What Are G-Codes in Medical Billing? - Detailed Explanation

- Updated Date Feb 6, 2026

- Medical Billing

- Follow

Many healthcare providers face claim delays, denials, and reporting issues simply because G-Codes are misunderstood or used incorrectly. These codes play an important role in tracking patient outcomes, supporting quality programs, and ensuring accurate reimbursement, especially for Medicare services.

For example, a physical therapy clinic may complete a full course of treatment for a Medicare patient but experience delayed payment because a required G-Code was missing or outdated on the claim. Even though the service was medically necessary, the claim can be held, reduced, or flagged for review due to reporting errors.

Whether you are a billing professional, provider, or practice manager, understanding how G-Codes work in medical billing helps prevent costly mistakes and improves compliance. This guide explains what G-Codes are, when they are required, common billing errors, and how they affect reimbursement.

What Are G-Codes?

G-codes are a special set of Medicare billing codes that fall under HCPCS Level II. They’re used when a service doesn’t have a matching CPT code or when the service is tied to a specific federal or Medicare program. In simple terms, they act as “extra codes” that cover situations not included in standard CPT coding.

These codes:

- Apply only to Medicare patients

- Often represent time-limited, pilot, or preventive services

- Help track services unique to Medicare programs

Every G-code starts with the letter “G” followed by four numbers. For example:

- G0442 - Annual alcohol misuse screening

- G0439 - Subsequent annual wellness visit

- G0463 - Hospital outpatient clinic visit

Think of G-codes as Medicare’s way of filling the gaps in billing when regular CPT codes don’t apply.

Why Medicare Uses G-Codes?

Medicare often launches new initiatives before CPT codes are created. Instead of waiting for the American Medical Association to assign a CPT code, CMS creates a G code. These codes can be used immediately and are often later replaced by CPT codes once they become permanent.

Reasons Medicare uses G-codes:

- To track preventive care services

- To measure outcomes for value-based care programs

- To reimburse for telehealth and chronic care services

- To test new programs before rolling them out nationally

Using G-codes helps Medicare collect data, shape policy, and control costs.

How G-Codes Affect Claim Payments?

G-Codes directly influence how insurance companies review, process, and reimburse certain medical claims, particularly for Medicare patients. While G-Codes do not always determine the payment amount by themselves, they provide important information about patient progress, treatment outcomes, and service quality.

When G-Codes are reported correctly, they help support medical necessity and show that care meets payer guidelines. This can lead to smoother claim processing and fewer payment delays.

However, when G-Codes are missing, outdated, or incorrectly paired with CPT codes, claims may be:

- Delayed for additional review

- Reduced in reimbursement

- Returned for correction

- Flagged for audits

- Denied in some cases

For example, in outpatient therapy services, Medicare requires specific G-Codes to track functional limitations and improvement. If these codes are not reported properly at evaluation, progress, and discharge, the claim may not process as expected, even if the therapy itself was appropriate.

Incorrect G-Code reporting can also trigger compliance concerns. Insurance companies use these codes as part of quality reporting programs, which means consistent errors may lead to increased claim scrutiny.

When Are G-Codes Required in Medical Billing?

G-Codes are primarily required for certain Medicare services, especially in outpatient therapy and quality reporting programs. They are used to track patient progress, functional limitations, and treatment outcomes rather than to determine the service itself.

One of the most common areas where G-Codes are required is Medicare outpatient therapy, including physical therapy, occupational therapy, and speech-language pathology. Providers must report specific G-Codes at key points in care, such as:

- At the initial evaluation

- During progress reporting periods

- At discharge

These codes help Medicare measure patient improvement and ensure that therapy services remain medically necessary.

G-Codes may also be required for quality reporting programs and performance-based care models. In these cases, they provide standardized data on patient outcomes and service effectiveness.

While Medicare is the main payer that requires G-Codes, some commercial insurers may follow similar reporting practices or request them for certain programs. However, requirements vary by payer, so it is important to review individual insurance guidelines.

