit one specific area instead of reviewing everything. This is common because many practices already know where problems are happening. For example, you may run a targeted audit for denial-heavy payers, certain CPT codes, high-dollar claims, recurring eligibility issues, or one location that has higher rejections.

Targeted audits are practical because they save time and get faster results. They help practices fix what is hurting revenue the most, without doing a full audit of the entire billing process.

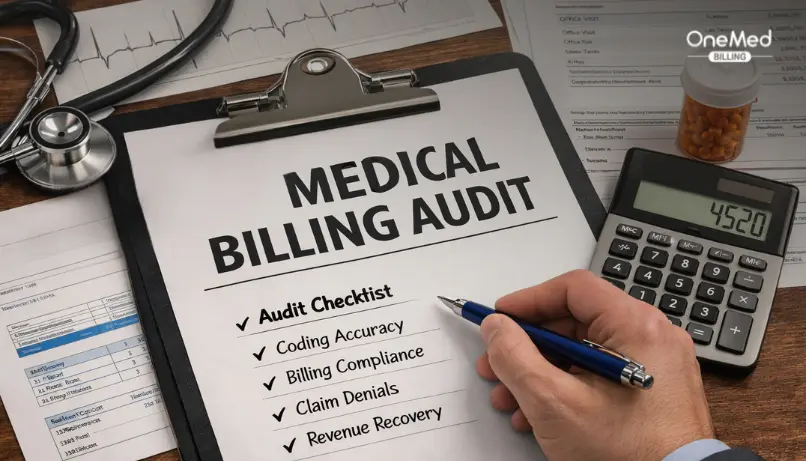

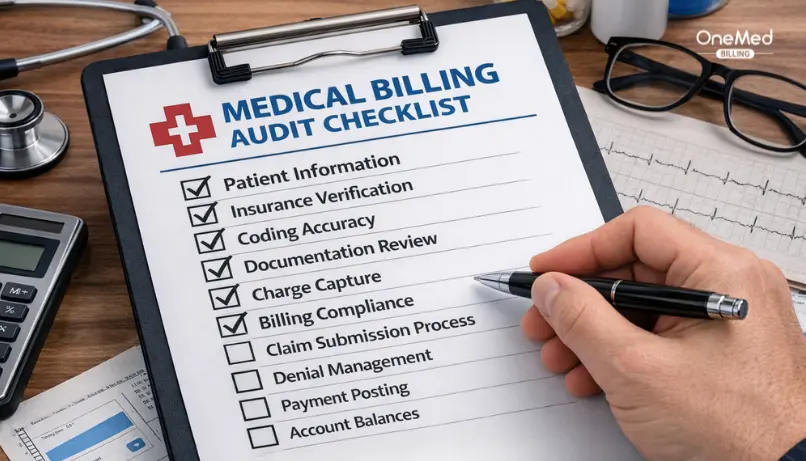

Medical Billing Audit Checklist

Auditors review a few core areas that impact claim accuracy, denials, and payment speed. Use this checklist to understand what they check and where issues usually start.

Patient and insurance verification checks

- Patient name, DOB, address, and other demographics match the claim

- Insurance is active for the date of service

- Correct primary vs secondary insurance is selected

- Member ID, group number, and payer details are entered correctly

Documentation and coding alignment checks

- Diagnosis supports the services billed

- Provider notes support the level of service billed

- CPT/HCPCS and ICD-10 codes are accurate

- Modifiers are used correctly and supported by documentation

Authorization and compliance checks

- Prior authorization is on file when required

- Authorization covers the correct service and date range

- Required documents are complete and easy to access

- Billing follows payer rules and internal policies

Denials and follow-up checks

- Denials are tracked and categorized by reason

- Appeals are filed when appropriate and on time

- Follow-up is consistent and documented

- Root causes are identified and fixed through training or workflow updates

Preparing for an audit requires time, access to records, and coordination across teams. In complex billing environments, going for a medical billing audit by experts often brings clarity and faster resolution.

Medical Billing Audit Process (step-by-step)

A medical billing audit follows a clear process so issues are identified, explained, and corrected in the right order. Each step builds on the previous one to improve accuracy and prevent repeat errors.

Step 1: Define the audit goal and scope

The first step is to decide what the audit should focus on. Common goals include reducing denials, checking compliance, finding revenue leakage, or validating current billing processes. Defining the scope early helps keep the audit focused and prevents wasted time reviewing areas that are not a priority.

