What Does Patient Responsibility Mean In Medical Billing?

- Updated Date January 17th, 2026

- Medical Billing

- Follow

As healthcare costs rise and insurance plans shift more expenses to patients, providers are seeing a growing gap in collections. What used to be mostly covered by payors is now increasingly the patient’s responsibility. This shift means more time spent explaining bills, chasing payments, and managing confusion over what’s owed.

Understanding patient responsibility and how to handle it correctly is now mandatory. It directly affects your revenue cycle, your staff’s workload, and your patients’ experience. When you know how to clearly estimate and communicate out-of-pocket costs, you can reduce delays, avoid billing disputes,

What Does Patient Responsibility Mean?

Patient responsibility is the part of a medical bill that the patient must pay out of pocket. It includes any amount not fully covered by their health plan. This often includes deductibles, copays, coinsurance, and noncovered services. These costs depend on the patient’s specific insurance plan and the type of care received.

Here’s a simple example:

A patient receives a service that costs $1,000.

- The insurance allows $800 for the procedure

- The insurance pays $600

- The patient is responsible for $200. This may include a deductible and coinsurance

This breakdown is explained in the Explanation of Benefits (EOB) sent to the patient and provider.

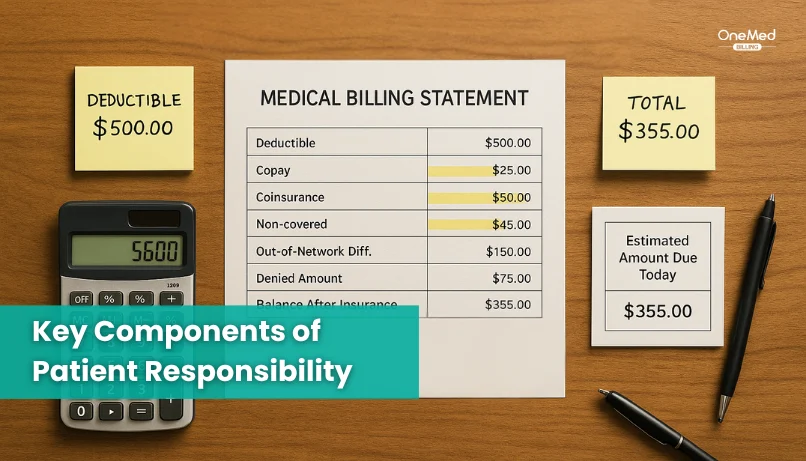

Key Components of Patient Responsibility

Understanding what makes up patient responsibility helps providers explain charges clearly and set accurate expectations. These are the most common parts patients may be asked to pay.

1. Deductible

A deductible is the amount a patient must pay each year before their insurance starts covering most services. Until it is met, the patient is responsible for the full cost of care, based on allowed amounts.

Example: If a patient has a $1,500 deductible and comes in for a procedure costing $1,200, they will owe the entire $1,200.

2. Copayment (Copay)

A copay is a fixed fee that patients pay at the time of service. It usually applies to office visits, urgent care, or prescriptions.

Example: A patient may owe $25 for a regular doctor visit or $50 for a specialist.

3. Coinsurance

Coinsurance is a percentage of the allowed amount that the patient pays after the deductible is met. The rest is paid by the insurance company.

Example: If the coinsurance is 20% and the allowed amount is $500, the patient pays $100 and the insurer pays $400.

4. Noncovered Services and Exclusions

Some services are not covered by certain plans. This could include elective procedures, out-of-network services, or treatments not considered medically necessary. In these cases, the patient is responsible for 100% of the cost.

Tip: Always verify coverage before providing services to avoid surprises for both the patient and your billing team.

5. Balance Billing and Out-of-Network

If a provider is not in-network with a patient’s insurance plan, the patient may receive a bill for the difference between the provider’s charge and what insurance covers. This is called balance billing.

Note: The No Surprises Act restricts balance billing for emergency care and certain out-of-network services.

6. Out-of-Pocket Maximum

This is the most a patient will pay out of pocket in a plan year for covered services. Once this limit is reached, insurance pays 100% for most covered care. This includes all deductibles, copays, and coinsurance.

Example: If a plan has a $7,000 out-of-pocket maximum, and the patient reaches that amount, insurance will cover additional costs for the rest of the year.

How to Calculate Patient Responsibility in Medical Billing?

Understanding how to accurately calculate patient responsibility is essential for providers. It ensures correct billing, reduces delays, and helps patients know what they owe before or after receiving care. This process involves several moving parts, from verifying benefits to applying the correct billing rules based on each patient’s insurance plan.

A) Verify Patient Benefits

The first step is to check the patient’s insurance details before the appointment. This includes confirming active coverage, deductible balance, coinsurance percentage, copay requirements, and whether the patient is nearing their out-of-pocket maximum. Without this information, it's nearly impossible to give a reliable estimate of the patient’s financial responsibility.