Common G-Codes and Their Uses

Here are some of the most commonly used G-codes and where they apply:

|

G-Code |

Description |

Use Case |

|

G0402 |

Initial preventive physical exam (IPPE) |

New Medicare patient “Welcome” visit |

|

G0438 |

Annual wellness visit, first visit |

Once-in-a-lifetime after 12 months of Part B |

|

G0439 |

Annual wellness visit, subsequent |

Used every year after the first |

|

G0444 |

Annual depression screening |

Covered once per year |

|

G0101 |

Pelvic and clinical breast exam |

For cervical or vaginal cancer screening |

|

G0463 |

Outpatient hospital clinic visit |

Frequently used in facility billing |

How Medicare Reimburses G-Codes?

Medicare uses G-Codes to reimburse services that fall outside standard CPT coding, especially for preventive care, quality reporting, telehealth, and special CMS programs. Unlike many CPT codes that are paid based on contracted fee schedules across payers, G-Codes are reimbursed strictly according to Medicare’s Physician Fee Schedule or Outpatient Prospective Payment System rules.

Many preventive G-Codes, such as annual wellness visits and certain screenings, are reimbursed at 100 percent of the Medicare allowable amount, meaning patients typically owe no coinsurance or deductible. This is why using the correct G-Code instead of a CPT code is critical. When providers bill the CPT version of a preventive service, Medicare often denies it, even though the G-Code version is fully covered.

Some G-Codes are paid as standalone services, while others are bundled into facility payments or subject to packaging rules in outpatient settings. For example, hospital outpatient clinic visit G-Codes may be reimbursed differently than physician office services, depending on CMS payment classifications.

Medicare also enforces strict frequency limits on many G-Codes. Annual wellness visits, screenings, and preventive assessments can only be reimbursed once per year or within specific time frames. Claims submitted outside these limits are automatically denied, even if the service was provided correctly.

Common G-Code Billing Mistakes That Cause Denials

G-Codes are closely monitored by Medicare because many of them tie to preventive services, quality reporting, and special reimbursement programs. Even small errors can lead to claim rejections, payment delays, or post-payment audits. Below are the most common mistakes that cause G-Code claims to be denied.

Using expired or deleted G-Codes

Medicare frequently retires G-Codes when permanent CPT or HCPCS codes are introduced. Billing outdated codes is one of the fastest ways to trigger automatic denials. Practices that don’t update code sets annually often continue using codes that are no longer reimbursable.

Billing G-Codes outside frequency limits

Many G-Codes are restricted to once per year, once per lifetime, or within specific time frames. For example, annual wellness visits and preventive screenings have strict limits. Submitting these services too often results in over-frequency denials, even when the service itself is covered.

Missing or insufficient documentation

Some G-Codes require proof that specific screenings, assessments, or time requirements were met. If the medical record does not clearly support the billed service, Medicare may deny the claim or request repayment during audits.

Pairing G-Codes with incompatible CPT codes

Certain G-Codes replace CPT codes rather than being billed alongside them. When both are submitted together incorrectly, Medicare may deny one or both services for duplicate billing or policy conflicts.

Failing to apply required modifiers

Some G-Codes require modifiers to show preventive intent, separate services, or telehealth use. Missing or incorrect modifiers can lead to reduced reimbursement or full claim denial.

Submitting G-Codes for non-Medicare patients

G-Codes are primarily Medicare-specific. Billing them to commercial insurers without confirmation of coverage typically results in immediate rejection.

Ignoring payer-specific coverage rules

Even within Medicare programs, local Medicare Administrative Contractors (MACs) may apply additional coverage criteria. Not following these local policies can result in denials despite using the correct G-Code.

What Providers Should Know About G-Codes?

G-codes may seem like just another set of billing codes, but for providers working with Medicare patients, they carry a lot of weight. Here are a few key points every provider should keep in mind:

1. G-Codes Are Medicare-Specific

Unlike CPT codes, G-codes only apply to Medicare beneficiaries. If you submit them for non-Medicare patients, the claim will almost always be denied.

