What Is Electronic Remittance Advice (ERA) In Medical Billing?

- Updated Date Oct 23, 2025

- Medical Billing

- Follow

Medical billing is becoming more complex every year as payors update rules, reimbursement models, and claim systems. For most healthcare providers, keeping up with manual payment posting and paper remittance forms slows down operations and increases the risk of errors. That’s why automation has become essential in today’s revenue cycle.

One of the most valuable tools driving this automation is Electronic Remittance Advice (ERA). It replaces manual payment explanations with electronic files that clearly show which claims were paid, denied, or adjusted and why. Instead of sorting through piles of Explanation of Benefits (EOBs), billing teams can process payments faster and with fewer mistakes.

In this blog, you’ll learn exactly what ERA means in medical billing, how it works, what information it contains, and why it’s critical for accurate and timely reimbursement. We’ll also look at its benefits, common challenges, and real-world examples of how practices use ERA to improve their revenue cycle performance.

What Is ERA in Medical Billing?

Electronic Remittance Advice (ERA) is a digital file that tells healthcare providers how their claims were processed and paid by the payor. In simple terms, it’s the electronic version of the Explanation of Benefits (EOB) that you used to receive on paper.

When a claim is submitted and processed, the payor sends an ERA file that includes details such as which claims were approved, which were denied, how much was paid, and any adjustments made. This allows billing teams to post payments automatically instead of entering them manually.

ERAs follow a national data standard known as ANSI X12 835, which was established under HIPAA and is recognized by the Centers for Medicare & Medicaid Services (CMS). This format ensures that all payors and providers exchange payment data consistently, reducing confusion and speeding up the revenue cycle.

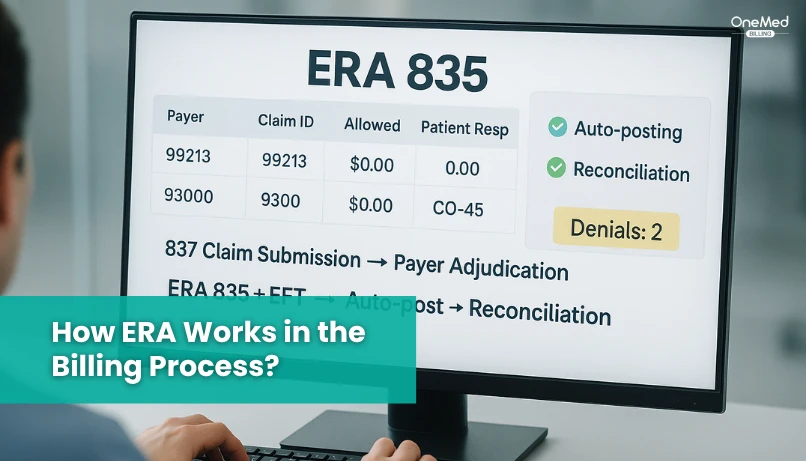

How ERA Works in the Billing Process?

The ERA plays an important role in the payment cycle between providers and payors. It helps billing teams see exactly how each claim was handled, without waiting for paper remittance advice or manual updates.

Here’s how it works step by step:

1. Claim Submission - After a patient visit, the provider or billing team submits the medical claim to the payor electronically.

2. Claim Adjudication - The payor reviews the claim to check coverage, coding accuracy, and allowed amounts. This step determines whether the claim is approved, partially paid, or denied.

3. ERA Generated - Once the payor finishes processing, they create an ERA file that lists each claim, payment amount, and any adjustments or denial reasons.

4. ERA Received and Posted - The ERA file is sent electronically to the provider’s practice management or EHR system, where payments can be posted automatically.

The ERA is often paired with EFT (Electronic Funds Transfer), which transfers the actual payment to the provider’s bank account. Both the ERA and EFT share a unique trace number, making it easy to match the payment details with the corresponding remittance advice.

When an ERA is connected to an auto-posting system, payments and adjustments are applied instantly to patient accounts. This eliminates manual entry, speeds up reconciliation, and reduces the chances of posting errors.

Key Components of an ERA File

An ERA file gives a detailed summary of how each claim was handled by the payor. Understanding its main sections helps providers post payments correctly and resolve denials faster.

- Claim Payment Details - Lists each claim with the billed, allowed, and paid amounts so you can confirm what was reimbursed and what was adjusted.

- Claim Adjustment Reason Codes (CARC) - Short codes that explain why a claim or service was adjusted, such as non-covered service, missing info, or incorrect code.

