Contractual Adjustment In Medical Billing Guide

- Updated Date Feb 7, 2026

- Medical Billing

- Follow

Open an ERA. You see CO 45 on a line, and the numbers shift. That is not a denial. That is your contract setting the allowed price. The gap is the contractual adjustment.

This matters every day. Post it right, and patient bills are clear, A R stays clean, and your reports tell the truth. Post it wrong and you create balance billing risk, rework, and bad data. In this guide, you will learn

- What Contractual Adjustment Means

- CO 45 Meaning on the EOB or ERA

- Contractual Adjustment Group Codes

- Essential Elements of Contractual Adjustments

- Types of Contractual Adjustments

- Contractual Adjustment Posting Steps

- Impact of Contractual Adjustments on Revenue Cycle Management

- Benefits of Accepting Contractual Adjustments

- Key Strategies to Improve Contractual Adjustment Rates

- Conclusion

- FAQ

What does Contractual Adjustment mean?

A contractual adjustment is the required write off set by your payor agreement. It is the exact difference between your charge and the payor’s allowed amount under the contract or fee schedule. This amount is never billable to the patient.

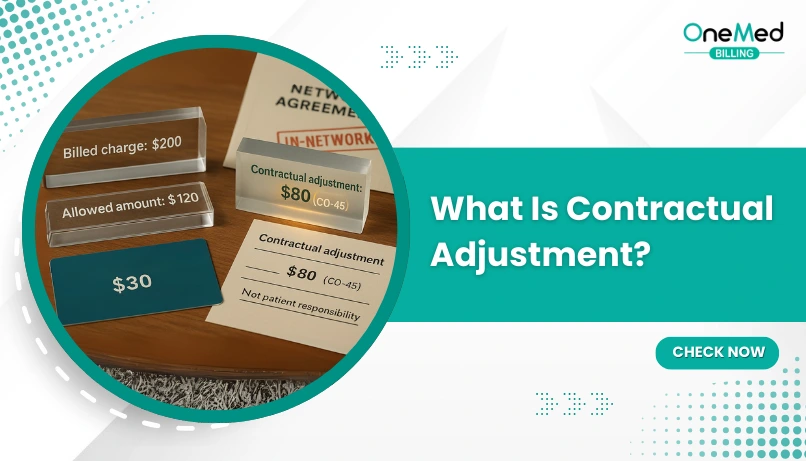

On the remit or EOB, you will see it under group code CO. The most common reason is CARC 45, which shows the plan reduced your charge down to the allowed amount. For example, you bill 200, the plan allows 140, you must adjust 60 as contractual.

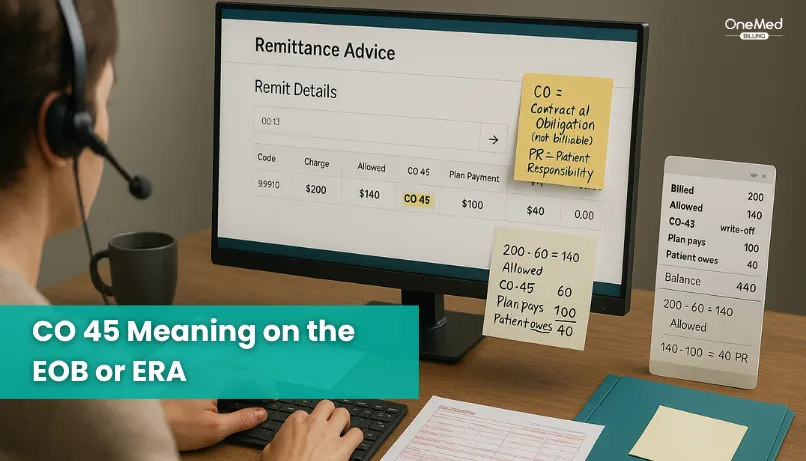

CO 45 Meaning on the EOB or ERA

CO 45 means the payor reduced your charge to the allowed amount under your contract or fee schedule. CO stands for contractual obligation, which is never billable to the patient. 45 is the reason code that says the charge was higher than the plan’s allowed rate.

On the remit, you will see the service line with CO 45 and the dollar amount written off. What is left is the allowed amount. From that allowed amount, the plan may pay part and assign the rest to patient responsibility as a deductible, copay, or coinsurance under PR. CO amounts are written off. PR amounts can be billed to the patient.

