What is a Clean Claim in Medical Billing?

- Updated Date Sep 26, 2025

- Claims Submission

- Follow

Clean claims are the backbone of a reliable revenue cycle. When claims are submitted correctly the first time, payments arrive faster, denials drop, and staff spend less time on rework. When they are not, revenue stalls and patient satisfaction often suffers. That is why the clean claim rate has become one of the most important benchmarks for healthcare practices.

In this article, we’ll take a closer look at what clean claim rate really means, why it matters, how to know if your numbers are strong, and the practical steps you can take to improve them.

What Is a Good Clean Claim Rate?

A clean claim rate measures how many claims are paid by insurance on the first submission without rejections, missing information, or errors. The higher the rate, the smoother your revenue cycle runs. High clean claim rates give providers financial stability, free staff from constant corrections, and create more time to focus on patient care.

How To Calculate Clean Claim Rate?

Most healthcare practices should aim for a clean claim rate of 95 percent or higher. In other words, at least 95 out of every 100 claims should be accepted and paid without additional follow-up. Rates in the 96 to 99 percent range are considered excellent and show that your billing process is both efficient and accurate.

If the clean claim rate falls below 90 percent, it usually signals problems such as incomplete documentation, coding mistakes, or untimely submissions. Keeping this number consistently high is essential for maintaining steady cash flow and reducing avoidable stress across your practice.

To calculate it, use this simple formula:

Clean Claim Rate = (Number of Clean Claims ÷ Total Number of Claims Submitted) × 100

For example, if your practice submits 1,000 claims in a month and 950 are paid on the first submission, your clean claim rate is 95 percent.

Break Down Clean Claim Rate by Claim Type

Clean claim rate is often discussed as a single percentage, but in practice, it can vary widely depending on the type of claim. Looking at the numbers by category gives providers a clearer picture of where issues may arise.

Professional claims (CMS-1500): These are typically less complex and often achieve higher clean claim rates. Errors still occur, but they are easier to resolve compared to other claim types.

Facility claims (UB-04): These involve multiple services, departments, and billing codes, which increases the chance of errors. Common problem areas include coding accuracy, site-of-service rules, and bundled charges.

Specialty claims: Services such as behavioral health, DME, infusion, and imaging usually require additional documentation. Prior authorizations, clinical notes, or medical necessity forms are often needed, which lowers first-pass acceptance rates.

Breaking clean claim rates into these categories helps practices compare their performance realistically and identify where focused improvements will make the biggest impact.

Key Challenges in Clean Claim Management

Maintaining a high clean claim rate is a constant challenge for healthcare providers. Errors, missing details, and process gaps can all affect whether a claim is accepted on the first submission. Below are the key challenges that often stand in the way of achieving consistently clean claims.

1. Incomplete or Inaccurate Patient Data

One of the most common obstacles is incorrect or missing patient information. Even small mistakes such as a wrong date of birth, outdated member ID, or a misspelled name can cause a claim to be rejected. In many practices, front desk teams are stretched thin, which makes errors more likely during registration. Without accurate demographic and insurance details, claims rarely make it through on the first attempt.

2. Prior Authorization and Referral Gaps

Providers often face delays when a service requires prior authorization or a referral that was not obtained or does not match the service billed. This is especially true for high-cost imaging, specialty medications, or behavioral health services. Missing or mismatched authorizations result in denials that could have been avoided, creating more work for staff and frustration for patients.

3. Coding Errors and Lack of Specificity

Coding continues to be one of the biggest challenges to maintaining a high clean claim rate. Errors occur when ICD-10 codes are too vague, CPT codes do not align with the diagnosis, or modifiers are missing. These mistakes can trigger payor edits and rejections. For specialties that rely on complex coding, such as surgery or orthopedics, even a small oversight can disrupt the entire billing process.

4. Variability in Payor Rules

Every payor has its own set of rules and coverage policies. What is accepted by one insurance plan might be denied by another for the exact same service. Providers must navigate differences in medical necessity criteria, documentation requirements, and benefit limits. This variability makes it challenging to achieve consistency, especially for practices working with multiple commercial and government payors.

