What Is Explanation Of Benefits In Medical Billing?

- Updated Date Sep 26, 2025

- Medical Billing

- Follow

EOBs are a simple way to see how a health plan handled a claim. They show what was billed, what the plan allowed, how much was paid, and what the patient may owe. For clinics, EOBs are the record you use to confirm payments, post adjustments, and spot issues early.

Many readers confuse an EOB with a patient bill. A bill asks for payment. An EOB explains the claim result so you can compare it with your records and fix mistakes before you send a statement.

In this guide, you will learn

- What Is an EOB in Medical Billing

- Why EOBs Matter to Your Workflow

- What an EOB Includes

- How to Read an EOB Step by Step

- EOB Compared with a Patient Bill

- Patient EOB vs Provider ERA

- Common EOB Mistakes You Could Make

- EOB Exceptions You Should Note

- Conclusion

- FAQ

What Is an EOB in Medical Billing?

An EOB, or Explanation of Benefits, is a summary your health plan sends after it processes a claim. It shows the services billed, the plan’s allowed amount, how much the plan paid, and the patient responsibility, such as deductible, copay, or coinsurance. It is information, not a bill.

EOBs help clinics and billing teams verify that payments match the contract and that adjustments are correct. They also explain denials or reductions with reason codes, so you know what to fix or appeal. Patients use the EOB to understand how their insurance processed the visit before they receive a statement.

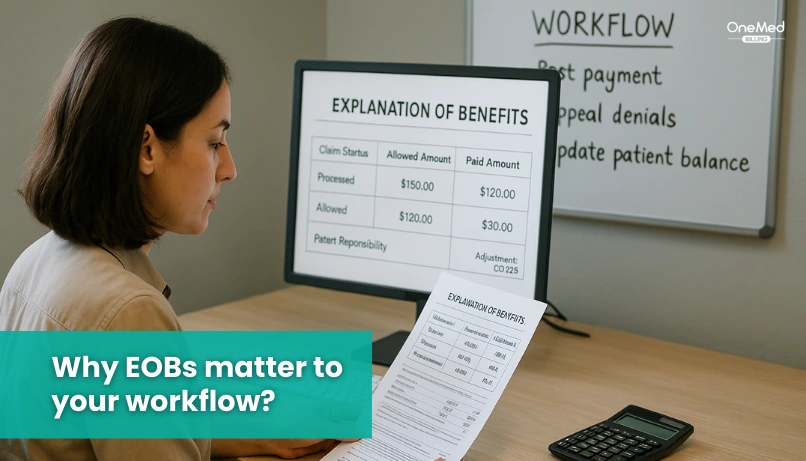

Why EOBs matter to your workflow?

An EOB gives you a clear picture of how the plan handled a claim, so your team knows what to post and what to check next. You can see the allowed amount, the plan payment, the write-offs, and the patient responsibility in one place, which makes payment posting and reconciliation simple. Match the EOB with your ERA or 835 and your EFT deposit to confirm totals. If something looks off, the reason codes point you to the fix, like a missing modifier, prior authorization, or coordination of benefits. Used this way, EOBs help you send accurate patient statements, bill secondary insurance on time, and reduce back-and-forth across your revenue cycle.

What does an EOB include?

An Explanation of Benefits is the payer’s summary of how a claim was handled for a specific visit. It helps you verify posting, adjustments, and follow-up. Below are the items included in an EOB that you should review each time.

1. Patient and plan info

Member name, ID, group number, and the health plan that processed the claim.

2. Dates of service and provider

When the visit or test happened, and which doctor or facility delivered care.

3. Services and CPT codes

Short descriptions of what was done with related procedure codes.

4. Billed charges and allowed amount

What the provider charged and what the plan agreed to allow under the contract.

5. Contractual adjustment or plan discount

The write-off the provider accepts based on the plan’s fee schedule.

6. Deductible, copay, and coinsurance applied

The member’s share is taken from the allowed amount.

7. Plan payment

The amount the insurer paid to the provider after adjustments.

8. Patient responsibility

What the patient may owe after the plan payment and write-offs.

9. Remarks and reason codes (CARC and RARC)

Short codes and messages that explain denials, reductions, or additional info needed.

How to Read an EOB Step by Step?

Follow these steps to understand any Explanation of Benefits and turn it into clear next actions.

