Real Reasons Behind Claim Denials in Medical Billing in 2026

- Updated Date January 17th, 2026

- Denial Management

- Follow

Claim denials in medical billing continue to be a major source of delayed payments and lost revenue for healthcare providers. While denial codes explain how a claim was rejected, the real issue often lies deeper, in eligibility gaps, missing or incorrect information, authorization failures, documentation weaknesses, and payer-specific rules.

In 2026, increasing payer scrutiny and stricter policy enforcement have made it even more important to understand why claims get denied, not just the denial codes, but the prevention and follow-up behind effective denial management. This guide breaks down the real reasons behind claim denials in medical billing, with practical examples and clear prevention strategies to help providers reduce rework, avoid payment delays, and improve overall revenue cycle performance.

The Real Reasons Behind Claim Denials in Medical Billing

Claim denials are often a symptom of breakdowns earlier in the workflow, from front-end verification to coding and documentation. The sections below explain what typically causes denials and how to prevent them.

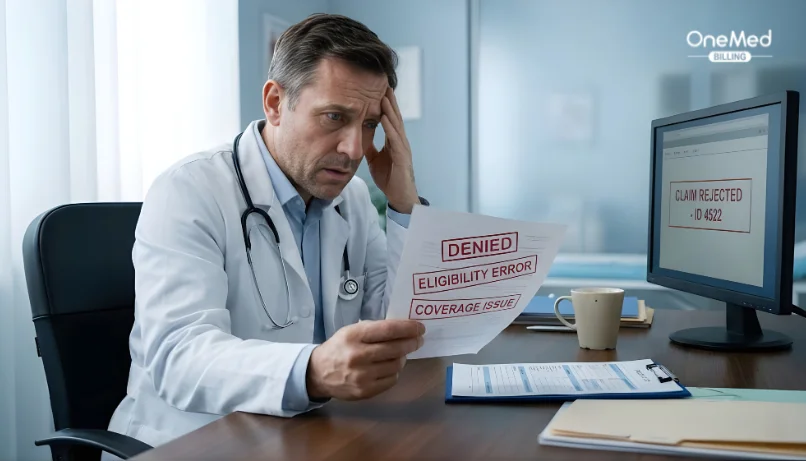

1. Eligibility and Coverage Errors

Eligibility and coverage issues are one of the most common reasons for claim denials in medical billing. Claims are often denied when insurance details are inaccurate or coverage is not verified at the time of service.

- Inactive or terminated insurance coverage

- Incorrect payer or plan selection

- Coordination of benefits (COB) issues for patients with multiple plans

Most eligibility-related denials can be prevented by verifying insurance coverage and benefits on the day of service and confirming payer responsibility upfront.

How to Prevent Eligibility-Related Denials

Most eligibility-related denials can be prevented by verifying insurance coverage and benefits on the day of service, not just at scheduling. Confirming patient responsibility and coordination of benefits upfront helps avoid billing inactive plans or the wrong insurer.

2. Missing or Invalid Claim Information

Claims are frequently denied due to missing, incomplete, or incorrect data that prevents the payer from processing the claim properly. Even small errors can trigger automatic denials.

- Incomplete patient or provider information

- Invalid or missing NPIs, modifiers, or place-of-service codes

- Data entry or formatting errors

Using pre-bill checks and claim scrubbers helps ensure claims are complete and accurate before submission.

How to Prevent Missing or Invalid Claim Information

Denials caused by missing or incorrect claim data can be reduced by using standardized pre-billing reviews. Validating patient demographics, provider identifiers, modifiers, and required fields before submission helps ensure claims are complete and clean.

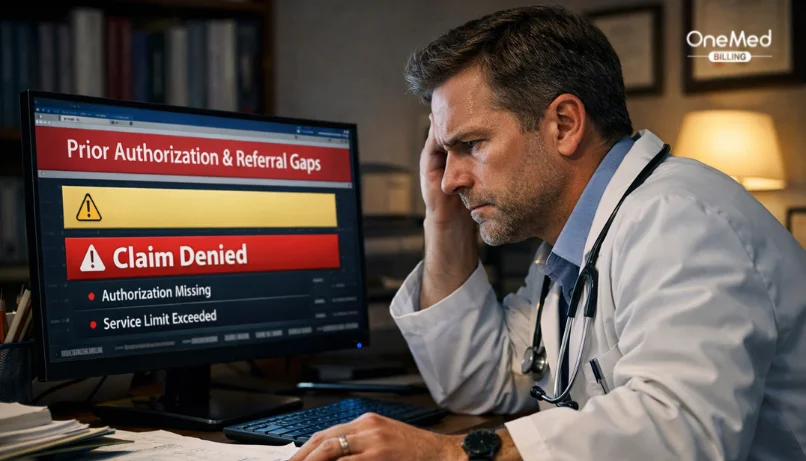

3. Prior Authorization and Referral Gaps

Many services require prior authorization or referrals, and claims are denied when these requirements are missed or improperly documented.