2. They Often Change or Expire

Many G-codes are temporary. Medicare creates them for new services, pilot programs, or special reporting needs. Once a permanent CPT or HCPCS code is assigned, the G-code may be deleted. That means providers and billers need to stay updated every year.

3. They’re Tied to Compliance and Quality Programs

Some G-codes are used for MIPS, PQRS, and other CMS quality reporting programs. Failing to use the right code can not only delay payment but may also affect compliance scores and incentives.

4. Documentation Is Critical

Just like CPT or ICD-10 codes, G-codes require solid documentation. If your notes don’t back up the service billed, you risk denials, audits, or even accusations of improper billing.

5. Telehealth Has Expanded Their Use

During COVID-19, CMS introduced new G-codes for telehealth. Many are still active today, making it easier to get reimbursed for virtual visits. Providers offering telehealth should double-check which G-codes apply to their services.

6. They Affect Reimbursement Rates

Because G-codes often represent preventive services, screenings, or new treatments, reimbursement rates can differ from standard CPT codes. Always check the Medicare Fee Schedule for the current rate.

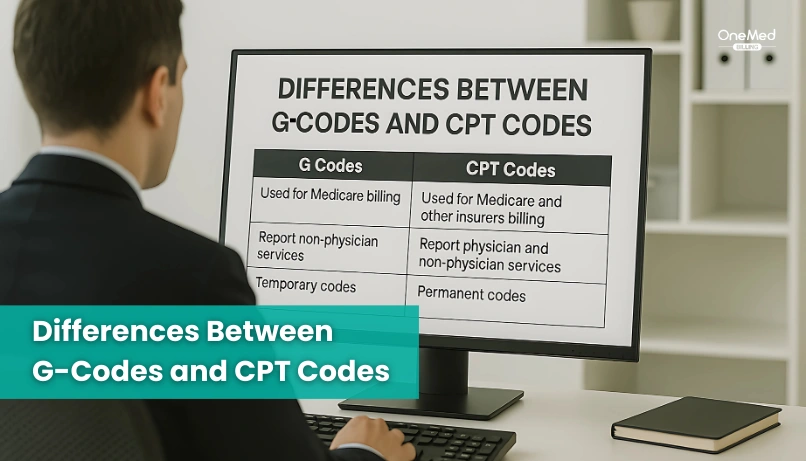

Key Differences Between G-Codes and CPT Codes

|

Feature |

G-Codes |

CPT Codes |

|

Maintained By |

CMS (Medicare) |

AMA |

|

Purpose |

Temporary, Medicare-specific services |

Broad use across all payers |

|

Use Case |

Preventive care, pilot programs, telehealth, value-based care |

Most office visits, procedures, and surgeries |

|

Payment Source |

Primarily Medicare |

Medicare, Medicaid, and Commercial insurers |

|

Flexibility |

Created and retired quickly |

Updated annu |

How to Use G-Codes Correctly in 2026?

G-Codes come with specific Medicare rules, and using them correctly requires more than simply adding a code to a claim. Modifiers, billing limits, and proper documentation all play a role in whether the service gets paid or denied. Below are the key best practices for accurate G-Code billing in 2026.

1. Always Follow Current Medicare Guidelines

CMS sets specific rules for when each G-Code can be billed, what documentation is required, and which patients qualify. These guidelines are updated regularly, so reviewing Medicare policy changes each year is essential.

For example:

- G0439 can only be billed if G0438 was completed in a previous year

- G0444 requires a 15-minute standardized depression screening

Billing outside these rules often leads to automatic denials.

2. Apply Required Modifiers Correctly

Some G-Codes need modifiers to indicate separate services, telehealth visits, or liability waivers. Common examples include:

- Modifier 25 for significant, separate E/M services

- Modifier 95 for telehealth services

- Modifier GA when a waiver of liability is on file

Missing or incorrect modifiers can reduce reimbursement or cause full claim denial.