5. Provider Enrollment and Identifier Issues

Clean claim rates often drop because of enrollment or credentialing problems. If a provider’s NPI, taxonomy, or service location is not properly registered with the payor, claims may be rejected before they are even reviewed. These errors create bottlenecks that are difficult to resolve quickly, especially when dealing with multiple payors or newly added providers.

6. Place of Service and Site-of-Care Errors

Using the wrong place of service code or failing to align with the correct site-of-care rules is another frequent challenge. For example, a telehealth claim may be denied if the POS code does not match payor guidelines, or a procedure performed in an outpatient setting may be billed incorrectly as inpatient. These errors often slip through because they appear minor but carry a major financial impact.

7. Missing Attachments or Documentation

Some claims require medical records, test results, or prior authorization letters to support medical necessity. When attachments are missing, claims are automatically delayed or denied. Providers who submit large volumes of claims may struggle to keep track of these requirements across multiple payors and service types, leading to inconsistencies in documentation.

8. Timing and Filing Deadlines

Timely filing is another critical hurdle. Each payor has its own deadline for when claims must be submitted, and missing these windows can result in a permanent loss of revenue. Even when corrections are made, resubmissions may be considered late if they fall outside the filing limit. This puts added pressure on billing teams to work quickly and accurately under strict timelines.

9. Coordination of Benefits Errors

When patients have more than one insurance policy, clean claim management becomes even more complicated. Errors in determining the correct primary and secondary payor often lead to rejections or payment delays. Coordination of benefits issues are especially common in cases involving Medicare and commercial insurance, or when patients change coverage without notifying the practice.

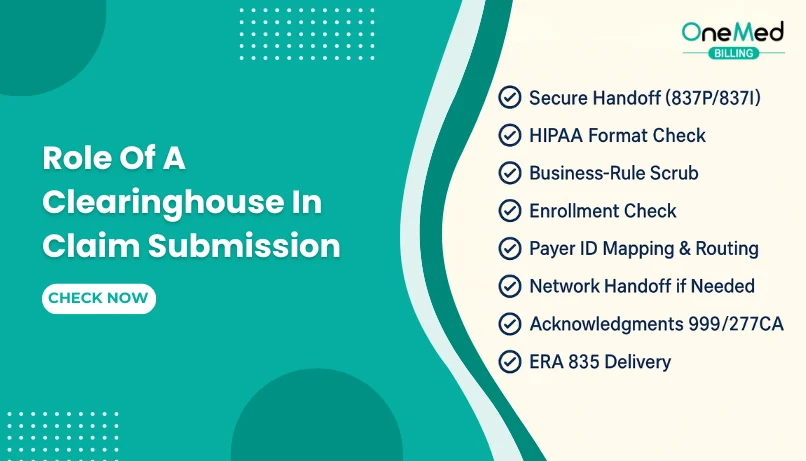

10. Clearinghouse and Format Errors

Not all claims make it to the payor. Some are rejected at the clearinghouse level because of incorrect formatting, mismatched payor IDs, or missing data elements. Even when working with the top clearing houses, providers can still face these problems if the claim contains missing or inaccurate information. These issues are frustrating because they often require back-and-forth troubleshooting with both the clearinghouse and the payor before the claim can be resubmitted.

11. Staff Turnover and Training Gaps

Maintaining a high clean claim rate requires consistent processes, but staff turnover and limited training create gaps. New employees may not be familiar with payor rules, coding requirements, or documentation standards, leading to repeated errors. Over time, this inconsistency results in lower claim accuracy and more denials.

12. Lack of Visibility Into Trends

Many practices handle claim rejections one by one without tracking the bigger picture. Without data and trend analysis, the same mistakes continue to happen, lowering the overall clean claim rate. This lack of visibility makes it difficult for providers to identify systemic issues and take corrective action.

