What Is Claim Scrubbing in Medical Billing?

- Updated Date Feb 6, 2026

- Claims Submission

- Follow

Most claim rejections and preventable denials happen before a payer ever reviews medical necessity. Small data errors, coding conflicts, and payer-specific rules break claims early in the billing process, slowing reimbursement and increasing rework. Claim scrubbing sits inside the claim lifecycle to catch these issues before submission, helping practices improve clean claim rates, reduce payment delays, and protect cash flow.

What Is Claim Scrubbing in Medical Billing?

Claim scrubbing is the process of reviewing medical claims for errors, missing information, and payer-specific requirements before they are submitted to insurance companies. Its main goal is to ensure that claims meet formatting rules, coverage policies, and coding guidelines so they can be processed as clean claims.

In real billing workflows, claim scrubbing acts as a quality control step between coding and claim submission. It checks whether patient details are accurate, diagnosis and procedure codes align correctly, modifiers are used properly, authorization numbers are included when required, and payer rules are followed.

Most practices use a combination of automated claim scrubbing software and manual review. Automated systems scan claims against thousands of payer edit rules in seconds, while billing teams review flagged issues to confirm accuracy before submission.

What Claim Scrubbing Actually Audits?

Claim scrubbing is designed to identify the most common issues that prevent claims from being processed smoothly by payers. These errors typically fall into several key categories that directly impact claim acceptance and reimbursement.

Here are the key categories of errors that claim scrubbing typically catches.

1. Patient & Insurance Data Errors

Claim scrubbing detects incorrect or missing patient demographics, subscriber ID numbers, group numbers, payer selection, and coverage status. Even small front-end mistakes such as a mismatched name or inactive insurance policy, can trigger immediate claim rejection, making data validation one of the most critical error checks.

2. ICD-10 and CPT Conflicts

Scrubbing systems review whether diagnosis codes properly support the procedures billed and flag invalid code combinations, outdated codes, and incorrect diagnosis pointers. These conflicts are a leading cause of medical necessity denials when the payer determines the service is not clinically justified by the diagnosis submitted.

3. Modifier Mistakes

Claim scrubbing identifies missing, incorrect, or incompatible modifiers that affect how services are reimbursed. This includes misuse of multiple procedure modifiers, bilateral service indicators, and modifiers that are not allowed with certain CPT codes, all of which commonly result in reduced payments or claim denials.

4. Authorization & Referral Issues

Many services require prior authorization or referral approval for coverage. Scrubbing flags missing authorization numbers, expired approvals, services exceeding authorized limits, and claims where referrals are required but not attached, helping prevent high-value denials tied to coverage conditions.

5. Coverage & Frequency Violations

Insurance plans often restrict how often certain services can be billed or exclude specific treatments altogether. Claim scrubbing catches duplicate claims, over-frequency billing, non-covered procedures, and benefit exclusions before submission, reducing avoidable denials and compliance risk.

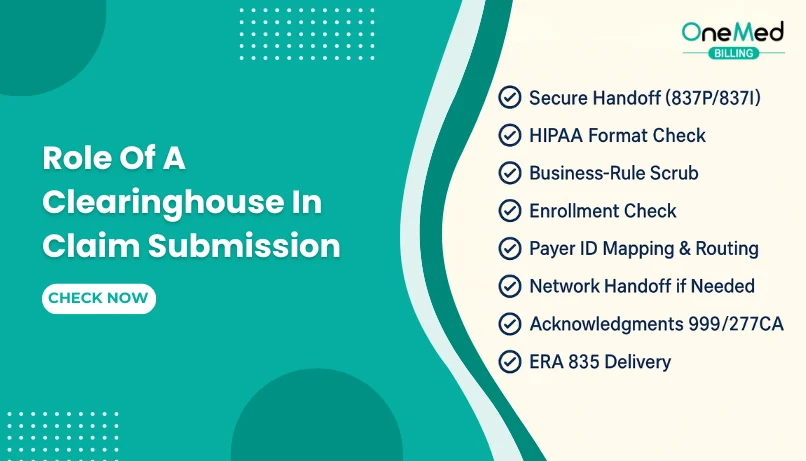

6. Technical Billing Errors

Scrubbing also reviews required electronic claim fields and billing structure, including provider identifiers, place of service codes, units of service, charge formatting, and mandatory data elements. These technical errors commonly lead to immediate clearinghouse rejections if not corrected.

How Claim Scrubbing Improves Clean Claim Rates in Medical Billing?

Clean claims are medical claims that pass through clearinghouses and insurance companies without being rejected or denied for errors. While accurate coding is important, clean claims are rarely achieved by coding alone. The main driver behind high clean claim rates is effective claim scrubbing.

Claim scrubbing works as the final quality control step before submission, where errors that typically break claims are caught and corrected early. This includes missing patient data, invalid code combinations, incorrect modifiers, authorization gaps, and payer-specific billing rules.

When these issues are fixed before claims reach insurers, claims move smoothly through the system instead of bouncing back for corrections.

Best Practices for Effective Claim Scrubbing

Effective claim scrubbing combines properly configured technology, updated payer requirements, human oversight, and performance monitoring to consistently reduce rejections and denials while improving reimbursement speed.

