Payment Posting Explained and How to Do It Right

- Updated Date January 17th, 2026

- Payment Posting

- Follow

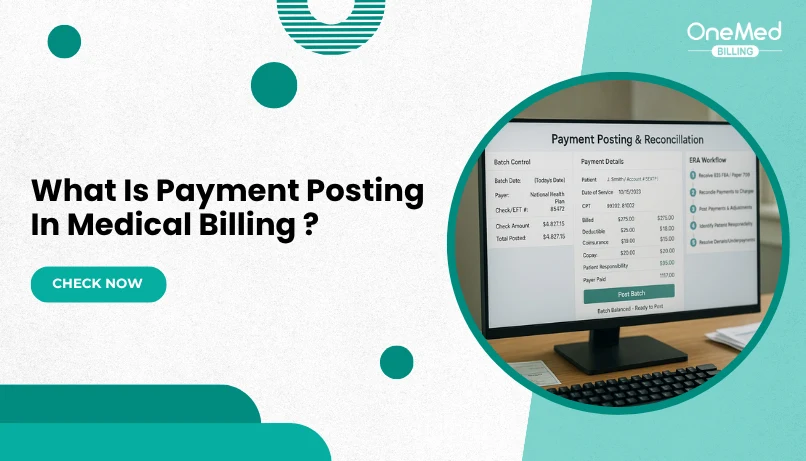

Every medical practice depends on timely payments to stay financially healthy. But receiving payments isn’t enough, they must be recorded correctly and linked to the right claims. That’s where payment posting is needed.

Payment posting helps you see the real picture of your revenue. It ensures that every payment, adjustment, and denial is entered accurately so your reports, A/R, and patient balances reflect the real figures. Without proper posting, even a small mistake can cause mismatched accounts, wrong patient statements, and missed follow-ups on unpaid claims.

What is Payment Posting?

Payment posting is the step where you record money received from payors and patients and apply it to the right claim, date of service, and line item. You match each payment to the ERA or EOB, post the allowed amount, take the contractual write off, and assign any remaining balance to patient responsibility.

Why is Payment Posting So Important?

Payment posting means matching each payment to the right patient, visit, and CPT line the same day it arrives. When you do this well, your books stay clean, staff know what to fix, and patients get bills they understand. Payment posting is important for these reasons

- Keeps accounts receivable accurate and up to date

- Finds denials and short pays the same day, so staff can act fast

- Captures CARC and RARC codes to support appeals and fix root causes

- Applies contractual write offs correctly and sets the right patient balance

- Makes patient statements match the EOB to reduce disputes

- Speeds month end close by tying batches to ERAs, EOBs, and deposits

- Improves cash forecasting and KPI reporting with clean data

- Flags underpayments and payer trends early for follow up

- Cuts rework by preventing posting errors from snowballing

- Supports front desk collections with clear, accurate balances

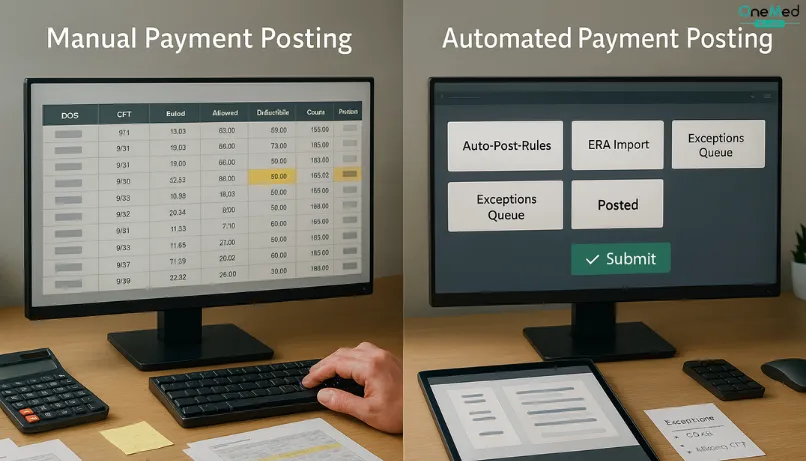

Methods of Payment Posting

There are two main methods of payment posting used in medical billing.

1. Manual Payment Posting

In this method, staff members enter each payment manually by reviewing EOBs, checks, or remittance documents. It gives better control and allows detailed review of each transaction, but it’s time-consuming and increases the chances of human error. Manual posting is usually preferred for complex claims or when additional notes need to be verified before posting.

2. Automated Payment Posting

Automated posting uses ERA (Electronic Remittance Advice) files sent by payors to post payments directly into the billing system. It’s faster, more accurate, and helps identify denials or underpayments immediately. Most practices rely on automation for routine payments and use manual posting only for exceptions or payors that don’t support ERA.