- Remittance Advice Remark Codes (RARC) - Provide extra notes that clarify CARCs, often explaining what needs to be corrected or supplied for reprocessing.

- Group Codes (PR, CO, OA, PI) - Indicate who is responsible for the adjustment:

- PR - Patient responsibility

- CO - Contractual adjustment

- OA - Other adjustment

- PI - Payor-initiated change

- Service Line Information - Breaks down payments at the procedure level, showing CPT codes, units, billed vs. allowed amounts, and what was paid.

- Trace Numbers and Payor Identifiers - Unique IDs that connect the ERA to the EFT payment and identify which payor issued it.

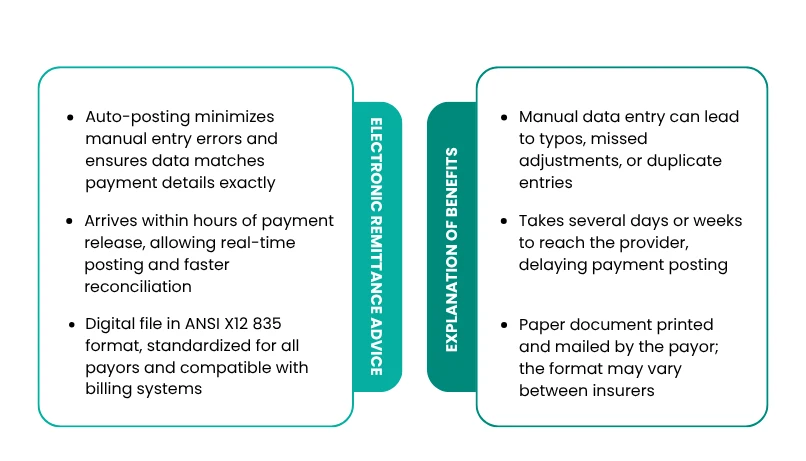

Both Electronic Remittance Advice (ERA) and Explanation of Benefits (EOB) explain how an insurance claim was processed and paid. The biggest difference is that ERAs are digital and automated, while EOBs are paper-based and manual. This difference changes how fast payments are posted, how accurate records are, and how easily teams can track claims.

|

Feature |

ERA (Electronic Remittance Advice) |

EOB (Explanation of Benefits) |

|

Format |

Digital file in ANSI X12 835 format, standardized for all payors and compatible with billing systems |

Paper document printed and mailed by the payor; the format may vary between insurers |

|

Delivery Method |

Sent electronically through clearinghouses or directly to your practice management or EHR system |

Delivered by mail to the provider or patient, requiring physical handling |

|

Processing Speed |

Arrives within hours of payment release, allowing real-time posting and faster reconciliation |

Takes several days or weeks to reach the provider, delaying payment posting |

|

Accuracy |

Auto-posting minimizes manual entry errors and ensures data matches payment details exactly |

Manual data entry can lead to typos, missed adjustments, or duplicate entries |

|

Usability |

Can be searched, filtered, and stored digitally; easy for reporting and audits |

Must be manually filed and reviewed; difficult to organize or analyze |

|

Integration with EFT |

Links directly to Electronic Funds Transfer (EFT) using a trace number for easy payment matching |

Requires manual cross-referencing between paper check and EOB |

|

Storage & Compliance |

Digital storage supports HIPAA-secure backups and reduces paper clutter |

Physical storage takes up space and increases the risk of lost or damaged documents |

In short, ERAs save time, reduce errors, and give billing teams better visibility into the revenue cycle. EOBs may still appear for small or out-of-network payors, but most major insurers now prefer ERAs because they’re faster, more secure, and easier to reconcile with electronic payments.

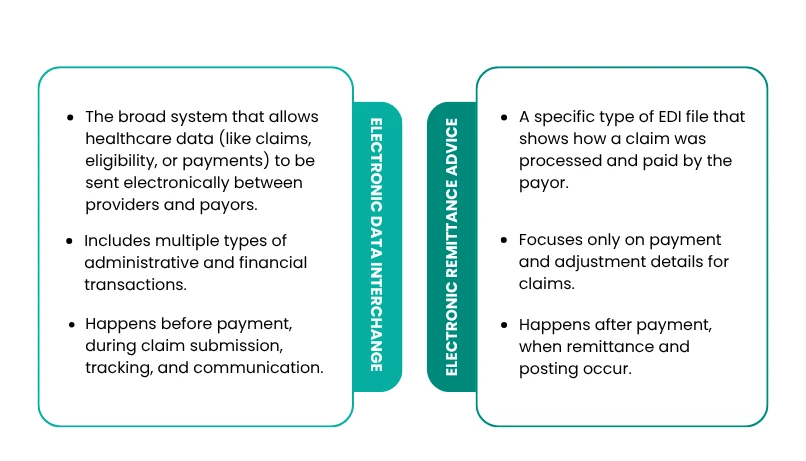

What Is the Difference Between ERA and EDI?