How to Achieve a High Clean Claim Rate

1. Verify Patient Information at Registration

Clean claims begin with accurate data entry. Errors in patient demographics, coverage details, or policy numbers are among the most common reasons for rejections. Every registration should include verification of insurance eligibility, active coverage dates, and coordination of benefits when more than one payor is involved.

2. Confirm Payor Rules and Requirements

Each payor has its own rules for medical necessity, prior authorization, referrals, and service limits. Submitting a claim without meeting these requirements almost guarantees a denial. Building payor-specific checklists helps staff confirm what is needed before the visit and reduces the risk of preventable rejections.

3. Use Accurate and Specific Coding

Coding errors are a major barrier to clean claims. Using nonspecific ICD-10 codes, missing modifiers, or mismatched CPT and ICD combinations often triggers payor edits. Coders and billers should use the highest level of specificity available, apply modifiers correctly, and confirm that diagnosis codes support the services billed.

4. Attach Required Documentation

Some claims, such as those for imaging, infusions, or durable medical equipment, require supporting documentation. Missing medical records, prior authorization letters, or test results can hold up payment. Providers should maintain a process to capture and attach all required documents before claim submission.

5. Monitor Timely Filing Deadlines

Even clean claims are denied if they are filed late. Every payor sets its own filing limits, which may range from 30 days to a year from the date of service. Practices must have systems in place to track deadlines and resubmit corrected claims quickly after denials to avoid lost revenue.

6. Standardize Workflows for Consistency

When staff follow different processes, claim quality becomes inconsistent. Standardized workflows ensure every step of registration, coding, documentation, and submission is handled the same way each time. Clear SOPs also make it easier to train new staff and keep performance steady even during turnover.

7. Use Claim Scrubbing to Catch Errors Early

Claim scrubbing is one of the most effective ways to improve first-pass acceptance. Automated scrubbers review claims before submission and flag common issues such as missing demographic data, incorrect coding, invalid modifiers, or payor-specific formatting errors. Scrubbers also provide valuable insight by identifying recurring mistakes, whether they come from registration, coding, or documentation. When combined with manual review, claim scrubbing gives providers the highest chance of achieving consistently clean claims.

8. Track Claim Trends and Denial Patterns

Managing claims one at a time fixes the symptom, not the root cause. By analyzing reports on denials, rejections, and claim status, practices can identify patterns such as recurring coding errors or payor-specific issues. Tracking these trends provides the insight needed to improve processes and raise clean claim rates over time.

9. Invest in Staff Training and Refreshers

Billing rules, coding guidelines, and payor requirements change regularly. Without ongoing training, staff may continue to make the same mistakes, lowering clean claim performance. Regular refreshers and workshops ensure the team stays current and consistent, protecting revenue while improving claim accuracy.

10. Coordinate Benefits Accurately

When patients have multiple payors, claims must be submitted to the correct primary insurer first. COB errors, such as submitting to the secondary before the primary, are a common reason for rejections. Verifying coordination of benefits during registration and eligibility checks helps prevent this problem and ensures faster payments.

Conclusion

Every provider has felt the frustration of claims bouncing back for reasons that could have been prevented. The clean claim rate is simply a measure of how often your process gets it right the first time. A strong rate means steady cash flow and less stress for your staff. A weak one is a warning sign that money is stuck in rework, and patients may end up with billing headaches.

If you want to submit more clean claims, you can take help from OneMed Billing through our clean claim submission services. Our team focuses on accuracy at every step so providers, so that reimbursements arrive on schedule and staff are not stuck fixing preventable errors.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What does a clean claim mean in medical billing?

A clean claim is a claim submitted with complete, accurate information that is accepted and paid by the payor on the first submission.

What is the difference between clean and unclean claims?

A clean claim is error-free and processed without delays, while an unclean claim has mistakes or missing data that cause rejections or denials.

What is the key to submitting a clean claim?

The key is accurate patient data, correct coding, required documentation, and verifying payor rules before submission.

What is the clean claim rate in medical billing?

Clean claim rate is the percentage of claims paid on the first submission. A strong rate is 95% or higher.