1) Match the basics

Check patient name, member ID, dates of service, and provider. Make sure the claim you are reading is the right visit.

2) Verify the services

Look at the service lines and CPT codes. Confirm they match what you submitted and what was actually performed.

3) Compare billed and allowed

Find billed charges and the allowed amount. The allowed amount is what the plan recognizes under the contract or fee schedule.

4) Review adjustments

Look for contractual adjustments and plan discounts. These are write-offs like CO-45 that reduce the billed amount down to the allowed amount.

5) Apply the member share

Confirm how the plan applied the deductible, copay, and coinsurance. This becomes part of the patient's responsibility.

6) Confirm plan payment

Check the amount paid by the insurer. Match it to the ERA or 835 and your bank EFT when you post payments.

7) Read the reason codes

Scan CARC and RARC messages. They explain denials, bundling, missing prior auth, or modifier issues. Use them to decide if you should correct, appeal, or bill secondary.

8) Decide next steps

If everything matches, post payment and send the patient statement if needed. If something is off, start a work item for correction or appeal and document it.

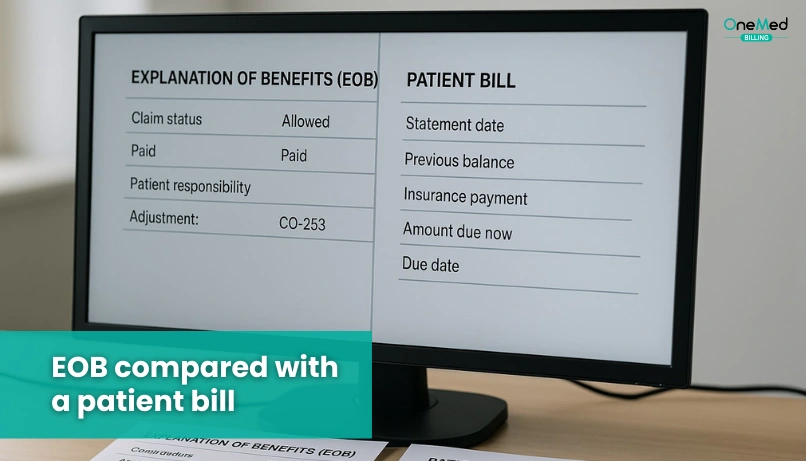

EOB Compared with a Patient Bill

An Explanation of Benefits and a patient bill are different documents. The EOB comes from the health plan and explains how the claim was processed. It shows the allowed amount, plan payment, adjustments, and the member's share. A patient bill comes from the provider and asks the patient to pay the remaining balance after insurance.

Think of the EOB as your reference and the bill as your action item. The EOB arrives after the insurer finishes processing the claim and includes helpful reason codes that explain denials or changes. The bill is sent after the provider posts payments and adjustments to the account.

Use them together. Match the bill’s balance to the EOB’s patient responsibility. If the numbers do not line up, call the provider's billing office and keep the EOB nearby so you can read the details.

Patient EOB vs. Provider ERA

A patient's EOB is the Explanation of Benefits that the health plan sends to the member. It explains how the claim was processed in simple terms. It lists the services, the allowed amount, the plan payment, and the patient responsibility, like deductible, copay, or coinsurance. It is for the patient’s reference. It is not a bill.

A provider ERA is the Electronic Remittance Advice that the payor sends to the clinic or billing team, often with the 835 file and EFT. It is a machine-readable payment report used for posting and reconciliation. It includes line-level details, CARC and RARC codes, and adjustment amounts so your system can post payments, write-offs, and secondary balances.

Think of them as two views of the same claim result. The EOB is patient-facing and easy to read. The ERA is provider-facing and built for automation. Your billing team should match ERA and EFT deposits to the patient account, and keep the EOB handy when patients call with questions.

Common EOB Mistakes You Could Make

Small misses on an Explanation of Benefits can slow posting and create extra follow-up. Use the quick checks below to keep your workflow clean and consistent.

1. Skipping the basics

Not checking the patient name, member ID, dates of service, or rendering provider can lead to posting on the wrong account and avoidable rework.

2. Confusing an EOB with a bill

An EOB explains how the plan processed a claim. A bill asks for payment. Mixing them up causes bad patient calls and incorrect collections.

