Claim Filing Time Limits in Medical Billing By State

- Updated Date January 17th, 2026

- Claims Submission

- Follow

Timely filing limits are one of the most important rules in medical billing. Every payor, including Medicare, Medicaid, and commercial payors, sets a strict deadline for when claims must be submitted. If a claim is filed after that deadline, it is usually denied regardless of the validity of the service provided.

If providers miss these deadlines, they risk losing revenue, running into compliance issues, and adding extra work. In this blog, we will explain what timely filing limits are, why they vary by state, and provide a complete state-by-state list of current deadlines.

What Are Timely Filing Limits in Medical Billing?

Timely filing limits are the deadlines set by payors for submitting claims after a service has been provided. Each payor sets its own rules. Medicare gives providers up to 12 months, while Medicaid programs and private payors may allow much less time. If a claim is not filed within the deadline, it will almost always be denied, no matter how necessary the treatment was.

For example, a clinic in Texas submitted a Medicaid claim for a patient’s outpatient visit 120 days after the date of service. Since Texas Medicaid requires claims to be filed within 95 days, the claim was automatically denied. The provider could not bill the patient and ended up losing the entire payment. This shows why knowing and following filing limits is critical for revenue protection.

Difference between commercial insurance vs. Medicare, vs. Medicaid filing rules.

Timely filing rules differ across payors, and understanding these differences is essential for providers. Medicare is the most consistent, allowing up to 12 months from the date of service to submit a claim. Medicaid varies significantly because each state sets its own deadlines; some allow up to 12 months, while others permit only 90 or 95 days. Commercial insurance payors also establish their own rules, usually between 90 and 180 days, though timelines can differ from one plan to another.

In practice, this means a provider could treat three patients on the same day, each insured under a different program, and face three separate filing deadlines. Missing even one of them can result in a denial that is often final and not open to appeal. This makes it essential for billing teams to have reliable systems that track payor-specific requirements and prevent costly mistakes.

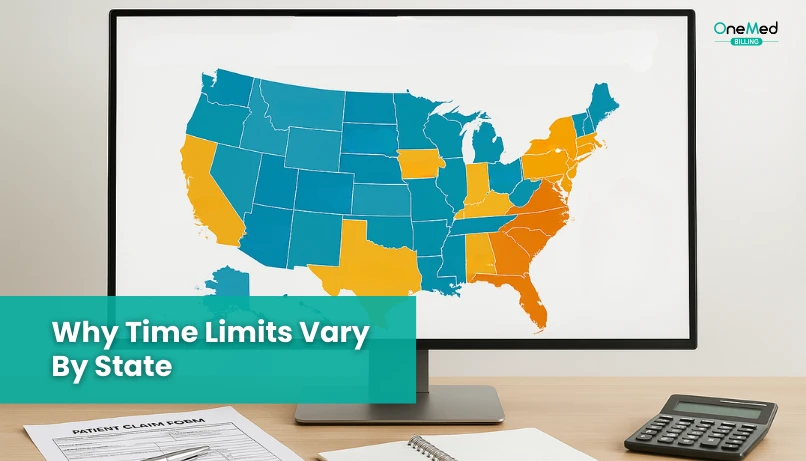

Why Claim Submission Time Limits Vary by State

Timely filing limits for Medicaid are not uniform because each state runs its own program under federal guidelines. As a result, the deadlines for submitting claims differ widely across the country. Some states are strict, such as New York with a 90-day limit or Texas with a 95-day limit, while others, like Florida or Michigan, allow up to 12 months.

It is also important to remember that filing limits apply not only to original claims but also to corrected claims and appeals. In many states, even denied claims often have to be re-appealed within 30 to 60 days of the denial, depending on the payor’s rules, even if the original timely filing limit was longer. Providers who miss these windows often lose the chance to resubmit and must absorb the financial loss.

