What Does A Clearinghouse Do During Claim Submission?

- Updated Date January 17th, 2026

- Claims Submission

- Follow

Clean claims are not luck. They come from a clear process that starts at the clearinghouse. In a few minutes, it checks the file, routes it, and sends a short status. We’ll walk through that flow so you can keep first pass acceptance high.

What Is a Clearinghouse?

A clearinghouse is a secure intermediary between your billing system and the payor. It converts claims to the HIPAA X12 format (e.g., 837), validates required segments and fields, runs basic data edits, maps the correct payor ID, and transmits the claim over an approved connection. It also returns electronic acknowledgments, 999 (receipt and format validation), and 277CA (intake validation result), so your team knows whether the submission was received and passed initial validation or needs correction.

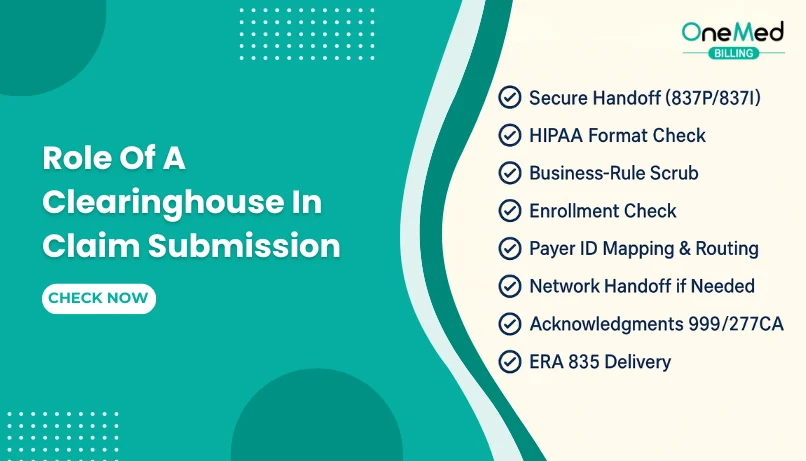

What Does A Clearinghouse Do During Claim Submission?

Below is a simple overview of the clearinghouse’s role during claim submission, showing its place in the process and when providers should take action.

1. Create The Claim File

In your PM or EHR, pick the patient and visit, enter diagnoses and procedures, and the system builds an electronic claim file (837P for professional or 837I for institutional). The clearinghouse is not involved yet. The claim sits in your outbox, ready to send. Before you submit, do a quick accuracy pass so simple errors do not bounce the claim, confirm the payor and plan, subscriber ID, and demographics, NPIs, dates, place of service, codes, and required modifiers.

2. Secure Handoff To The Clearinghouse

Your PM or EHR encrypts the claim file and sends it to the clearinghouse over a secure channel. The clearinghouse receives it, logs a batch ID and timestamp, and places it in the processing queue. You should see the batch appear in the portal within a short window. If it does not, check credentials and connection settings, then resend. This step protects PHI and creates a clear audit trail before any content checks begin.

3. Format and Compliance Check

The clearinghouse reads the 837 file and validates it against HIPAA X12 rules. It confirms required segments are present, fields use the right lengths and characters, and dates and IDs are in valid formats. If the structure is broken or something required is missing, the claim stops here, and you get a 999 or portal message showing the error. Fix the named field in your PM or EHR, regenerate the claim, and resend. If it passes, the file moves on to business-rule scrubbing.

4. Business-rule Scrub

After the file passes format checks, the clearinghouse runs practical edits to catch everyday mistakes. It checks NPIs and TINs, subscriber or member IDs, dates and place of service, CPT and ICD pairing with required modifiers, units and charges, prior authorization numbers, and the payer ID. If something is off, you will see a clear edit message in the portal pointing to the field. Fix the issue in your PM or EHR at the source and resubmit the same day. Update provider, payor, or template records so the error does not return on future claims.

5. Enrollment Check

The clearinghouse confirms that your payor connections are active for claim submission and ERA or EFT under the correct NPI and TIN. If an enrollment is missing or still pending, the portal will show a warning, and the claim may be rejected or stalled. Use the clearinghouse enrollment tool to submit or link the payor’s forms, then watch the status until it shows approved. Some payors require separate enrollments by location or plan, so verify each one before sending your first batch. Once approved, the route goes live, and claims move normally.