3. Ignoring the allowed amount

Posting from billed charges instead of the allowed amount breaks contract logic and throws off adjustments and patient responsibility.

4. Missing CARC and RARC details

Reason codes explain denials, bundling, and reductions. Skipping them means you miss the fix, from a missing modifier to prior authorization.

5. Posting before reconciliation

Posting payments without matching ERA, EFT, and EOB creates variances. Always reconcile the 835 file, bank deposit, and EOB line by line.

6. Overlooking secondary insurance

Stopping after primary leaves a balance wrong. Use the EOB to trigger secondary claims and update the account.

7. Misreading patient responsibility

Copay, deductible, and coinsurance are different. Read how the plan applied to each, so your statement shows the real balance.

8. Ignoring remark notes

Plan remarks include next steps, document needs, or appeal timelines. Missing these notes delays resolution.

9. Not tying the service facility to the claim

If the service location is wrong, downstream records and patient statements can be wrong too. Match the site to the EOB.

10. Failing to keep an audit trail

Throwing away EOBs or not saving PDFs makes appeals and audits harder. Keep EOBs with your posting and denial files.

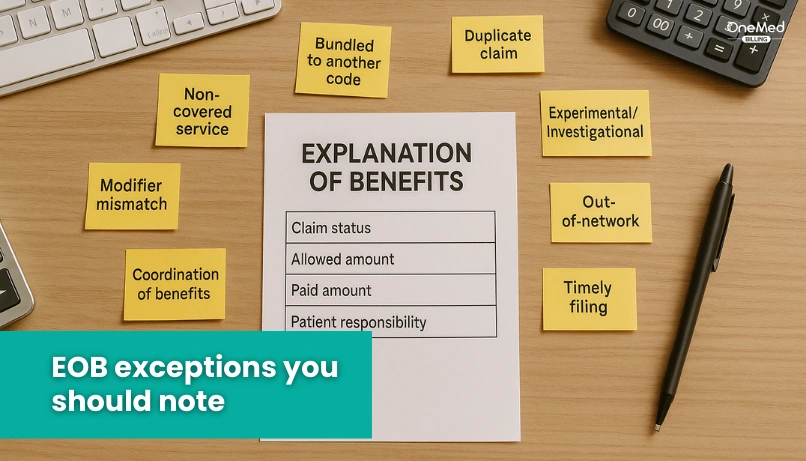

EOB Exceptions You Should Note

Most EOBs follow a standard pattern, but a few situations work differently. Keep these in mind so your posting and follow-up stay accurate.

- Original Medicare sends an MSN, not an EOB

- Medicare Advantage and Part D send monthly EOBs

- HMO/capitated visits may not produce a patient's EOB

- Self-pay visits have no EOB

- Secondary insurance waits for the primary EOB

- COB issues can pause or reduce payment on the EOB

- Portal-only delivery means EOBs may be online only

- Bundled or global services show one combined allowed amount

- Corrected claims can show reversals and reissues

- Workers’ comp/liability may use letters instead of a standard EOB

- Pediatric accounts list the child as the patient, the parent as the policyholder

Conclusion

EOBs turn claim results into clear steps your team can act on. Read them to confirm the allowed amount, apply adjustments, post payments, and set the right patient balance. Pair each EOB with your ERA and bank deposit so totals match, and follow-up is simple.

Make EOB review a daily habit. Check names and dates, compare billed to allowed, read reason codes, and start secondary or appeals when needed. Small checks here prevent bigger problems later.

If you want a clean, repeatable process for posting and reconciliation, OneMed Billing can help your team set it up and keep it running.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What does EOB mean in medical terms?

Explanation of Benefits. It is the health plan’s summary of how a claim was processed, including allowed amount, plan payment, and what the patient may owe.

What is the difference between EOB and claims?

A claim is the request for payment the provider sends to the plan. An EOB is the plan’s response that explains what was allowed, paid, reduced, or denied.

How do you see your EOB?

By mail or in your health plan’s online portal. Many plans default to paperless EOBs, so check your account settings.

Is an EOB the same as an itemized bill?

No. An EOB explains how insurance handled the claim. An itemized bill comes from the provider and lists charges you may need to pay.

How long does it take to get an EOB?

You receive it after the plan processes the claim, often within a few weeks. Medicare Advantage and Part D send monthly EOBs. Original Medicare sends a Medicare Summary Notice instead.