What is upcoding in medical billing? Everything To Know

- Updated Date Oct 7, 2025

- Medical Coding

- Follow

Summary

Upcoding is when a provider bills for a service that’s more expensive than what was actually done. It can be unintentional, but if done knowingly, it’s considered fraud and can lead to audits, fines, license suspension, or even criminal charges.

Why It Happens

- To bring in higher reimbursements

- Due to billing errors or lack of training

- Confusion with complex coding systems

- Pressure to meet financial goals

Examples of Upcoding in Real Billing Scenarios

- Billing a full exam when only a quick check-up was done

- Charging for two vaccines when only one was given

- Reporting a 60-minute therapy session that only lasted 30

Legal and Financial Risks of Upcoding

- Large fines under the False Claims Act

- Being banned from Medicare or Medicaid

- Possible jail time for intentional fraud

- Damaged reputation and trust

How to Avoid Upcoding Mistakes

- Regular staff training on coding guidelines

- Match billing codes to what's actually documented

- Carefully review all claims before submission

- Use smart billing software with built-in checks

- Consult coding experts when in doubt

How Payers and Auditors Detect Upcoding

- Software that flags suspicious billing patterns

- Audits comparing medical notes to submitted codes

- Whistleblower reports or patient complaints

- Benchmarking against how peers bill for similar cases

Below is the complete expanded version of this summary, with detailed explanations, real examples, and practical tips for avoiding upcoding issues.

Understanding the Basics of Upcoding

Upcoding is a type of error in medical billing where a provider charges for a service that’s more expensive than what was actually done. It means using a billing code for a more serious or complex procedure, even if the real service was quicker or simpler.

Medical billing uses codes called CPT (Current Procedural Terminology) and ICD (International Classification of Diseases) to describe the services a patient receives. These codes are used by insurance companies to decide how much to pay the provider.

If the wrong code is used, especially a code for a service that costs more, it can lead to overbilling. That’s called upcoding.

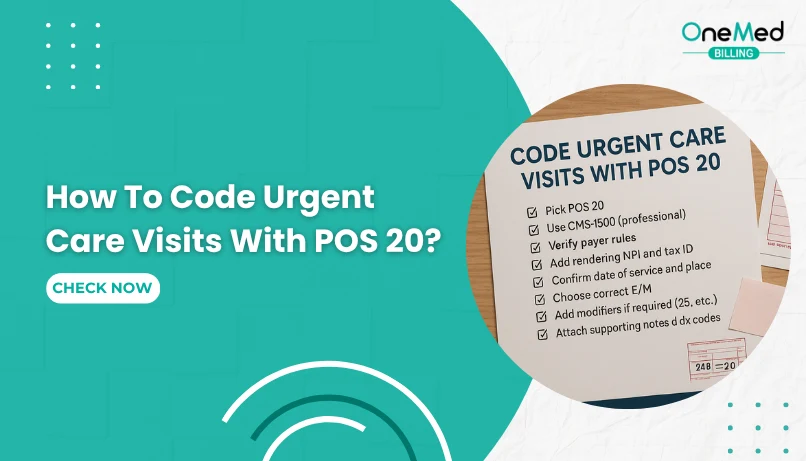

Why Do Some Providers Use Upcoding?

There are several reasons why upcoding happens in medical billing. Some providers do it on purpose, while others may not even realize they’re doing it. Let’s break down the common reasons:

1. To Increase Reimbursement

One of the main reasons upcoding happens is to make more money. Higher-level billing codes usually pay more. For example, billing a high-complexity office visit brings in more reimbursement than a basic check-up. Some providers may be tempted to choose a higher-paying code, even if the service doesn’t match.

2. Pressure to Meet Financial Goals

In busy clinics or hospitals, there’s often pressure to hit revenue targets. Billing staff or managers may feel they need to code higher to meet those goals. This pressure can lead to mistakes or poor decisions.

3. Lack of Training or Understanding

Not all billing mistakes are intentional. Sometimes, upcoding happens because a coder or provider doesn’t fully understand the correct coding guidelines. If the person choosing the code guesses or assumes incorrectly, they might end up selecting a code that’s too high.