Many people use the terms ERA and EDI interchangeably, but they refer to different parts of the electronic billing process. Both are essential for modern revenue cycle management, but they serve different purposes.

|

Aspect |

EDI (Electronic Data Interchange) |

ERA (Electronic Remittance Advice) |

|

Meaning |

The broad system that allows healthcare data (like claims, eligibility, or payments) to be sent electronically between providers and payors. |

A specific type of EDI file that shows how a claim was processed and paid by the payor. |

|

Purpose |

Used to submit, receive, and exchange multiple types of healthcare transactions (claims, eligibility checks, authorizations, etc.). |

Used to explain the result of a claim, including payments, denials, and adjustments. |

|

Standard Format |

Various formats, such as 837 for claims, 270/271 for eligibility, and 276/277 for claim status. |

Standard format ANSI X12 835, defined under HIPAA. |

|

Data Type |

Includes multiple types of administrative and financial transactions. |

Focuses only on payment and adjustment details for claims. |

|

Workflow Role |

Happens before payment, during claim submission, tracking, and communication. |

Happens after payment, when remittance and posting occur. |

In simple terms, EDI is the system that moves all electronic healthcare data, while ERA is one of the specific file types within that system.

When a claim is submitted through EDI (using the 837 file), the payor processes it and then sends back an ERA (835 file) to show how that claim was handled, including what was paid, denied, or adjusted.

So, while EDI handles communication, ERA delivers results. Both work together to make medical billing faster, more accurate, and fully electronic.

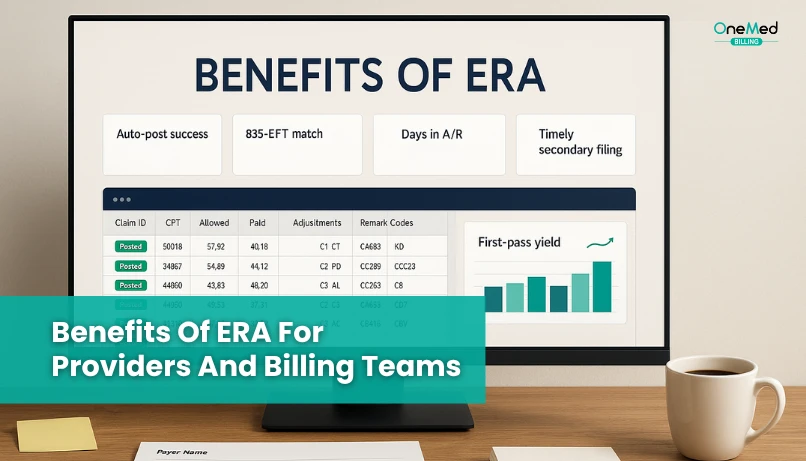

Benefits of ERA for Providers and Billing Teams

Electronic Remittance Advice (ERA) offers both operational and financial advantages that make billing smoother and faster. By replacing manual posting and paper EOBs, ERAs help providers save time, reduce errors, and maintain better control over revenue.

Operational Benefits

- Faster Posting and Reconciliation- Payments are received and posted automatically as soon as the ERA file arrives. This saves hours of manual data entry and allows billing teams to close accounts faster.

- Fewer Manual Errors - Auto-posting eliminates the risk of typos, duplicate entries, and mismatched payments that often occur when data is keyed in by hand.

- Clearer Payment Visibility - ERAs show payment status for every claim in real time, making it easy to see which claims were approved, denied, or adjusted.

- Easier Denial Tracking and Correction - Each ERA includes detailed adjustment and denial codes, helping teams identify the cause quickly and take corrective action without waiting for paper EOBs.

Financial Benefits

- Stronger Audit Trail - All ERA transactions are stored digitally with trace numbers and timestamps, making it easier to verify payments and support audits.

- Better Reporting Accuracy - Because ERAs feed directly into billing software, reports reflect real-time data. This improves forecasting, financial planning, and compliance tracking.

- Improved Cash Flow - With faster payment posting and fewer errors, providers receive reimbursements sooner and maintain a more predictable cash flow.

