What is an Electronic Claim? The Submission Process and Benefits

- Updated Date Sep 26, 2025

- Claims Submission

- Follow

Quick Summary

Electronic claim submission means sending medical claims to insurance companies online, instead of using paper forms. It’s faster, easier to track, and reduces manual errors.

To submit claims electronically, you need billing software or a clearinghouse. You enter complete patient info, check eligibility, create the claim, scrub for errors, and then transmit it securely.

Benefits include:

- Faster payments (often within 7–14 days)

- Fewer rejections due to built-in error checks

- Lower admin costs (no postage, paper, etc.)

- Real-time tracking and better control over revenue

- Easier compliance with payer and HIPAA rules

But it’s not perfect - Some payers still require paper, setup can be tricky, errors still happen, some documents must be sent manually, and you rely heavily on tech.

What is Electronic Claim Submission?

Electronic claim submission is the process of sending medical claims to insurance companies through a digital system, instead of mailing paper forms.

Think of it like this: instead of printing out each claim, putting it in an envelope, and waiting days (or weeks) for it to be reviewed, you’re uploading the claim into a secure system and the payer receives it almost instantly.

This method is faster, more accurate, and much easier to track. Most practices today use software like clearinghouses or integrated billing platforms to handle these submissions.

How to Submit Claims Electronically

Submitting claims electronically isn’t complicated; it just takes the right tools and a step-by-step process. Here’s how you can submit a claim electronically:

1. Use a Billing Software or Clearinghouse

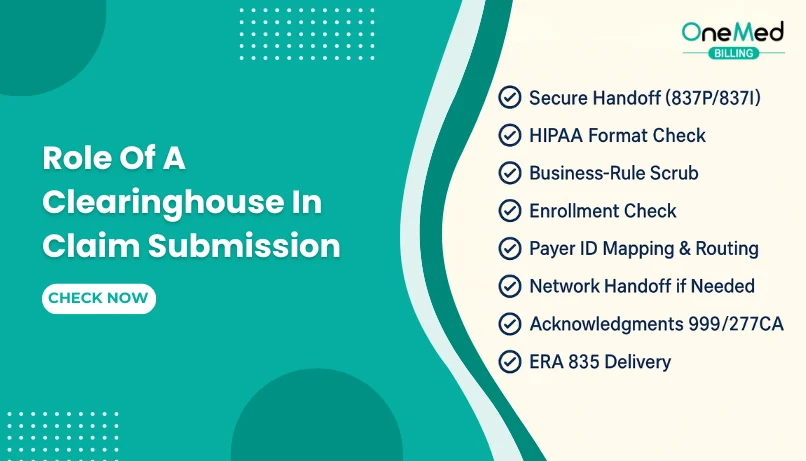

First, you’ll need access to a billing system or a clearinghouse. This is the platform that creates and sends your claims. Many practices use medical billing software that connects directly to insurers, while others go through a third-party clearinghouse that checks and routes the claims.

2. Enter Complete Patient and Insurance Details

Before you submit anything, make sure all the patient’s information is filled out accurately, including their insurance ID, date of birth, diagnosis codes, and treatment details. Even small mistakes can lead to rejections.

3. Verify Eligibility First (Optional but Smart)

It’s a good idea to check insurance eligibility before submitting the claim. This helps you catch coverage issues early so you’re not submitting a claim for a non-covered service.

4. Create the Claim

Once the visit is complete and everything is documented, your system creates the claim using standard formats (like the CMS-1500 for professional claims). This includes the provider info, diagnosis codes (ICD-10), and procedure codes (CPT or HCPCS).

5. Check for Errors Before Sending

Most billing systems or clearinghouses will scan your claim for common mistakes before sending it. These built-in “claim scrubbing” tools help reduce denials by catching missing fields or mismatched codes.

6. Submit the Claim to the Payer

Once everything checks out, the claim is transmitted electronically to the insurance company. This is usually done through secure, HIPAA-compliant channels.

If managing claim submissions sounds overwhelming or time-consuming, you don’t have to do it all yourself. Many healthcare providers now choose to partner with companies that specialize in claim submission services.

Benefits of Filing Electronic Submissions

Let’s be honest, handling claims manually is a pain. You deal with delays, human errors, lost paperwork, and endless back-and-forth with payers. That’s why more and more practices are switching to electronic claim submission.

Instead of printing forms or faxing them (and hoping they go through), you send the claim straight from your billing software to the insurance company. It’s faster, cleaner, and gives you a better shot at getting paid on time, without the usual drama. Here’s how it helps in detail:

You Get Paid Faster Without Waiting for Mail

Electronic submissions send your claims directly to the insurance payer within seconds. There's no waiting for physical mail to arrive, no time wasted in transit, and no manual data entry once it gets there. In many cases, insurers process electronic claims within 7 to 14 days, sometimes even faster compared to 30+ days with paper claims.