Here is a simple example in words. You billed 200. The plan allows 140. The remit shows CO 45 for 60. That brings the charge down to the allowed 140. The plan pays 100, and the patient owes 40. You post the 60 as a contractual adjustment, not to the patient balance. If the allowed amount does not match your fee schedule, flag it and check your contract.

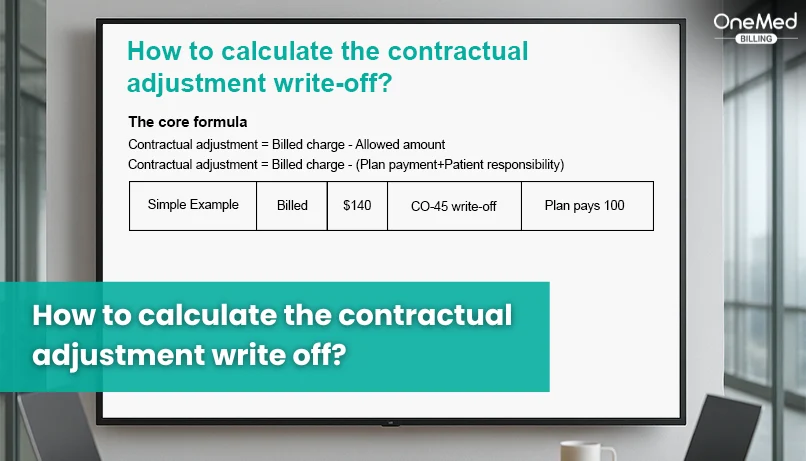

How to calculate the contractual adjustment write-off?

The core formula

Contractual adjustment = Billed charge − Allowed amount

• Billed charge: what your clinic billed.

• Allowed amount: what the plan says the service is worth under the contract.

• The allowed amount is split into the plan payment + patient responsibility.

So you can also use:

Contractual adjustment = Billed charge − (Plan payment + Patient responsibility)

How to find these on the EOB/ERA

1. Find the Allowed amount line or field.

2. Add up PR group codes for the patient part (copay, deductible, coinsurance).

3. Add up the plan payment.

4. The rest, usually in the CO group with codes like CO-45, is your contractual write-off.

Quick examples

Example 1: Standard split

• Charge: $200

• Allowed: $120

• Patient owes: $30

• Plan pays: $90

• Contractual = 200 − 120 = $80

(Matches CO group totals on the EOB.)

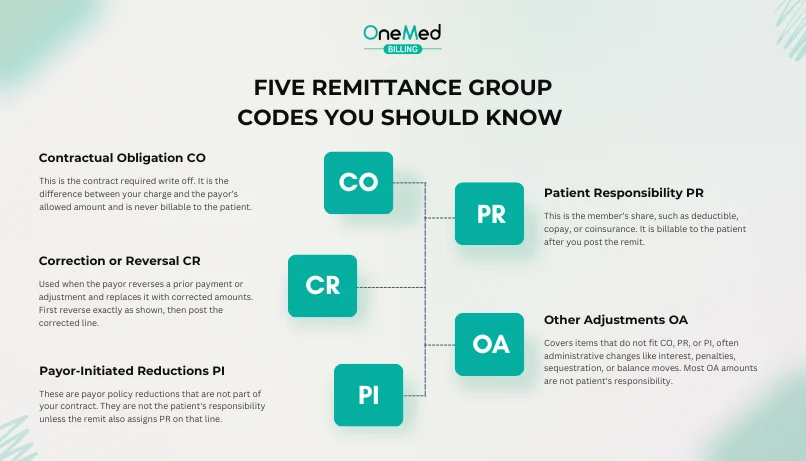

Five Remittance Group Codes You Should Know

Here are some common codes for contractual adjustments in medical billing you should be aware of.

1. Contractual Obligation CO

This is the contract required write off. It is the difference between your charge and the payor’s allowed amount and is never billable to the patient. Post it to contractual adjustment, not to patient balance.

2. Patient Responsibility PR

This is the member’s share, such as deductible, copay, or coinsurance. It is billable to the patient after you post the remit. Make sure your statements label the PR type clearly.

3. Payor-Initiated Reductions PI

These are payor policy reductions that are not part of your contract. They are not the patient's responsibility unless the remit also assigns PR on that line. Post as a payor adjustment and keep a distinct reason in your system.