1. Software Configuration and Custom Edit Rules

Claim scrubbing software should be customized for each payer’s billing requirements rather than relying on default settings. This includes setting edits for diagnosis and procedure compatibility, modifier rules, authorization fields, coverage limitations, and required claim data so errors are caught before submission instead of after rejection.

2. Regular Updates for Payer Rules and Policies

Payers frequently change coverage guidelines, authorization requirements, and billing restrictions, which can quickly make scrubbing rules outdated. Keeping systems updated based on payer policy changes and denial trends helps prevent recurring denials caused by new or revised billing requirements.

3. Manual Review for High-Risk and Complex Claims

Automation speeds up error detection, but complex claims still require human review for medical necessity, modifier accuracy, authorization compliance, and payer-specific policies. Reviewing high-dollar or complicated services adds an extra layer of protection against costly denials.

4. Feedback Loops Based on Rejections and Denials

Denied and rejected claims should be analyzed regularly to identify recurring issues and gaps in scrubbing rules. Using this data to update software edits and improve workflows turns denial management into a prevention strategy rather than a correction process.

Impact of Poorly Done Claim Scrubbing

When claim scrubbing is incomplete, outdated, or rushed, small billing errors quickly turn into larger revenue and workflow problems. Instead of preventing issues early, weak scrubbing allows preventable mistakes to move further into the revenue cycle where they are harder and more expensive to fix.

Common impacts include:

- Higher claim rejection rates due to missing patient information, invalid codes, and formatting errors that stop claims before payer review

- Increase in preventable denials caused by missed authorization requirements, incorrect modifiers, and medical necessity conflicts

- Longer reimbursement timelines as rejected and denied claims require correction, resubmission, and additional payer review

- Greater administrative workload from repeated follow-ups, documentation requests, and appeal processes

- Reduced cash flow and higher A/R days as payments are delayed and revenue remains tied up in unpaid claims

- Higher compliance and audit risk when recurring errors signal weak billing controls to insurance companies

How Claim Scrubbing Improves Revenue Performance?

Claim scrubbing directly affects how quickly and how much a practice gets paid. By catching errors before claims reach payers, it reduces rework, shortens payment cycles, and protects revenue that would otherwise be lost to denials and delays.

- Key ways claim scrubbing strengthens financial performance include:

- Higher clean claim rate by ensuring claims are accurate and compliant the first time, which leads to faster approvals and fewer rejections

- Faster reimbursement cycles as clean claims move through payer systems without additional review or correction

- Lower denial volume by preventing common issues such as missing authorizations, coding conflicts, and modifier errors

- Reduced rework and labor costs since billing teams spend less time fixing and resubmitting claims

- Improved cash flow consistency with fewer payment gaps and more predictable revenue

- Stronger compliance and lower audit risk by meeting payer billing and documentation requirements upfront

How OneMed Helps with Claim Scrubbing?

OneMed supports healthcare practices by reviewing claims carefully before they are sent to insurance companies, focusing on accuracy, payer rules, and common denial risks. Rather than treating scrubbing as a separate step, we have built it directly into our claim submission services so every claim is checked for missing information, coding issues, authorization requirements, and formatting errors ahead of time. This helps ensure claims go out clean, reduces avoidable delays, and keeps the billing process moving smoothly.

Key benefits include:

- Fewer rejected and denied claims

- Faster reimbursement timelines

- Less rework for billing staff

- Stronger compliance with payer policies

- More reliable cash flow

What This Means for Your Billing Workflow

In day-to-day operations, strong claim scrubbing should function as a built-in quality checkpoint before claims ever leave your system. This means verifying patient information at intake, confirming coding accuracy before charge posting, checking authorizations at the time of billing, and running payer-specific edits prior to submission. When these steps are consistent, most preventable rejections and denials never reach the insurer.

For billing teams, this translates into fewer corrections, faster claim turnaround, and less time spent on resubmissions and appeals. For practices, it means payments arrive more predictably and revenue is not held up by avoidable errors. Instead of reacting to denials after they occur, claim scrubbing allows workflows to prevent problems upfront and keep the revenue cycle moving smoothly.

Over time, practices that treat scrubbing as a daily operational standard rather than a last-minute check see stronger clean claim rates, shorter A/R days, and more efficient billing processes overall.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What is the most common issue detected by a claim scrubber?

The most common issues caught by claim scrubbers are missing or incorrect patient and insurance information, such as wrong subscriber IDs, inactive coverage, or incomplete required fields. These small data errors are responsible for a large percentage

What does scrubbing claims mean?

Scrubbing claims means reviewing medical claims for errors, missing details, and payer-specific rules before sending them to insurance companies. The goal is to catch problems early so claims can be processed as clean claims instead of being rejected o

What service is used to scrub a claim for errors?

Claims are typically scrubbed using claim scrubbing software built into billing systems or clearinghouses, along with manual review by billing specialists. The software checks claims against payer rules and formatting requirements, while human reviewer

What is the process of scrubbing?

The claim scrubbing process starts after coding is complete and before claims are submitted to insurers. Claims are scanned for patient data accuracy, code compatibility, modifier use, authorization requirements, coverage limits, and technical billing