Complete Medical Billing Time Limits by State

|

State |

Initial timely filing limit |

Common notes/exceptions |

Source |

|

Alabama |

12 months from DOS |

— |

(Missouri Department of Social Services) |

|

Arizona (AHCCCS) |

6 months from DOS |

If initially denied/timely, resubmissions are allowed up to 12 months |

(Oregon) |

|

California (Medi-Cal) |

Varies by program; pharmacy FFS has a 6-month billing limit |

Other lines often use longer windows—check the relevant DHCS manual |

(DHCS) |

|

Colorado (Health First CO) |

365 days from DOS |

60 days after Medicaid denial; 365 days from retro-eligibility letter |

(medi-calrx.dhcs.ca.gov) |

|

Connecticut |

180 days from DOS |

Retro eligibility: up to 12 months |

(Missouri Department of Social Services) |

|

Delaware |

365 days from DOS (typical) |

State docs reference a 365-day window across programs |

(Delaware Health and Social Services) |

|

Florida |

12 months from DOS |

Medicare crossovers & TPL follow separate timelines |

(Washington State Legislative Information) |

|

Illinois |

Generally 180 days (outpatient/professional) |

Inpatient has distinct rules; see HFS guidance |

(njmmis.com) |

|

Iowa |

12 months from DOS |

Denial code set explicitly cites a 12-month limit |

(Health & Human Services) |

|

Louisiana |

12 months from DOS (straight Medicaid) |

KIDMED: 60 days |

(Washington State Health Care Authority) |

|

Maryland |

12 months from DOS/discharge |

120 days from Medicare EOB; 60 days from TPL EOB |

(Maryland.gov Enterprise Agency Template) |

|

Michigan |

365 days from DOS |

— |

(Tennessee State Government) |

|

Mississippi |

365 days from DOS (FFS) |

Medicare crossovers: 180 days from the Medicare paid date |

(Mississippi Division of Medicaid -) |

|

Missouri |

12 months from DOS |

— |

(Missouri Department of Social Services) |

|

Nevada |

180 days from DOS |

— |

(njmmis.com) |

|

New Jersey |

180 days from DOS |

Some services have plan/manual-specific nuances |

(Missouri Department of Social Services) |

|

New York |

90 days from DOS |

Exceptions for retro-eligibility and other payor actions |

(Washington State Health Care Authority) |

|

North Carolina |

365 days from DOS |

— |

(Virginia Medicaid) |

|

Nebraska |

6 months from DOS (FFS) |

Reconsiderations within TF window or 3 months of denial |

(Department of Health and Human Services) |

|

Ohio |

365 days from DOS |

— |

(Alabama Medicaid) |

|

Oklahoma (SoonerCare) |

365 days from DOS |

Denials within 12 months can be adjusted |

(Missouri Department of Social Services) |

|

Oregon |

12 months from DOS |

— |

(Medicaid Utah) |

|

Pennsylvania |

180 days from DOS |

— |

(Alabama Medicaid) |

|

Rhode Island |

365 days from DOS |

Denials >90 days after RA not accepted for TF relief |

(RI Executive Office of Health Services) |

|

South Dakota |

6 months from month after DOS |

Appeals usually within 3 months of denial |

(Department of Social Services) |

|

Tennessee (TennCare) |

12 months from DOS |

— |

(Missouri Department of Social Services) |

|

Texas |

95 days from DOS |

Strict window; watch MCO vs. FFS differences |

(Washington State Health Care Authority) |

|

Virginia |

12 months from DOS |

— |

(Tennessee State Government) |

|

Washington (Apple Health) |

365 days from DOS (initial) |

Resubmissions/adjustments are commonly allowed up to 24 months |

(medi-calrx.dhcs.ca.gov) |

|

Wisconsin (ForwardHealth) |

365 days from DOS |

Adjustments past 365 days require the TF appeal process |

(ForwardHealth) |

Key Challenges Providers Face With Time Limits

- Missing deadlines due to delays - Timely submission often depends on how quickly clinical documentation is completed and forwarded to the billing team. If providers or coders take too long to finalize records, or if payors delay eligibility verification or prior authorization responses, the claim window can shrink significantly. By the time all required information is in place, the filing deadline may already be at risk.

- Incorrect understanding of state rules - Filing limits are not consistent across the country, and assuming they are the same can lead to costly errors. For example, Texas Medicaid requires claims to be submitted within 95 days, while Florida allows 12 months. If staff apply the wrong standard, valid claims can be denied automatically. This shows why maintaining a clear reference of state-specific rules is essential.

- Staff turnover and training gaps - High turnover in billing departments is common, and new staff may not be trained on the specific filing rules for Medicare, Medicaid, and commercial payors. Without structured onboarding and ongoing education, employees may overlook critical timelines, resulting in repeated denials that hurt cash flow and compliance performance.

- Lack of tracking systems - Many practices still rely on manual processes, which makes it easy for deadlines to slip through. Without modern billing software, claim alerts, or filing calendars, providers may only discover missed deadlines after a denial arrives. By then, the chance to correct or appeal is often lost, leaving revenue unrecoverable.

Best Practices to Avoid Timely Filing Denials

- Use software with deadline alerts - Billing software that tracks claim status can flag upcoming deadlines, giving staff enough time to submit or correct claims before the filing window closes.

- Maintain updated payor rules - Since each payor has its own filing timelines, keeping an updated library of Medicare, Medicaid, and commercial insurance rules in the billing system helps staff avoid mistakes.

- Provide regular staff training - Continuous training ensures billing teams understand the differences between Medicare’s 12-month limit, state Medicaid rules, and commercial deadlines. Well-informed staff are less likely to miss critical filing dates.

- Outsource denial management if needed - Partnering with denial management specialists can help recover revenue tied to missed deadlines. These teams also handle appeals and corrected claims that require a quick turnaround.

- Set internal filing buffers - Do not wait until the last day to submit claims. Establish internal deadlines such as 30 days from the date of service, which creates a safety margin for corrections or resubmission of claims.

How to Turn Filing Limits into a Strength

Filing limits can serve as a performance KPI to track how quickly a billing team submits claims.

Regular audits of accounts receivable help identify if denials are linked to missed deadlines. This allows providers to fix workflow or training issues early.

Setting internal targets that are stricter than payor deadlines also adds protection. For example, Texas Medicaid allows 95 days, but aiming to file within 30 days gives room to correct errors while staying compliant.

Conclusion

Filing limits vary by state, and overlooking them can quickly cost providers valuable revenue. Once a deadline passes, most claims are denied with little chance of recovery.

The solution lies in proactive processes, ongoing staff training, and technology that tracks deadlines and reduces errors. These steps give providers the structure needed to stay ahead of payor rules.

Managing timely filing is not only about meeting compliance standards. It is also about protecting revenue and building patient trust by keeping the billing process clear and reliable.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What are timely filing limits in medical billing?

Deadlines set by each payer for when a claim must be received. They start from the date of service or discharge and vary by plan and contract.

What is the time limit for filing a medical insurance claim?

It depends on the payer. Many commercial plans allow 90–180 days, Medicaid varies by state, and Medicare allows up to 12 months from the date of service.

What is considered timely medical billing?

Submitting a clean claim within the payer’s filing window, with all required data and documents, so it is accepted on the first pass.

What is the timely filing rule for CMS?

For Medicare (CMS), claims must be received within 12 months, or one calendar year, from the date of service. Limited exceptions apply for things like retroactive entitlement or administrative error.