What Is A Revenue Code In Medical Billing?

- Updated Date Sep 27, 2025

- Medical Billing

- Follow

If you’ve ever had a claim kicked back and couldn’t figure out why, chances are a revenue code was part of the problem. These little four-digit numbers often don’t get much attention, but payors look at them closely to decide how a claim should be processed.

A revenue code basically tells the insurance company where the service happened, in the ER, the lab, the pharmacy, or somewhere else in your facility. Paired with CPT or HCPCS codes that describe what was done, they give payors the full picture they need to release payment.

In this blog, we will cover:

• What a Revenue Code Really Means for Providers

• A Complete List of Revenue Codes

• Revenue Codes vs. CPT/HCPCS

What is a Revenue Code in Medical Billing?

In medical billing, a revenue code is a simple number that shows where a patient received care. It tells the insurance company if the service was provided in the emergency room, lab, pharmacy, or even in a hospital room. Think of it as the “department tag” on a claim.

While the code may look small, it plays a big role in how quickly providers get paid. If a revenue code is missing or doesn’t match the service performed, the claim can be denied or delayed. For example, sending a claim for a surgery but attaching an ER revenue code will almost always trigger a denial.

Every type of provider uses revenue codes, from large hospitals to small outpatient clinics. In a hospital, they separate charges by department so billing is accurate. In outpatient settings, they help insurers understand what kind of care was given and where. Without them, the revenue cycle would break down.

What a Revenue Code Really Means for Providers

A revenue code is a 4-digit number used on hospital or facility claims that tells the insurance company what type of service was provided and where it was provided (like ER, radiology, or lab). It helps payors match the service to the correct department and decide the right payment amount.

For example:

- 0450 = Emergency Room, general visit

- 0250 = Pharmacy

- 0300 = Laboratory tests

In practice, a revenue code acts like a department label attached to every billed service. If a patient comes to the ER for chest pain, the ER visit is billed under 0450. If they receive medication during the visit, the pharmacy code 0250 is also attached. And if a blood test is ordered, the lab code 0300 comes into play.

For providers, the importance of these codes is simple: the right revenue code ensures the right department gets paid. A mistake can mean the claim is either denied, underpaid, or pushed back for correction.

Complete List of Revenue Codes in Medical Billing

Knowing the accurate billing codes can help providers keep claims organized, match charges to the right departments, and simplify audits.

1. Inpatient Room & Board Codes (01X - 02X)

- 0110 - 0119: Private room & board - Used when a patient is admitted to a private hospital room. Since charges are per day, coding errors here can cause significant underpayment across the entire stay.

- 0120 - 0129: Semi-private room (2 beds) - Most common inpatient setting. If billed incorrectly as private, insurers may lower reimbursement to match semi-private coverage.

- 0130 - 0139: Semi-private (3 - 4 beds) - Assigned for ward-type settings. Coding must match patient records; otherwise, claims may be denied or adjusted downward.

- 0140 - 0149: Ward (more than 4 beds) - Applies when patients are in open ward setups. Wrong coding can shift reimbursement amounts significantly.

- 0160 - 0169: Other room & board - For cases that don’t fit typical categories, such as special observation or step-down units.

2. ICU Revenue Codes (020X)

- 0200: General ICU - Covers standard intensive care services for critically ill patients. Always ensure medical necessity is documented.

- 0201: Surgical ICU - For post-surgical patients needing advanced monitoring. Incorrect coding may cause insurers to downgrade claims to standard surgical care.

- 0202: Medical ICU - Used for non-surgical critical patients, such as those with sepsis or cardiac failure. Payors audit these carefully to confirm diagnosis matches the intensity of care.

- 0203: Pediatric ICU - For children in intensive care. Denials often occur if age documentation is unclear.

- 0207: Burn ICU - Reserved for specialized burn units. Documentation must include burn classification and the extent of treatment.

3. Operating Room & Anesthesia Codes (036X - 037X)

- 0360 - 0369: Operating room services - Billed for surgical procedures performed in the OR. Codes vary by complexity, transplant, or minor surgery.

- 0370 - 0379: Anesthesia services - Covers general, local, or sedation anesthesia. These must match surgical procedures to avoid denials.

4. Pharmacy Revenue Codes (025X)

- 0250: General pharmacy - Used for general drug dispensing, not tied to specific categories.

- 0251: Generic drugs - Reflects use of generic medications, reimbursed at a lower rate than branded drugs.

- 0252: Brand-name drugs - Higher cost and often require prior authorization. Incorrectly using generic codes may cut reimbursement by half.

- 0258: IV solutions - Includes fluids administered intravenously during inpatient or outpatient care.

5. Laboratory & Pathology (030X - 031X)

- 0300: Laboratory, general - Covers standard blood work and basic lab services.

- 0301: Chemistry - For tests like blood glucose, electrolytes, or cholesterol levels.

- 0305: Hematology - For blood count tests and clotting studies.

- 0310: Pathology - Used for specimen analysis, including biopsies.

- 0319: Other pathology services - For pathology that doesn’t fit into a defined category.

6. Radiology & Imaging (032X - 035X)

- 0320: Diagnostic radiology, general - Includes plain X-rays and general imaging studies.

- 0325: CT scan - Used when billing for CT scans in hospital radiology departments.

- 0330: Nuclear medicine - Covers scans using radioactive tracers, such as thyroid or bone scans.

- 0340: MRI - For MRI imaging, often requiring prior authorization due to high cost.