4. Other Adjustments OA

Covers items that do not fit CO, PR, or PI, often administrative changes like interest, penalties, sequestration, or balance moves. Most OA amounts are not patient's responsibility. Map OA reasons to specific adjustment codes so reports stay clear.

5. Correction or Reversal CR

Used when the payor reverses a prior payment or adjustment and replaces it with corrected amounts. First reverse exactly as shown, then post the corrected line. Keep both entries tied to the same claim for a clean audit trail.

Note: Medicare ERAs typically use CO, PR, and OA, and may use CR for corrections; Medicare does not use PI. Some commercial payors do use PI.

Common contractual adjustment reason codes

These are CARC reason codes that explain why a contractual write-off happened. They usually appear with the CO group on the EOB or ERA.

CARC 45

Charge exceeds the fee schedule or contracted amount. The payor reduces the line to the allowed amount. Post the difference as a contractual adjustment.

CARC 131

Claim a specific negotiated discount. A one-time or claim-level discount applies under your agreement. Post only the discounted portion as contractual.

CARC 246

Fee schedule not in effect. The plan used a different effective date or table. Post as contractual and flag for a fee schedule review.

Payor-specific contractual text

Some payors send custom wording with the CO group. Read the paired RARC remark for extra detail. Treat it as contractual if the group is CO.

Essential Elements of Contractual Adjustments

- Billed charge - The price sent on the claim, used as the starting point.

- Allowed amount - The payor’s price from the contract or fee schedule that the line must be reduced to.

- Group code CO - Marks the write off as a contractual obligation and is never billable to the patient.

- Reason code CARC - Explains why the write off happened, such as 45 for fee schedule reduction or 131 for a negotiated discount.

- Remark code RARC - Adds short explanatory text from the payor when extra context is needed.

- Patient responsibility PR - Deductible, copay, or coinsurance tied to the allowed amount that can be billed to the patient.

- Plan payment - The portion of the allowed amount paid by the insurer that should match the deposit on the remit.

- Posting rules - CO to contractual adjustment, PR to patient balance, payor amount to insurance payment, with no CO dollars landing in patient A R.

- Effective dates and fee schedules - The allowed amount should match the contract for that date of service, or you flag it for review.

- ERA 835 linkage - Store the remit with the claim and keep CARC and RARC on the line for a clear audit trail.

- Secondary or crossover handling - Finalize the patient balance only after secondary processing is complete and all remits are posted in order.

- Reporting and GL mapping - Use a distinct code for contractual adjustments, separate from patient discounts and bad debt, to keep revenue reports accurate.

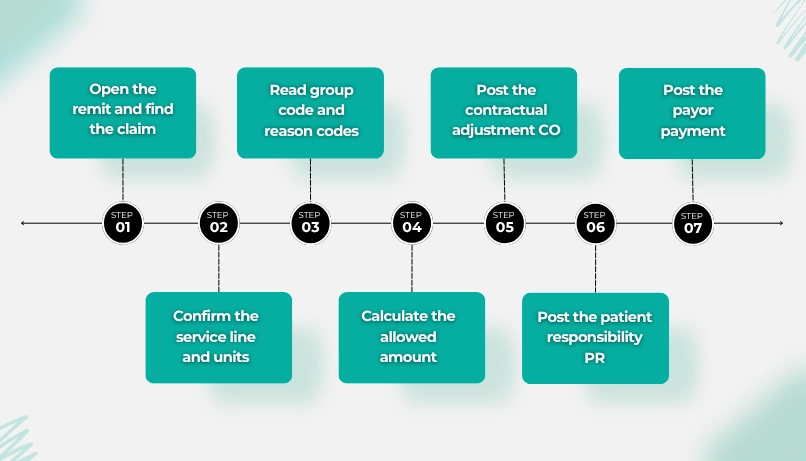

Contractual Adjustment Posting Steps

1. Open the remit and find the claim

Pull the ERA 835 or the EOB. Match the patient, payor control number, claim ID, and dates of service. Confirm you are working the right payor sequence, primary or secondary.

2. Confirm the service line and units

Check CPT or HCPCS, modifiers, place of service, revenue code if facility, and units. Make sure the billed charge and units on the remit match what you sent. Fix any obvious keying errors before you post.

