What Is ICN In Medical Billing? - Track Claims Efficiently

- Updated Date Oct 3, 2025

- Claims Submission

- Follow

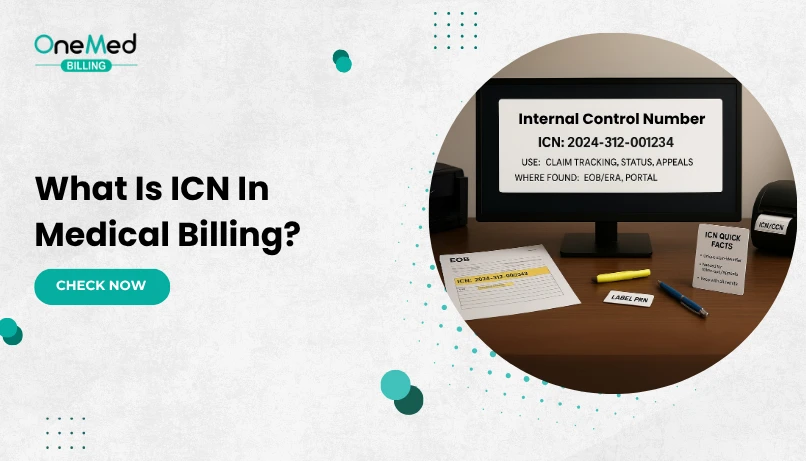

Every medical claim that leaves your office takes a journey through clearinghouses, payors, and processing systems. Along the way, it needs a way to be tracked, just like a package you ship. That tracking tool in medical billing is called the ICN, or Internal Control Number.

In medical billing, the ICN, or Internal Control Number, is what payors use to track every claim they receive. Providers and billing teams rely on it to check claim status, work denials, submit corrected claims, and follow up on payments. If it’s missed or recorded incorrectly, delays and denials are almost guaranteed. That’s why knowing how the ICN works is essential for keeping your revenue cycle on track.

What Does ICN Mean in Medical Billing?

ICN stands for Internal Control Number. It is the unique number a payor assigns to each claim once it enters their system. Think of it as the claim’s tracking ID. Just as shipping companies use tracking numbers to follow a package, payors use the ICN to follow a claim from submission through processing and payment.

Every insurance company has its own way of generating ICNs, but the purpose is the same: to identify and track claims. For Medicare, the ICN is usually a 13-digit number. The digits often represent details such as the year the claim was received, the type of claim, and the sequence in which it was entered into the system.

Breaking Down ICN Format and Structure

Every payor uses ICNs to track claims, but Medicare’s format is one of the most commonly recognized. A standard Medicare ICN is 13 digits long, and each part of that number has meaning. It is not random.

The digits often include details such as:

Year of receipt - the first two numbers usually show the year the claim was entered into the Medicare system.

Batch number - identifies the group or batch of claims processed together.

Claim sequence - shows the order of the claim within that batch.

For example, if a claim has an ICN that starts with “25,” it usually means it was received in 2025. The next digits may indicate which batch it was grouped into, and the final numbers show where it fell in the processing line.

Why ICN Is Important for Providers?

For providers, the ICN is a safety net in the billing process. It confirms that the payor has received the claim and is working on it. When payments are delayed or denied, the ICN is the quickest way to get answers. Instead of waiting for staff to dig through records, the ICN lets the payor find the claim immediately.

It also matters during appeals and corrections. If a claim is denied, providers can only challenge it by referencing the ICN. The same is true when sending a corrected claim or canceling a duplicate. Without it, the payor may not accept the request, which can hold up reimbursement.

Why ICN Is Important for Coders?

For coders, the ICN is a tool that helps keep claims organized and accurate. When a payor requests a corrected claim, coders must include the original ICN so the payor can connect the two. If the ICN is missing, the claim may be rejected or delayed.

Coders also rely on ICNs when working on claim status checks and account follow-ups. Having the number at hand makes communication with payors smoother and reduces time wasted on back-and-forth calls.

When and Where Is ICN Assigned?

The ICN is created by the payor, not by the provider or the billing office. It is generated once the claim is accepted into the payor’s system. At that point, the payor assigns an Internal Control Number so the claim can be tracked during processing, payment, or appeals.

For Medicare claims, there is an important distinction:

Medicare Part A (inpatient hospital claims) uses what is called the Document Control Number (DCN).

Medicare Part B (physician and outpatient services) uses the Internal Control Number (ICN).

While the names are different, they serve the same purpose. Both numbers act as the unique identifier for the claim within Medicare’s system. Providers will often see them on remittance advice notices or when checking claim status through Medicare portals.

Commercial payors follow a similar process, assigning their own ICN once the claim is received. The format may differ from Medicare’s 13-digit structure, but the role is the same: to confirm receipt and allow tracking throughout the claim’s life cycle.

For providers and billing teams, this means the ICN is only available after the payor accepts the claim. Until that point, clearinghouses or practice management systems may use their own temporary reference numbers, but those are not the official ICNs used by payors.

What Is the Difference Between DCN and ICN?

Both ICN (Internal Control Number) and DCN (Document Control Number) are claim identifiers used in medical billing, but the difference lies mainly in the type of claim and the payor’s terminology.

ICN (Internal Control Number)

This term is most often used for Medicare Part B claims, which include physician services, outpatient care, and supplier claims (such as DME suppliers). When a Part B claim is accepted into Medicare’s system, it is assigned an ICN to track its progress.