4. Complex Billing Systems

Medical billing is full of rules, updates, and complicated code sets. It’s easy to get confused, especially when trying to match documentation to the correct CPT or ICD codes. In some cases, electronic health record (EHR) systems may suggest the wrong code, leading to unintentional upcoding.

5. Belief That the Time or Effort Deserves More

Sometimes, providers feel they should be paid more for the time they spent with a patient, even if the code doesn’t match that time or service. But billing must always reflect what was actually done, not how long it felt or how hard it was.

Is Upcoding Considered Fraud?

Yes, upcoding is considered fraud when it’s done on purpose.

If a provider knowingly uses a billing code for a service that wasn’t actually performed—or chooses a code that makes the visit look more serious than it was, they are committing fraud. This is a serious offense under federal law.

In the U.S., upcoding can be punished under the False Claims Act, which is a law that protects the government from being overcharged. Since many medical bills are paid by Medicare, Medicaid, or other government programs, upcoding can be seen as stealing from taxpayers.

Here’s what makes it fraud:

- The provider knows the code is wrong

- The provider chooses the higher code anyway

- The goal is to get more money than they should

Even if only one code is wrong, it can lead to big problems. Providers may face:

- Large fines

- Being asked to repay the money

- Loss of their medical license

- Even jail time in serious cases

But not all upcoding is fraud. Sometimes it happens by mistake. If the provider or billing team didn’t mean to overbill and corrects the error quickly, it’s not usually treated as criminal fraud. However, repeated “mistakes” can still trigger audits or penalties.

Examples of Upcoding in Real Billing Scenarios

Upcoding can happen in many ways, across different types of medical services. Here are some simple, real-world examples to help you understand how it works:

Example 1: Office Visit Upcoding

A patient comes in for a quick check-up that takes 10 minutes. The doctor performs a basic exam with no serious concerns.

But the provider bills it as a 30-minute, high-level visit.

- What actually happened: A simple, short visit

- What was billed: A long, complex evaluation

Example 2: Mental Health Counseling

A therapist meets with a patient for a 30-minute session. The code for 30 minutes should be used.

But instead, they bill it as a 60-minute session to get paid more.

- What actually happened: 30-minute session

- What was billed: 60-minute session

Example 3: Pediatric Vaccines

A child comes in for a routine vaccination. The provider gives one shot.

But they bill for two shots and an extra office visit that didn’t happen.

- What actually happened: One service

- What was billed: Two services plus a visit

Legal and Financial Risks of Upcoding

Upcoding may seem like a small billing mistake, but it can lead to serious trouble, especially if it's done often or on purpose. Whether it's a simple error or intentional fraud, the legal and financial risks can be big.

1. Fines and Penalties

If a provider is caught upcoding, they may have to pay back all the extra money they received. On top of that, they can be fined thousands or even millions of dollars, depending on how many false claims were made.

Under the False Claims Act, the government can charge a provider up to $25,000 or more per claim, plus triple the amount they were overpaid.

2. Loss of Trust

Upcoding can damage a provider’s reputation with insurance companies, government payers like Medicare, and even patients. A clinic that’s known for bad billing practices may lose contracts or referrals.

3. Being Excluded from Medicare or Medicaid

If a provider is found guilty of upcoding, they can be banned from billing Medicare and Medicaid. This can hurt a practice badly, especially if they rely on those patients.

4. Criminal Charges

In the worst cases, upcoding can lead to criminal charges. If it’s proven that a provider knowingly submitted false claims, they could face jail time—especially if the amount is large or the fraud went on for years.

5. More Audits and Investigations

Once a provider is flagged for upcoding, they may face frequent audits in the future. This means more time, more paperwork, and higher costs just to prove you’re following the rules.

How to Avoid Upcoding Mistakes

Upcoding isn’t always done on purpose. Sometimes it happens because of confusion, bad habits, or lack of training. That’s why many providers naturally turn to expert medical coding services to ensure accuracy and compliance. The good news is that upcoding can be avoided with the right steps.