3. Read group code and reason codes

Identify the group code on each line. CO means contractual write-off. PR means patient responsibility. PI and OA are payor or other adjustments. Read the CARC reason text and any RARC remarks so you know why the amounts changed. If a line has more than one reason, note each part.

4. Calculate the allowed amount

Use the allowed amount shown on the remit when it is present. If it is not shown, compute it as plan payment plus PR amounts plus CO amounts on that line. Do not include interest or administrative OA items in the allowed math.

5. Post the contractual adjustment CO

Post the difference between your charge and the allowed amount to your contractual write off code. Keep distinct reasons for CO 45 versus other CO reasons so reports stay clear. Never move CO dollars to the patient's balance.

6. Post the patient responsibility PR

Post deductible, copay, and coinsurance to the patient balance by type. Hold the patient statement if a secondary payor is listed. Use clear statement text so patients know why they owe the amount.

7. Post the payor payment

Apply the payor payment to the claim lines and record the EFT or check trace number and payment date. If the remit shows interest or sequestration, post those separately to the correct buckets. Tie the payment to the remit for your audit trail.

8. Check for secondary or crossover

Look for secondary payor details or Medicare crossover notes. Do not finalize the patient balance until the secondary remit is posted. Post primary first, then secondary, in order.

9. Save the remit detail to the claim

Store the ERA file or EOB image with the claim. Keep the CARC and RARC codes on each line. Capture the payor control number so you can reference it later without reopening the batch.

10. Reconcile to the bank deposit

Total all payments in the ERA and match them to the EFT deposit in the bank. Account for recoupments, reversals, and interest so the net matches. Do not close the batch until the deposit ties out.

11. Handle exceptions and mismatches

Flag any line where the allowed amount does not match your contract for that date of service. Open a payor ticket if the remit shows PR where the contract requires CO, or if units or modifiers were priced incorrectly. Correct and resubmit when the payor instructs.

12. Close the visit and update reports

After all payors post, finalize the visit and run reports. Review contractual write offs, PR totals, and payment trends by payor and code. Use the findings to update fee schedules, edit rules, and staff checklists.

Types of contractual adjustments

These are true contractual write-offs. They will show with the group code CO on the EOB or ERA.

- Fee schedule reduction - Your charge is higher than the payor’s allowed amount. The difference is written off as CO.

- Medicare or Medicaid allowed amount - The program fee schedule sets the price. Anything over the allowed posts as CO.

- Bundled or included services - The contract says one service is included in another, so the separate line adjusts as CO.

- Multiple procedure pricing - Additional procedures on the same day are paid at a reduced contracted percent. The reduction posts as CO.

- Global package inclusions - Services inside a surgical or maternity global are not separately payable per contract, so they adjust as CO.

- Site of service differential - The allowed amount changes by location. Any amount above the allowed becomes CO.

- Case rate or capitation reconciliation - Payment is fixed per case or per member. Lines reconcile to that amount, and the remainder posts as CO.

Often confused but not always contractual

These items are not contractual unless the remit actually uses CO on that line.

- Prompt payment discount - Sometimes contractual, but many payors send it as PI payor-initiated reduction. Post by the group code shown.

- Charity or financial assistance - Provider policy, not a payor contract. This is an internal write-off, not CO, and it does not appear on the ERA.

- Non-covered services - Usually, PR patient responsibility or a denial. Only write off as CO if your contract bans balance billing and the remit shows CO.

- Administrative adjustments - Items like interest, sequestration, or balance moves often appear as OA other adjustments, not CO.

Main Impact of Contractual Adjustments on Revenue Cycle Management

Contractual adjustments set the allowed price and tell you what to write off. When you post them correctly, reports are accurate, patient bills make sense, and A R stays clean. When they are wrong, A R inflates, staff redo work, and you risk billing patients for amounts the contract does not allow.

- Net revenue accuracy - CO moves charges to the allowed amount, so KPIs like collection rate and RVU-based metrics stay accurate.

- A R integrity - CO is never patient balance. Misposting CO as PR inflates A R and creates avoidable follow-up.

- Patient billing clarity - Correct CO posting prevents balance billing and reduces statement disputes.

- Posting efficiency - Clear CO mapping with CARC and RARC raises ERA auto post rates and cuts touches per claim.