Step 2: Choose the audit sample

Next, a sample of claims or encounters is selected for review. Many audits start with a small sample to establish a baseline. If patterns or issues are found, the sample can be expanded to confirm how widespread the problem is across providers, locations, or time periods.

Step 3: Review claims, documentation, and workflow

This is the core of the audit. Auditors compare what was documented by the provider, how it was coded, what was billed, and how it was paid. They also review the workflow to see where errors may be introduced, such as during registration, charge entry, or claim submission.

Step 4: Report findings and patterns

Once the review is complete, findings are documented and organized by impact. High-risk and high-frequency issues are highlighted first so the team knows where to focus. Clear reporting helps billing teams and leadership understand not just what went wrong, but why it happened.

Step 5: Fix root causes and re-audit

The final step is action. This may include staff training, updated templates, system edits, or workflow changes. After fixes are applied, a follow-up audit is done to confirm improvement and ensure the same issues do not continue.

Common Errors Found in Medical Billing Audits

Medical billing audits often uncover the same types of errors across practices. These issues usually fall into three main categories, based on where they occur in the billing process.

Front-end errors

Front-end errors happen before the claim is created and are one of the most common causes of rejections and denials. Auditors frequently find incorrect insurance information, missing patient details, or eligibility that was not verified for the date of service. Errors in primary and secondary insurance setup also fall into this category and can delay payment even when services are billed correctly.

Coding and documentation gaps

These errors occur when the documentation does not fully support what was billed. Auditors often see unsupported codes, missing or incorrect modifiers, and clinical notes that lack enough detail to justify the level of service. Even when services were performed correctly, weak documentation can lead to downcoding, denials, or compliance risk.

Back-end errors

Back-end errors happen after the claim is submitted. Common findings include payment posting mistakes, incorrect adjustments, and delays or gaps in denial follow-up. When denials are not tracked or addressed consistently, small issues can turn into larger revenue losses over time.

How Often Should a Practice Perform a Billing Audit?

There is no one-size-fits-all schedule for medical billing audits. How often a practice should audit depends on factors like claim volume, denial rates, payer mix, and how often changes occur, such as adding new providers, services, or locations. Practices with frequent changes or higher denial rates usually benefit from more regular audits.

Many clinics follow a quarterly, biannual, or annual audit schedule. Quarterly audits work well for high-volume practices or those actively fixing billing issues. Biannual audits are common for stable practices that want routine checks without heavy disruption. Annual audits are often used as a broad review to confirm overall accuracy and compliance. The right cadence is the one that helps catch issues early and prevents the same errors from repeating.

How to Prepare for a Medical Billing Audit?

Preparing for a medical billing audit does not have to be overwhelming. A little organization and clarity upfront can make the audit process smoother and help teams get more useful results from the review.

- Organize all billing records, including claims, EOBs or ERAs, and payment reports

- Ensure patient demographics and insurance information are up to date

- Confirm that documentation is complete and easy to access

- Gather prior authorizations and referral records where required

- Review internal billing workflows and note who handles each step

- Identify recent denial trends or problem areas to focus on

- Assign clear roles and timelines to the audit team

- Be prepared to document findings and track follow-up actions

If you’re looking for a practical, step-by-step walkthrough, our guide on how to do a medical billing audit explains the process in detail

Conclusion

A medical billing audit is not about finding faults or pointing fingers. It’s about understanding where your billing process quietly breaks down and fixing those gaps before they turn into denials or lost revenue. Most billing issues don’t come from one big mistake, they come from small errors repeated every day.

The most effective audits start small and stay consistent. Review a limited set of claims, focus on the patterns that matter most, fix the root causes, and check again. When audits are treated as a regular improvement tool instead of a one-time event, they help billing teams work smarter, reduce stress, and keep revenue predictable.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is the goal of a medical billing audit?

The goal of a medical billing audit is to identify billing errors, improve accuracy, and prevent denials or payment delays. It helps practices find weak points in their billing process and fix them before they affect revenue.

Is a medical billing audit the same as a coding audit?

No. A coding audit focuses only on whether codes are selected correctly. A medical billing audit reviews the entire billing process, including registration, documentation, claim submission, payments, and follow-up.

What’s the difference between pre-bill and post-bill audits?

Pre-bill audits review claims before they are submitted to prevent errors early. Post-bill audits review claims after submission or payment to identify patterns, root causes, and areas for long-term improvement.

Can a medical billing audit help reduce denials?

Yes. By identifying common error patterns and fixing them at the source, medical billing audits help reduce repeat denials and improve clean claim rates over time.