Here’s how healthcare providers and billing teams can prevent upcoding:

1. Train Your Staff Regularly

Billing and coding rules can be tricky and often change. Make sure your team is trained on the latest CPT and ICD guidelines. Even experienced staff need regular updates.

2. Match Codes to Documentation

Only bill for what’s written in the patient’s chart. If the provider’s notes don’t support a higher-level service, don’t code it that way. Always let the documentation lead the coding.

3. Double-Check Before Submitting Claims

Mistakes happen when claims are rushed. Always take a moment to review the codes and make sure they match the service provided.

4. Use Reliable Billing Software

Good software can help you catch common coding errors. Many billing tools offer code suggestions, alerts, or checks that flag possible mistakes.

5. Do Regular Internal Audits

Check your billing reports from time to time. Look for patterns, like always billing the highest level of service. Spotting issues early helps you fix them before they cause trouble.

6. Ask for Help When Needed

If you're unsure about a code, ask a certified coder or billing expert. It's better to pause and get it right than risk overbilling and facing penalties later.

For example, many providers check reputable sources like the DesignRush list of top medical billing agencies in Delaware to find trustworthy billing partners who can ensure compliance and reduce the risk of upcoding.

Remember: Honest billing builds trust with patients, insurers, and regulators. It also protects your practice from audits, paybacks, or even lawsuits.

How Payers and Auditors Detect Upcoding

Insurance companies, Medicare, and government auditors have systems in place to find upcoding. They look for signs that a provider is billing for more expensive services than what was actually done.

Here’s how they usually spot it:

1. Data Patterns and Trends

Payers use software to scan billing records. If a provider always uses the highest-paying codes, more often than others in the same specialty, it raises a red flag.

Example: If most clinics bill level 3 visits 50% of the time, but your clinic bills level 5 visits 90% of the time, they’ll notice.

2. Comparing Notes to Codes

Auditors check if the medical records match the billing. If the notes don’t support the code used, it can be considered upcoding.

Example: If you billed for a detailed exam, but your chart only shows a quick check-up, they may mark it as incorrect.

3. Sudden Spikes in Billing

If your clinic suddenly starts billing for more complex services, that change may trigger a review. Big jumps in revenue without a clear reason often attract attention.

4. Complaints or Whistleblowers

Sometimes, a staff member or patient reports suspicious billing. This can lead to an audit, even if no software flagged the issue.

5. Benchmarking Against Peers

Payers compare your billing to other providers in your field. If your codes are much higher than average for similar services, they’ll take a closer look.

Conclusion

Upcoding may seem like a small billing mistake, but it can lead to big problems, especially if it happens often or on purpose. Whether it’s done to bring in more money or simply by accident, upcoding can result in audits, denied payments, fines, and even legal trouble.

The best way to avoid upcoding is to keep your billing honest and accurate. Make sure your team is trained, your documentation is clear, and your codes always match the care that was actually provided.

When billing is done right, everyone benefits—providers, patients, and payers. Most importantly, it helps build trust and keeps your practice safe. If you're not sure your billing process is fully compliant, it might be time to get expert support. Working with a trusted medical billing company can help you stay on track and avoid costly mistakes.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is upcoding in medical billing?

Upcoding is billing for a higher level of service or a more complex procedure than was actually provided or documented. It inflates reimbursement and creates compliance risk.

What is an example of upcoding?

Billing an established office visit as 99214 when the note supports only 99213. Another example is billing a complex laceration repair when only a simple repair was performed.

How can you avoid accidentally upcoding?

Match codes to the documentation. Use current coding guidelines, standardized templates, and internal audits. Train staff on medical necessity, time-based rules, and E/M criteria. Run pre-submission edits to flag outliers.

What is the penalty for upcoding?

Payers can demand refunds, assess fines, and trigger audits. Under the False Claims Act, penalties may include treble damages and per-claim fines. Repeat or intentional behavior can lead to exclusion from programs and, in severe cases, criminal liabili