Medical Billing Vs Revenue Cycle Management: The Comparison

- Updated Date January 17th, 2026

- Revenue Cycle Management

- Follow

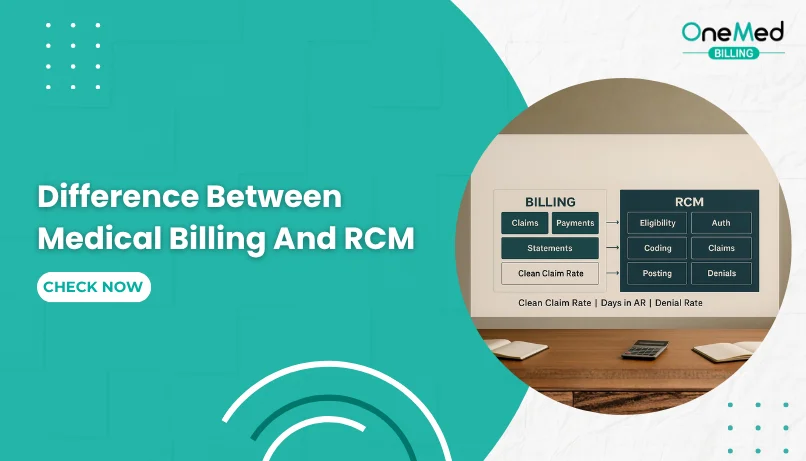

Many people use the terms medical billing and revenue cycle management as if they mean the same thing, but they don’t. While both deal with how a healthcare organization gets paid, they cover very different parts of the process. Medical billing focuses on creating and submitting claims to payors, while revenue cycle management (RCM) covers the entire financial journey from scheduling a patient to resolving every account.

Understanding the difference matters because it helps providers assign the right tasks to the right people, improve efficiency, and close payment gaps. In this blog, we’ll break down what each term really means, how they connect, and why knowing the difference can help your practice run smoother and get paid faster.

Understanding Medical Billing and Revenue Cycle Management

RCM (revenue cycle management): The entire process by which money moves through a healthcare organization from the moment a patient schedules or arrives for care, through claims, payment, account maintenance, audits, and back again when the patient returns or is referred elsewhere.

Medical billing: The specific set of activities that take place when a claim is created and sent to a third party (typically an insurer). Medical billing focuses on compiling visit information, generating the claim, submitting the claim, following up, and resolving the patient balance.

Complete Breakdown of the Healthcare Revenue Cycle Process

Think of the revenue cycle as the whole pie. It describes how the money flows through healthcare. In practical terms, it includes:

- Patient access and scheduling (self-referral or provider referral).

- Check-in, verification of benefits, collection of co-pays, and patient responsibilities.

- Clinical encounter and documentation by the provider.

- Creation of charges, coding, and claim generation.

- Claim submission and follow-up with payors (medical billing work).

- Payment posting, patient billing (if applicable), appeals, and account resolution.

- Audits, account maintenance, and preparation for future visits or referrals.

The reason we call it a cycle is simple: patients often return for follow-ups, ongoing care, or referrals, so the flow of activity and finances tends to repeat.

Where Medical Billing Fits Within the Revenue Cycle?

Medical billing is a critical slice of that pie. It primarily begins when the claim is created from the provider’s notes and ends when the patient account balance is resolved. In other words:

Medical billing starts at claim creation and claim submission to a carrier.

The primary goal of medical billing is to get the balance to zero either by insurance payment, patient payment, or appropriate adjustments.

Some billers also handle front-end charge capture, coding checks, and verification tasks, but these activities are technically part of the wider revenue cycle.

Common Misconceptions About Medical Billing and RCM

- People often use "medical billing" and "revenue cycle management" interchangeably. Beware that many professionals mean different things when they use these terms.

- Front-desk and clinical staff are integral parts of the revenue cycle, even though they don’t typically identify as medical billers. Their actions (scheduling, benefit checks, accurate documentation) directly influence revenue outcomes.

- Revenue cycle management includes strategic elements audits, process improvement, account maintenance, and patient retention efforts that often sit outside the day-to-day duties of a medical biller.

Why Knowing the Difference Between Billing and RCM Matters

Understanding the difference helps you:

- Assign responsibilities clearly within a practice or organization.

- Set the right expectations for vendors, staff roles, and KPIs.

- Spot process gaps (for example, front-end errors that cause downstream denials).

- Design meaningful RCM improvements that address the whole lifecycle, not just claim submission.

Real-Life Example of How Medical Billing Works

Imagine a patient schedules a visit and pays a co-pay at check-in. The provider documents the visit, and the coder assigns CPT/ICD codes. From there:

- The biller compiles the charge info and submits the claim to the insurer.

- If the insurer underpays or denies, the biller follows up, appeals, or bills the patient as appropriate.

- Once the account balance reaches zero, the biller’s primary work is complete as the revenue cycle continues through audits, adjustments, and potential future visits.

Conclusion

Medical billing and revenue cycle management are closely connected, but they serve different purposes. Medical billing focuses on creating claims, sending them to payors, and making sure payments are received and posted correctly. Revenue cycle management covers the entire process of how money moves through a healthcare organization, starting from scheduling and eligibility checks to collections and account reviews.

When you understand the difference, you can assign responsibilities more clearly, find weak points in your process, and keep your cash flow steady. Good revenue cycle management depends on teamwork between billers, front-desk staff, and clinical teams.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is the difference between medical billing and RCM?

Medical billing handles claim submission and payment posting, while RCM manages the entire financial process from scheduling to collections.

What is RCM in medical billing?

RCM, or revenue cycle management, is the full process that tracks a patient’s journey from appointment to final payment.

What are the 4 P's of the revenue cycle?

The 4 P’s are Patients, Providers, Payers, and Processes, each plays a key role in generating and collecting revenue.

What are the 7 steps of RCM?

The seven steps are: patient registration, insurance verification, charge capture, claim submission, payment posting, denial management, and reporting.