- Compliance and audit safety - Billing CO to patients triggers refunds and audit risk. Keeping CO in the right bucket protects you.

Key Strategies to Improve Contractual Adjustment Rates

Use these practical steps to keep contractual write-offs accurate, cut preventable variance, and spot underpayments fast.

- Keep payor fee schedules current - Load correct effective dates, site of service rules, multiple procedure reductions, bilateral rules, and modifier pricing. Recheck after contract renewals.

- Fix the charge master - Set rational charges so the allowed variance is predictable. Remove outdated codes, align units and modifiers, and review quarterly.

- Post by group code every time - CO to contractual adjustment, PR to patient balance, PI and OA to payor or other adjustments. Never move the CO to the patient.

- Map CARC and RARC cleanly - Maintain a reason code dictionary that drives auto posting. Use specific internal adjustment reasons for CO 45, CO 131, and others.

- Audit allowed variance monthly - Report by payor, code, site, and date of service. Set tolerance bands. Work lines where allowed are below the contract and open payor tickets.

- Use real-time eligibility and estimates - Run 270 and 271 from scheduling. Capture deductible, copay, and coinsurance. Set patient expectations and reduce rework.

- Tighten coding and edits - Apply NCCI rules, correct modifiers, and right units. Clean claims prevent wrong splits of CO vs PR and avoid rebills.

- Work 999 and 277CA the same day - Fix front end rejects before they become denials. Faster acks mean fewer touches per claim.

- Hold statements until secondary posts - Let primary CO and PR set the base. Post secondary ERAs before billing patients to avoid refunds.

- Train and QA posters - Sample a few ERAs per poster each week. Check CO vs PR placement, allowed math, and note quality. Coach with real examples.

- Use data in contract talks - Share underpayment trends, carve outs, and high variance codes with the payor. Ask for fee schedule fixes or updated terms.

- Track the right KPIs - CO percent of gross by payor and code, allowed variance rate, ERA auto post percent, and refund rate tied to CO errors. Adjust workflows based on trends.

Challenges Associated with Contractual Adjustments

- Fee schedule drift - Outdated contract tables cause allowed amounts to differ from your contract, creating constant variance and rework.

- CO vs PR misposting - Posting contractual amounts to patient responsibility inflates A/R and triggers balance billing complaints.

- Unmapped CARC and RARC - Missing or bad mappings block ERA auto posting and force manual line edits.

- Bundling and modifier rules - Contract rules for multiple procedures, global packages, or modifiers are applied inconsistently, leading to wrong write offs.

- Secondary coordination - Finalizing patient balances before secondary remits arrive causes refunds and duplicate statements.

- Site of service and POS errors - Wrong place of service or taxonomy changes the allowed amount and the CO math.

- Capitation and case rate reconciliation - Teams confuse reconciliation write offs with denials or patient balances.

- Documentation and attachments - Missing required notes or 275 attachments delay pricing, and looks like underpayment or incorrect CO.

- Reporting and GL mix-ups - Contractual adjustments get lumped with discounts or bad debt, breaking revenue analytics and audits.

Conclusion

Contractual adjustments are the built-in write offs that come from your payor agreements. They set the allowed price for each line and are never billable to the patient.

Treat the remit as your source of truth. Post CO as a contractual write off. Post PR to the patient balance. Keep PI and OA separate so reports stay clean. When that split is right, statements are accurate, and A R reflects reality.

Make a few habits standard. Keep fee schedules current for the right effective dates. Map CARC and RARC to clear internal reasons so ERA lines auto post. Work 999 and 277CA on the same day to fix issues before they turn into denials. Hold patient billing until secondary remits post.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is an example of a contractual adjustment?

You bill $200. The plan allows $140. You write off $60 as the contractual adjustment. The $140 is then split between the plan payment and the patient sh

What is the difference between a contractual adjustment and a write off?

A contractual adjustment is required by your payer contract and is never billable to the patient. A write off is a provider decision for other reasons,

How can we calculate the contractual adjustment?

Contractual adjustment = Billed charge − Allowed amount. If the allowed is not shown, use Billed charge − (Plan payment + Patient responsibi

What is another term for a contractual adjustment?

Contractual allowance. Some teams also say contract adjustment.

Who pays the contractual adjustment?

No one. It is written off by the provider and cannot be billed to the patient or the plan.