- 0350: Other CT services - Reserved for CT imaging outside the general classification.

7. Emergency Room & Observation (045X, 076X)

- 0450: ER, general classification - For emergency visits, covering patient assessment and basic care.

- 0456: ER, urgent care - For urgent but non-life-threatening conditions, billed differently from general ER.

- 0459: Other ER services - Used for specialized services not in standard ER categories.

- 0760: Observation room - For patients monitored without full inpatient admission.

- 0762: Observation hourly - Allows hourly billing for observation services.

8. Clinic Revenue Codes (051X)

- 0510: General clinic - For clinic services not tied to a specialty.

- 0516: Urgent care clinic - Tracks urgent care visits, reimbursed differently from general clinic.

- 0517: Family practice clinic - Used for general medicine or family health visits.

9. Therapy Services (042X - 044X)

- 0420: Physical therapy - For rehab and mobility services provided to patients post-injury or surgery.

- 0430: Occupational therapy - For services that restore daily living and work-related abilities.

- 0440: Speech therapy - For speech and swallowing therapy, often after stroke or head trauma.

10. Dialysis (080X - 085X)

- 0800: General dialysis - For dialysis services not specified under other codes.

- 0820: Hemodialysis - For standard inpatient or outpatient hemodialysis treatments.

- 0830: Peritoneal dialysis - For dialysis performed via the peritoneal cavity.

- 0840: CAPD - Continuous ambulatory peritoneal dialysis.

- 0850: CCPD - Continuous cycling peritoneal dialysis.

11. Ambulance & Transportation (054X - 055X)

- 0540: Ambulance, general - Basic ambulance services not otherwise classified.

- 0541: Ambulance, emergency transport - For urgent ambulance trips, billed at higher rates.

- 0542: Ambulance, non-emergency - For routine transport such as dialysis patient pickup.

- 0550: Air ambulance - Covers helicopter or airplane emergency transport.

12. Miscellaneous & Professional Fees (090X - 098X)

- 0900: Behavioral health services - For general behavioral therapy or counseling.

- 0910: Psychiatric services - Used for psychiatric inpatient or outpatient treatment.

- 0940: Other therapeutic services - For services not listed under other therapy codes.

- 0960 - 0980: Professional fees - Tracks physician or provider professional fees on UB-04 claims.

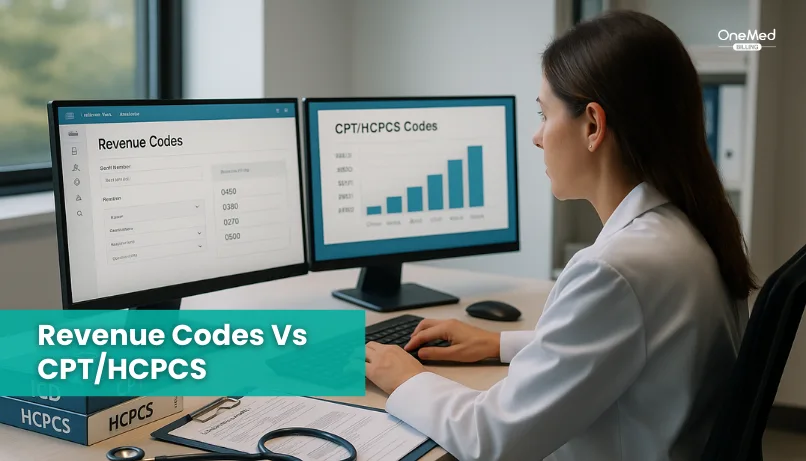

Revenue Codes vs. CPT/HCPCS

In medical billing, it’s essential to understand the difference between revenue codes and CPT/HCPCS codes. While they often appear together on a claim, each serves a different purpose, and both are needed for accurate reimbursement.

- CPT/HCPCS codes explain what was done. These codes describe the specific service, test, or procedure that was provided to the patient. For example, CPT code 71045 is for a single-view chest X-ray.

- Revenue codes explain where it was done. These numbers tell the payor which department or service area delivered the care. For example, revenue code 0320 shows the service came from diagnostic radiology.

When combined, these codes give the insurance company a complete picture: the procedure (CPT/HCPCS) and the place of service (Revenue Code).

Example in Practice:

A patient comes to the hospital for a chest X-ray.

- The CPT code 71045 (chest X-ray) explains the service.

- The revenue code 0320 (diagnostic radiology) explains that it was performed in the radiology department.

If the CPT and revenue codes don’t match, the insurer may deny the claim, even though the service was provided correctly.

Conclusion

If you’ve worked in billing long enough, you already know it’s never the big things that trip you up; it’s the little details. Revenue codes are a perfect example. Most days they’re routine, but the moment one is wrong, the whole claim stalls and everyone’s asking what went wrong.

That’s why it makes sense to treat revenue codes less like an afterthought and more like a checkpoint. A quick review now saves hours of appeals later. And when codes match up the way they should, billing feels less like a fight and more like a system that actually works.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is the difference between a CPT code and a revenue code?

CPT code describes the exact medical service or procedure, while a revenue code shows the department or service category where it was performed.

Can you bill a revenue code without a CPT code?

No. Revenue codes usually need a matching CPT or HCPCS code to explain the specific service for correct claim payment.

Are revenue codes used for outpatient services?

Yes. Revenue codes are required on outpatient facility claims to classify services by department or type.

What is the purpose of a revenue code?

A revenue code tells the insurer what kind of service was provided and in which department, ensuring accurate reimbursement.