3. Monitor Frequency and Coverage Limits

Many G-Codes are restricted to once per year, once per lifetime, or within defined time frames. Submitting services more frequently than allowed can result in over-frequency denials or payment recoupments.

Tracking prior services and patient eligibility helps prevent these errors.

4. Maintain Strong Supporting Documentation

Medicare closely reviews G-Code claims, especially during audits. Documentation should clearly support:

- Time spent on the service

- Tools or assessments used

- Provider credentials

- Patient eligibility and consent when required

In 2026, correct G-Code billing depends on staying current with Medicare policies, using modifiers properly, respecting frequency limits, and maintaining solid documentation. Following these steps consistently helps protect reimbursement and reduce compliance risk.

Real-World Example: How G-Codes Come Into Use

Imagine a provider sees a new Medicare patient for a preventive visit. The billing team submits CPT 99385 (new patient preventive exam). A few weeks later, the claim is denied. Why?

Because Medicare doesn’t reimburse CPT 99385 for preventive services. Instead, Medicare uses a G-code: G0402 (Initial Preventive Physical Exam). This service is covered only once in a patient’s lifetime, and it must be done within the first 12 months of enrolling in Medicare.

If the provider had billed G0402 with proper documentation, the claim would have been paid without delay.

This shows exactly how G-codes come into play; they replace CPT codes for certain Medicare-covered services.

How to Stay Updated on G-Codes

G-codes aren’t permanent. Medicare often introduces new ones, updates existing codes, or retires old ones as services evolve. For providers and billing teams, staying current is the only way to avoid denials and compliance issues. Here’s how to keep up:

1. Check CMS Updates Regularly

The Centers for Medicare & Medicaid Services (CMS) publishes coding updates every year, usually in October. This includes new G-codes, deleted codes, and reimbursement changes. Bookmark the CMS website and review the annual updates.

2. Subscribe to Official Bulletins

Sign up for Medicare Learning Network (MLN) newsletters and local Medicare Administrative Contractor (MAC) bulletins. These provide real-time updates on coding and billing changes.

3. Use Updated Coding Software

Good billing or practice management software should update code sets automatically. Make sure your system refreshes ICD, CPT, and HCPCS codes each year so you’re never billing with outdated codes.

4. Provide Ongoing Training for Staff

Coders and billers should receive regular training on Medicare-specific codes, including G-codes. Even experienced staff benefit from refreshers when new rules or services are added.

5. Join Professional Associations

Organizations like AAPC and AHIMA often provide coding updates, webinars, and quick-reference guides. These are great for staying ahead of industry changes.

Conclusion

G-codes are the key to getting paid for services that don’t fall under CPT. Whether it’s a wellness visit, a preventive screening, or a telehealth check-in, the right G-code makes the difference between a clean claim and a denial. The challenge with G-codes is that they change often, expire, or come with specific rules that are easy to miss. Many practices end up losing revenue without realizing it. That’s why it’s so important to keep your team updated on the latest Medicare guidelines and coding changes.

At OneMed Billing, we keep track of every Medicare update so your team doesn’t have to. Our medical billing coders know how and when to apply G-codes correctly, helping you stay compliant, reduce rework, and protect your revenue.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What are G-codes in medical?

G-codes are Medicare-specific billing codes used for services that don’t have a CPT code, are tied to federal programs, or are temporary for new services.

Are G-codes still used?

Yes, G-codes are still used by Medicare, especially for preventive services, wellness visits, quality reporting, and certain telehealth services.

What is the difference between CPT codes and G-codes?

CPT codes are standard codes used by all payers to bill medical services, while G-codes are Medicare-only and often temporary, created for services not yet assigned a CPT code.

Where can providers find the latest list of G-codes?

Providers can find the latest list of G-codes on the Centers for Medicare & Medicaid Services (CMS) website, specifically in the annual HCPCS Level II code updates.