Common ERA Adjustment Codes

When you review an ERA, you’ll notice short codes that explain why a claim or service line was adjusted or denied. These are called Claim Adjustment Reason Codes (CARC), Remittance Advice Remark Codes (RARC), and Group Codes.

Understanding these codes helps billing teams identify the reason behind payment changes and take the right action quickly.

|

Code |

Type |

Description |

Meaning for Providers |

|

CO-45 |

CARC |

Contractual Obligation |

Charge exceeds the fee schedule or contracted rate. Write off the difference. |

|

PR-1 |

Group Code |

Patient Responsibility |

The deductible amount the patient must pay. |

|

CO-97 |

CARC |

Contractual Obligation |

The benefit of this service is included in the payment for another service. |

|

PI-204 |

CARC |

Payor Initiated |

Service not covered under the patient’s plan. |

|

RARC-N290 |

RARC |

Remark Code |

Missing or incomplete information; additional documentation may be required. |

Practical Challenges Billing Teams Encounter with ERA

While Electronic Remittance Advice (ERA) makes billing faster and more accurate, it’s not always smooth sailing. Many practices still face challenges that affect how efficiently payments are posted and reconciled. Understanding these issues can help teams fix problems early and make the most of ERA automation.

1. Payer-to-Payer Format Differences

Not all payors follow the same ERA structure. Even though HIPAA defines the ANSI X12 835 format, each payor may include slightly different data fields or label sections differently. This inconsistency can cause confusion or prevent automatic posting in some billing systems.

2. Delayed ERAs or Missing Trace Numbers

Sometimes ERAs arrive late, or they’re missing the trace number that links the remittance to an Electronic Funds Transfer (EFT) payment. Without that match, billing teams must manually track which payment belongs to which claim, slowing reconciliation and increasing the risk of posting errors.

3. Integration Issues with Legacy Software

Older practice management or EHR systems may not fully support ERA import features. In these cases, files have to be converted, uploaded manually, or partially entered by hand, which defeats the purpose of automation.

4. Partial Posting or Mismatched Payments

Occasionally, the amounts listed in an ERA don’t line up perfectly with the EFT payment. This can happen due to payor rounding rules, bundled adjustments, or missing service lines. When that occurs, the system might only post part of the payment, leaving the rest to be reconciled manually.

5. Staff Training Gaps in Reading ERA Codes

Even the best technology can’t replace human understanding. Staff who aren’t familiar with CARC, RARC, and Group Codes may struggle to interpret adjustments or spot underpayments. Regular training ensures that billing teams can read and act on ERA data correctly.

By addressing these challenges, through medical billing software, staff education, and consistent payor communication, providers can unlock the full benefits of ERA and keep their revenue cycle running smoothly.

Best Practices for Managing and Optimizing ERAs Effectively

Once your practice starts using Electronic Remittance Advice (ERA) regularly, the key to success is consistency and organization. Following a few best practices can help you prevent errors, speed up payment posting, and stay audit-ready.

1. Regularly verify the ERA setup with payors

Make sure your payors are sending ERAs correctly and that your clearinghouse or billing software is receiving them without errors or duplicates.

2. Match ERA and EFT using trace numbers

Use the trace number in both the ERA and Electronic Funds Transfer (EFT) to confirm every payment is posted to the right claim. This helps prevent mismatched or missing payments.

3. Reconcile daily to avoid a backlog

Posting ERAs daily keeps your accounts current and prevents claim backlogs that can delay revenue or cause reporting inaccuracies.

4. Keep a centralized archive of all ERA files for audit readiness

Store ERA files in one secure, searchable location. This makes it easy to trace payments, review adjustments, and respond quickly to audit requests.

5. Train staff to interpret adjustment codes accurately

Make sure your billing team understands CARC, RARC, and Group Codes so they can act on denials and adjustments promptly.

Conclusion

ERA isn’t just a digital version of an EOB; it’s the foundation of faster, cleaner, and more transparent payment posting. By automating how payments are received and recorded, providers can reduce manual work, prevent errors, and gain better visibility into their revenue cycle.

If your practice still relies on paper remittances, now is the time to make the switch. Electronic Remittance Advice helps you stay organized, meet compliance requirements, and speed up reimbursements with far less effort.

If your team struggles with manual posting, missing ERA files, or slow reconciliations, our medical billing team can help. Our experts automate ERA processing, streamline payment posting, and strengthen your cash flow, so your staff doesn’t have to worry with paperwork.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.