DCN (Document Control Number)

This term is primarily used for Medicare Part A claims, which cover inpatient hospital services, skilled nursing facilities, and home health. When these institutional claims are received, Medicare assigns a DCN instead of an ICN.

Even though the names are different, the function is the same. Both numbers serve as the unique identifier for the claim in the Medicare system. They are required for claim inquiries, appeals, corrections, and voids.

Uses Of ICN in the Billing Process

In day-to-day billing, the Internal Control Number is the reference point that makes many claim activities possible. Here are the most common ways providers and billing teams rely on the ICN.

1. Resubmission and Corrected Claims

When a claim needs to be corrected, adjusted, or voided, payors require the original ICN. This allows them to link the new submission directly to the old one. Without the ICN, the payor may treat the corrected claim as a duplicate, which often leads to denial.

2. Claim Status Inquiries

Checking claim status is one of the most frequent uses of the ICN. If a provider calls a payor or checks through an online portal, the ICN is the fastest way for the system to locate the claim. It saves time and ensures that billing staff and payor representatives are both looking at the same record.

3. Dispute Resolution

Sometimes payors tell providers that a claim was never received. In those cases, the ICN is proof that the claim entered the payor’s system. Quoting the ICN during a dispute prevents the claim from being written off as lost and helps move the resolution forward.

4. Internal Auditing and Quality Control

Many billing departments track ICNs in their internal reports. This practice makes it easier to review the history of claims, spot patterns in denials, and confirm that claims were processed correctly. For providers, this adds an extra layer of accountability and reduces the risk of revenue leakage.

Issues and Challenges with ICN Use

While ICNs are essential for tracking and managing claims, they are not without challenges. Providers and billing teams often run into problems when ICNs are missing, incorrect, or misunderstood.

A. Missing or Incorrect ICNs

One common issue is when an ICN is not properly recorded or entered into the billing system. Without it, staff may struggle to follow up on the claim or submit corrections. Even a single wrong digit can prevent the payor from locating the claim.

B. Differences Across Payers

Not all payors use the same ICN format. Medicare uses a 13-digit ICN, while commercial payors may have shorter or differently structured numbers. These variations can confuse billing teams if they are not familiar with each payor’s format.

C. Resubmission Problems

Corrected or voided claims must include the original ICN. If that number is left out, payors often deny the claim as a duplicate or incomplete submission. This adds extra work for billing staff and delays reimbursement.

D. Communication Breakdowns

When payors and providers are not aligned on ICNs, disputes can arise. For example, a payor may say they cannot find a claim, even though the provider has an ICN. This can happen if the payor’s system reassigns a different number during processing or if the ICN is misread.

E. Extra Burden During Audits

ICNs are valuable in audits, but they can also be a source of stress. If records are disorganized and ICNs are not clearly linked to documentation, audits take longer and increase the risk of findings against the provider.

Despite these challenges, the benefits of ICNs outweigh the drawbacks. With good record-keeping and staff training, most of these problems can be avoided.

Best Practices for Handling ICNs in Claims

Managing ICNs well can save providers from delays, denials, and unnecessary write-offs. A few simple habits in daily billing workflows make it easier to track claims, handle corrections, and stay compliant.

- Record ICNs immediately when claims are accepted by the payor. Save them in your billing software or tracking sheets.

- Use ICNs in all follow-ups with payors to speed up claim status checks and reduce wasted time.

- Always include the ICN when submitting corrected, adjusted, or voided claims to avoid denials.

- Cross-check ICNs against clearinghouse reports and remittance advices to confirm claim accuracy.

- Train billing staff on how to locate, record, and use ICNs properly across different payors.

- Keep ICNs linked to patient records for easy access during audits, disputes, or appeals.

- Standardize your workflow so every claim is tracked by ICN, reducing the risk of lost or duplicate claims.

Conclusion

The Internal Control Number may look like a small detail on a claim, but it plays a major role in the billing process. From tracking claims in a payor’s system to resolving denials, submitting corrected claims, and protecting providers during audits, the ICN is one of the most reliable tools in revenue cycle management.

For providers, using ICNs the right way means fewer delays, faster reimbursements, and stronger compliance. For coders and billing teams, it creates a clear path to manage claims with accuracy and confidence.

Still, managing claims can be challenging for providers, especially with staffing shortages, heavy workloads, and complex payor rules. Many practices choose to outsource claim submission to a trusted medical billing company like OneMed Billing, which handles ICN tracking, denial management, and payor communication to reduce errors, improve collections, and free up time for patient care.

Contact OneMed Billing today to learn how we can simplify your claims process and strengthen your revenue cycle.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is an ICN number in billing?

An ICN, or Internal Control Number, is the unique number a payer assigns to each claim once it enters their system. It is used to track, correct, and reference claims throughout processing.

Is an ICN the same as a claim number?

No. A claim number is the identifier assigned by your practice or clearinghouse, while the ICN is generated by the payer after the claim is accepted.

What does ICN stand for?

ICN stands for Internal Control Number. It is the payer’s tracking ID for a submitted claim.

Where do I find the ICN number?

You can find the ICN on the payer’s remittance advice, Explanation of Benefits (EOB), or in the payer’s claim status portal once the claim is accepted.

What if multiple ICNs are shown on a payer’s remittance?

Multiple ICNs may appear if the claim was split, adjusted, or reprocessed. Always use the most recent ICN for appeals, corrections, or follow-ups.