B) Determine the Allowed Amount

Once coverage is verified, the provider must reference the allowed amount for the service. This is the negotiated rate between the provider and the insurance company. It is typically lower than the provider’s standard charge and is used to calculate both insurer payment and patient responsibility.

C) Apply Deductibles First

If the patient has not yet met their deductible, they are responsible for paying the allowed amount up to that deductible limit. Only after the deductible is satisfied does the insurer begin to cover the remaining cost.

D) Add Coinsurance and Copay

After the deductible is met, coinsurance applies. This is a percentage of the allowed amount that the patient still needs to pay. Copays, if required, are fixed amounts and may apply to office visits or specific services. These are added on top of any coinsurance.

E) Account for Noncovered Services

If a procedure is not covered by the patient’s plan, they are fully responsible for the cost. This may include elective procedures, out-of-network services, or anything specifically excluded by the policy.

Use PR Adjustment Codes

Once a claim is processed, specific codes indicate which portions of the bill fall under patient responsibility. Common codes include:

- PR-1 for deductibles

- PR-2 for coinsurance

- PR-3 for copays

These codes help clarify the breakdown on both the claim and the Explanation of Benefits (EOB) sent to the patient.

F) Watch for Common Errors

Accurate calculation relies on real-time data and clear communication between billing staff and insurers. Mistakes such as incorrect eligibility checks, outdated fee schedules, or coding errors can result in denied claims and patient confusion.

How Patient Responsibility Appears on the EOB?

Patient responsibility appears on the Explanation of Benefits (EOB) as a separate section or column that lists the exact amount the patient owes after the insurance has processed the claim. Once the insurance company reviews the provider’s charges, it applies the plan’s deductible, copay, and coinsurance rules to determine how much is covered and how much is left for the patient. The total patient amount is then shown on the EOB, usually labeled as “Patient Owes,” “Your Responsibility,” or “Amount Not Covered.”

Each line item on the EOB includes codes that explain why a charge was assigned to the patient. For example, PR-1 means the amount was applied to the deductible, PR-2 indicates coinsurance, and PR-3 identifies a copay. These codes help both providers and patients understand how the final balance was calculated. By reviewing this section carefully, providers can confirm that the claim was processed correctly and communicate clear, accurate balances to their patients.

Legal and Regulatory Considerations

Providers have a legal and ethical responsibility to calculate and communicate patient responsibility accurately. Several federal and state regulations guide how much can be billed to the patient and when. Staying compliant with these rules helps avoid disputes, protect revenue, and maintain trust.

Key considerations include:

- CMS Billing Guidelines - The Centers for Medicare & Medicaid Services require that providers apply deductibles, coinsurance, and copays exactly as outlined in the patient’s plan. Overcharging or misapplying responsibility can lead to audits and payment delays.

- No Surprises Act - This federal law protects patients from unexpected out-of-network bills in emergency situations or at in-network facilities when care is provided by out-of-network clinicians. Providers must also give a Good Faith Estimate for uninsured or self-pay patients before services are delivered.

- State Regulations - Many states have laws requiring cost disclosures, billing timelines, and appeal processes for denied claims. Some also limit balance billing beyond federal rules.

- Patient Rights - Patients have the right to understand their bills, request itemized statements, and appeal denied charges. Clear communication and documentation reduce the risk of complaints or legal challenges.

How OneMed Helps with Patient Responsibility?

We help providers manage patient responsibility with tools that fit directly into your daily workflow. Before the visit, our system verifies insurance eligibility and pulls real-time data on deductibles, copays, and coinsurance. At check-in, your staff can give patients a clear estimate of what they owe, based on actual plan details and contracted rates. After the visit, automated reminders and simple payment options help patients pay their balance without confusion. This approach reduces billing errors, shortens payment cycles, and gives your team more control over collections from day one.

Conclusion

Patient responsibility is a growing part of the provider revenue cycle. As more patients take on higher deductibles and out-of-pocket costs, the pressure on front office and billing teams increases. Success now depends on how well you can explain charges, set expectations, and collect balances without disrupting the patient experience.

That’s where the right systems and support make a difference. When you have accurate benefit checks, real-time cost estimates, and simple payment options, your team can stay ahead of billing issues instead of reacting to them.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is patient responsibility?

The part of a medical bill the patient must pay. It can include copay, deductible, coinsurance, and any non-covered charges.

What are PR1 and PR2 in medical billing?

PR1 = Deductible amount the patient owes. PR2 = Coinsurance amount the patient owes.

What does patient responsibility mean on EOB?

On the EOB, it is the total the patient owes after the insurer’s payment and write-offs. It is the sum of copay, deductible applied, coinsurance, and any non-covered items.

How to calculate patient responsibility?

Get the payor's allowed amount. Add copay. Add deductible applied (up to what remains of the deductible).