- Services requiring authorization that was not obtained

- Missing, expired, or incomplete approvals

- Visit limits exceeded for recurring services

Authorization-related denials can be reduced by tracking approval requirements, authorization numbers, and visit limits before services are rendered.

How to Prevent Authorization and Referral Denials

Authorization-related denials can be avoided by identifying approval requirements before services are scheduled. Tracking authorization numbers, approval dates, and visit limits ensures claims are submitted only when valid authorization is in place.

4. Coding Errors and Diagnosis-Procedure Mismatches

Coding issues occur when diagnosis and procedure codes do not align with payer coverage rules or medical necessity guidelines, often resulting in repeat denials tied to the same denial codes.

- ICD-10 and CPT code compatibility issues

- Overuse of unspecified or outdated diagnosis codes

- Failure to follow payer-specific coverage policies

Validating code combinations and following payer guidelines helps reduce coding-related denials.

How to Prevent Coding-Related Denials

Coding-related denials are best prevented by validating diagnosis and procedure code combinations against payer coverage rules. Using specific diagnosis codes and reviewing payer guidelines before submission helps ensure claims meet medical necessity requirements.

5. Medical Necessity and Documentation Issues

Claims may be denied when clinical documentation does not support the medical necessity of the billed service.

- Insufficient or vague clinical documentation

- Failure to meet Local or National Coverage Determinations (LCDs/NCDs)

- Missing supporting notes, test results, or physician rationale

Clear, detailed documentation that aligns with payer policies is essential for supporting reimbursement.

How to Prevent Medical Necessity Denials

Medical necessity denials can be reduced by ensuring clinical documentation clearly explains why a service was required. Detailed provider notes, supporting test results, and alignment with payer policies strengthen claims and support reimbursement.

6. Timely Filing and Process Delays

Timely filing denials occur when claims or corrections are submitted after payer deadlines.

- Missed claim submission deadlines

- Delayed corrections or resubmissions

- Internal workflow bottlenecks that slow claim processing

Tracking payer-specific claim filing time limits and monitoring claim status regularly helps prevent late submissions.

How to Prevent Timely Filing Denials

Timely filing denials are prevented by submitting claims promptly and tracking payer-specific deadlines. Monitoring delayed claims and addressing issues early helps avoid missed filing windows and late resubmissions.

7. Provider Enrollment and Credentialing Issues

Claims are denied when services are billed under providers who are not properly enrolled or credentialed with the payer.

- Billing under non-credentialed or unenrolled providers

- Credentialing effective date mismatches

- Enrollment delays and recredentialing lapses

Maintaining an up-to-date credentialing tracker ensures claims are submitted only for eligible providers.

How to Prevent Credentialing-Related Denials

Credentialing denials can be avoided by confirming provider enrollment before services are rendered. Maintaining an up-to-date credentialing tracker with effective dates and re-credentialing timelines ensures claims are billed only for eligible providers.

Conclusion

If you look closely, most claim denials come from the same handful of mistakes showing up again and again. Coverage wasn’t checked. Information wasn’t complete. An authorization was missed. Documentation didn’t clearly support the service. None of these are unusual, but when they’re not caught early, they turn into denials.

The real fix isn’t reacting to denials after they happen. It’s tightening what happens before claims are sent and deciding who owns denial follow-up when it does occur, whether that responsibility stays in-house or is handled by a denial management company to keep denials from piling up.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What are the top reasons for claim denials?

Claims are most often denied due to eligibility errors, missing information, lack of authorization, coding issues, documentation gaps, or late submission.

What are the types of claim denials?

Common types include eligibility denials, authorization denials, coding and medical necessity denials, timely filing denials, and credentialing denials.

How can I prevent common denial codes?

Verify insurance, confirm authorizations, submit clean claims, use correct codes, and track filing deadlines to prevent most denial codes.

What are the most common denial codes in medical billing?

The most common denial codes relate to missing information, non-covered services, diagnosis mismatches, lack of authorization, timely filing, and provider enrollment.