How to Post Payments: Step-by-Step Process

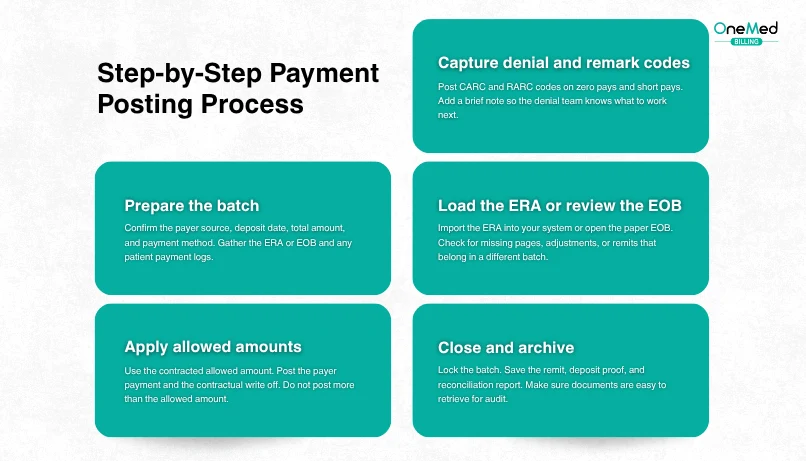

Use this simple sequence to post payments correctly. It walks you through prepping the batch, matching each payment to the right claim, applying allowed amounts and patient responsibility, capturing denials, and reconciling totals.

1. Prepare the batch

Confirm the payer source, deposit date, total amount, and payment method. Gather the ERA or EOB and any patient payment logs.

2. Load the ERA or review the EOB

Import the ERA into your system or open the paper EOB. Check for missing pages, adjustments, or remits that belong in a different batch.

3. Match the payment to the right account

Find the correct patient, claim, and date of service. Verify the rendering provider, place of service, CPT, and units.

4. Apply allowed amounts

Use the contracted allowed amount. Post the payer payment and the contractual write off. Do not post more than the allowed amount.

5. Post patient responsibility

Record deductible, copay, and coinsurance. Make sure PR codes line up with the EOB and the contract.

6. Capture denial and remark codes

Post CARC and RARC codes on zero pays and short pays. Add a brief note so the denial team knows what to work on next.

7. Handle variances and partial payments

If the payer paid less than the allowed amount, note the reason. Route underpayments to follow up. Do not close the line until it is clear why a variance exists.

8. Trigger secondary and patient billing

If a secondary payer is listed, create and queue the secondary claim. If not, move the remaining balance to patient responsibility for statement processing.

9. Post patient payments and refunds

Apply patient checks, cards, portal payments, or payment plan amounts to the correct visits. Record any refunds or reversals with supporting notes.

10. Reconcile the batch

Tie the posted totals to the ERA or EOB and to the bank deposit. Investigate any difference and correct before closing.

11. Close and archive

Lock the batch. Save the remit, deposit proof, and reconciliation report. Make sure documents are easy to retrieve for audit.

12. Review quality and report

Run a quick report for zero pays, short pays, and unapplied cash. Share trends with coding, front desk, and denial management so root causes are fixed.

How to reconcile posted payments?

Reconciliation is the final step that confirms your payment posting is accurate. It involves matching the payments recorded in your billing system with the actual amounts deposited in your bank account. Start by comparing the total of all posted payments for the day against your bank deposit slips or electronic payment reports. Any mismatches should be investigated immediately. Common causes include duplicate entries, missed deposits, or posting to the wrong patient account.

Once all differences are corrected, the daily or weekly reconciliation report should match exactly with your financial records. This process ensures your A/R is accurate, prevents cash flow discrepancies, and keeps your accounting team and billers working with the same reliable data. Regular reconciliation not only maintains financial transparency but also helps detect payment issues before they become larger reporting problems.

Common Issues with Payment Posting

Errors in payment posting often come from simple mistakes that add up over time. These include posting payments to the wrong patient account or entering the wrong amounts.

Another common issue is missing secondary insurance payments. When these are not posted, the balance looks higher than it should, and follow-up gets messy.

Delays in posting also cause confusion between posted and unposted payments. This makes A/R reports unreliable and slows down your cash flow.

Sometimes, adjustments or write-offs are applied incorrectly. That hurts revenue tracking and reimbursement accuracy. Regular audits, clear posting steps, and staff training help prevent these problems and keep your records clean.

Role of Payment Posting in Revenue Cycle Management

Payment posting plays a key role in the revenue cycle because it connects the front-end and back-end billing processes. When payments are posted correctly, your accounts receivable reflects the real financial position of the practice. It helps identify underpayments, denials, and payer patterns early so the billing team can take timely action.

Accurate posting also supports clean reporting. It allows practices to track revenue trends, find gaps in collections, and measure payer performance. On the patient side, it ensures that balances and statements are correct, improving transparency and trust.

Conclusion

Payment posting may seem like a small part of the billing cycle, but it has a major influence on your overall financial health. It gives a clear picture of your revenue flow. It also ensures that patients receive correct statements, helping your practice maintain trust and transparency.

Strong payment posting practices also help you identify payer trends, track recurring issues, and plan better for future claims. By keeping this process consistent, your practice can maintain steady cash flow and improve billing accuracy.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is payment posting in billing?

Payment posting is the process of recording payments received from insurance companies and patients into the billing system to keep financial records accurate and up to date.

What is reconciliation in payment posting?

Reconciliation means matching the payments recorded in your billing software with the actual deposits in your bank account to confirm everything is posted correctly.

What is the formula for payment posting in medical billing?

Total Payment = Posted Amount + Adjustments + Patient Responsibility

What are the two types of payment posting?

The two main types are manual posting (entered by staff) and automated posting (via ERA files from payers).