Fewer Claim Errors Means Fewer Denials

Mistakes like mismatched patient info, missing modifiers, or incorrect CPT/ICD-10 codes are common reasons for denials. Electronic systems often have built-in validation checks that flag these issues before the claim is sent. That means your claims are more likely to be accepted the first time.

You Spend Less Money on Paper, Postage, and Admin

Paper-based billing comes with hidden costs, including printing, envelopes, postage, scanner time, and staff hours. All that adds up quickly. By going digital, you cut down these expenses significantly. Your team also saves time by submitting in bulk through your billing software, freeing them up for tasks that directly impact patient care or collections.

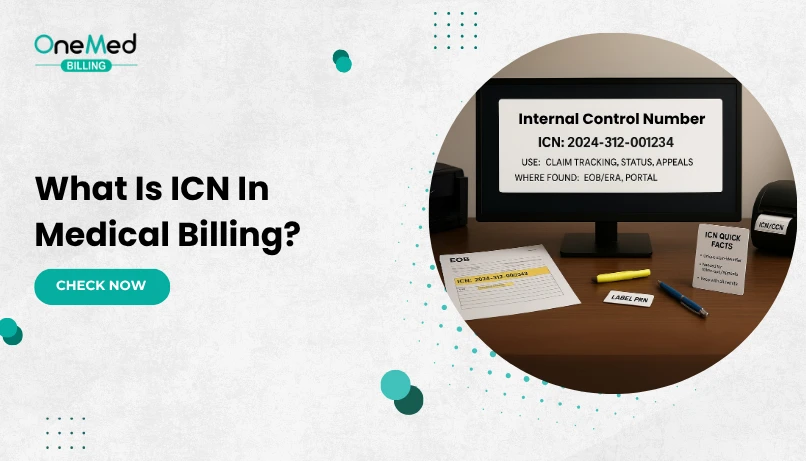

You Can Track Claim Status in Real-Time

Electronic claim submission systems give you live status updates on every claim, submitted, accepted, denied, or paid. You no longer need to call payers or check paper reports. This real-time visibility makes it easier to prioritize follow-ups, catch problems early, and reduce the chance of claims getting lost in the shuffle.

It’s Easier to Stay Compliant with Rules and Payers

Every insurance company has slightly different billing rules and requirements. Electronic systems are regularly updated to follow the latest payer rules and HIPAA guidelines. That means you don’t have to worry as much about non-compliant claims, missed deadlines, or formatting errors.

More Clean Claims Mean More Reliable Revenue

When your claims are submitted clean on the first try, your revenue becomes more predictable. Electronic submission helps you maintain a higher clean claim rate, reducing the number of rejections and delays. That stability gives you more control over your monthly income, which is especially important for smaller practices with tighter margins.

Limitations of Electronic Claim Submissions

Electronic claim submission is definitely a time-saver, but it’s not without its flaws. If you’re thinking of switching or already using it, here are a few things you should honestly know:

1. Not Every Insurance Payer Accepts E-Claims

Even today, some smaller or less common insurance plans still require paper submissions. If you're seeing a wide mix of patients, you'll probably still need to handle a few claims manually here and there. It’s rare, but it happens.

2. Initial Setup Can Be Tricky

You’ll need to get your clearinghouse connection set up, configure your billing software, and make sure all payer IDs and formats match what each insurer expects. If you’ve never done it before, it might feel overwhelming, especially if you're doing it without support.

3. Errors Can Still Happen

Submitting electronically doesn’t mean your claim is bulletproof. If you enter wrong codes, forget modifiers, or skip required fields, it’ll still get denied or rejected, just faster. So you still need solid billing practices in place.

4. Some Attachments Still Need Manual Upload

For certain services like operative reports, chart notes, or prior auth letters, you may still need to send documents separately. Not every payer allows attachments within the electronic claim itself.

5. Relying on Technology Means Relying on Uptime

If your billing software or clearinghouse platform goes down, even briefly, you’re stuck waiting. That’s why it helps to have a backup process or dedicated support team ready in case of issues.

Conclusion

If you're still doing paper claims, you're working way harder than you need to. Electronic claim submission is faster, cleaner, and gives you better visibility into what’s going on with your money.

And if handling all the claim submissions, follow-ups, and compliance steps feels overwhelming, this might be the right time to bring in a medical billing company. They already know the ins and outs of electronic claims and can handle the entire process for you.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is electronic claim submission?

It's the digital process of sending medical claims to insurers, replacing paper forms for faster and more accurate payments.

How do I submit medical claims electronically?

Use billing software or a clearinghouse to create, validate, and send claims directly to payers through secure, HIPAA-compliant systems.

How fast are electronic claims processed?

Most electronic claims are processed in 7–14 days, compared to 30+ days for paper submissions.

Are electronic claims more reliable?

Yes, they go through automatic checks to catch errors before submission, reducing denials and rework.

Can I outsource electronic claim submissions?

Yes, many providers use medical billing companies to handle claim submission services for better accuracy and faster payments.