6. Payer ID Mapping and Routing

The clearinghouse takes the payor you selected and matches it to the correct payer ID in its network, then chooses the best route for delivery. If more than one ID exists for the same brand (for example, Medicaid MCOs, TPAs, or state-specific BCBS plans), the wrong choice will cause front-door rejects, so confirm the exact ID your clearinghouse supports for that plan and state. Once mapped, the claim is sent on the active route; if the payor sits on a partner network, the clearinghouse handles that handoff in the background.

For payors that do not take electronic claims, some medical billing clearinghouses convert to paper and mail on your behalf. Keep your payor list up to date with the approved IDs and test new routes with a small batch before sending volume.

7. Network Handoff When Needed

If the payor is not on your clearinghouse’s network, the claim is forwarded to a partner network so it still reaches the correct payor. This handoff is tracked with batch or interchange IDs, and you may see acknowledgments from the partner as well as the clearinghouse. No action is needed unless you get a rejection. If that happens, confirm the payor ID, check enrollment for that route, fix the named field in your PM or EHR, and resend.

8. Send Acknowledgments To Providers

After a claim is routed, the clearinghouse sends machine responses so providers can see the status without calling the payor. A 999 usually arrives within minutes or hours and confirms the file was received and passed basic format checks. If it fails, fix the file issue in your PM or EHR, regenerate, and resend. A 277CA shows whether the claim was accepted at the front door or rejected with a specific reason. Correct the named field, confirm the payor ID if needed, and resubmit the same day. Some payors send additional 277 updates as the claim moves, but the first 277CA is the one to act on during submission. These acknowledgments create a clear audit trail and keep first-pass acceptance high.

9. Hold and Resubmit The Loop

If a claim fails format checks or gets a 277CA reject, the clearinghouse holds it in a visible worklist. Providers review the reason, fix the issue at the source in the PM or EHR, regenerate the claim, and resubmit the same day. The portal keeps the history, timestamps, and who touched the claim so you can audit progress. If the same error repeats, update provider or patient profiles, payor records, templates, or enrollments so it does not come back. Most portals also let you filter by error type and export a daily reject list to track clean-up and first-pass acceptance.

10. Status and Basic Reporting

The clearinghouse portal gives providers a quick view of submission health. You can see batches sent, 999 received, 277CA rejects, time to acceptance, top error reasons, and routes by payor. Check this dashboard each morning to clear rejects and spot repeat issues. Track a few simple KPIs over time, like first pass acceptance, time to first 277CA, reject rate, and clean claim rate. Set email alerts for failed 999s or sudden spikes in rejects so the team can act the same day. Export a weekly report to share trends with billing and the front desk so fixes happen at the source.

11. Transition To Payment Phase

Once the claim is accepted at the front door, it moves into payor processing. The clearinghouse’s role shifts from submission to delivery of payment data. When the payor finishes, the clearinghouse sends the 835 ERA to your billing system so you can post payments, adjustments, and patient responsibility. Denials and short pays move to follow up. If coordination of benefits is present, secondary claims can generate from the ERA and route automatically.

Conclusion

A clearinghouse is the quality gate and traffic controller for claim submission. It validates the file, scrubs basic errors, routes to the correct payor, and returns 999 and 277CA so providers know what to fix. When teams check those files each day and resubmit the same day, first-pass acceptance rises and cash moves faster. Keep enrollments active, use the correct payor IDs, and fix repeat issues at the source in your PM or EHR. A quick morning dashboard review is enough to catch problems early and keep claims flowing to ERA and payment.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What does a clearinghouse do for claims submission?

Receives the 837 file, validates HIPAA X12 format, runs basic edits, maps the correct payor ID, routes the claim, and returns 999 and 277CA status.

What happens when claims are submitted in batches using a clearinghouse?

The batch is encrypted and queued, each claim is validated and routed, 999 confirms receipt, 277CA shows accept or reject, and rejects are listed to fix and resend.

What is the purpose of a clearinghouse?

To cut front-end rejects, standardize files, route to many payors through one connection, and give fast status so issues are fixed the same day.

What is important when you send the claim through a clearinghouse?

Active enrollments, the correct payor ID, clean demographics and NPIs, proper codes and dates, and same-day review of 999 and 277CA.