Complete Guide to Medical Coding | Everything You Need to Know

- Updated Date Aug 29, 2025

- Medical Coding

- Follow

Medical coding is the foundation of revenue cycle management (RCM). It translates patient visits, diagnoses, and treatments into standardized codes like CPT, ICD-10, HCPCS, and J-codes that payers use to process claims. Accurate coding keeps claims clean, reduces denials, ensures compliance with CMS and HIPAA rules, and protects revenue. This guide covers why coding is important, the main types of codes, common mistakes, their impact on revenue, best practices for accuracy, when outsourcing makes sense, and future trends like AI-driven coding.

What is Medical Coding in RCM?

Medical coding is the process of turning healthcare services into standard codes that insurance companies and payers can understand. Every time a patient visits a doctor, gets a test, or has a treatment, those details are recorded in the medical record. Coders then take that information and translate it into recognized code sets such as ICD-10 for diagnoses and CPT or HCPCS for procedures and services.

This step may sound small, but it is the foundation of the entire revenue cycle. Without accurate codes, claims cannot be submitted correctly, and providers may not get paid on time or at all. Coding bridges the gap between the care a patient receives and the payment a provider earns.

In the revenue cycle management (RCM) process, medical coding plays a central role:

- Capturing clinical details: Codes represent diagnoses, treatments, and procedures in a consistent format.

- Supporting claim submission: Payers rely on these codes to decide if a service is covered and how much should be reimbursed.

- Reducing errors and denials: Clean and accurate coding helps avoid delays, denials, and rework.

Simply put, medical coding is the language of healthcare billing. It allows providers, payers, and regulators to communicate clearly and ensures that every service delivered translates into timely, accurate revenue.

Importance of Medical Coding in Healthcare

Medical coding is more than just paperwork. It is the link that connects patients, providers, and payers in the healthcare system. When a patient visits a doctor, their symptoms, tests, and treatments are documented. Coders translate those details into standardized codes that providers use to bill payers. Without this step, insurance companies would not know what care was delivered or how much to reimburse.

This process creates a shared language between everyone involved:

Patients: Get accurate records of their care and clear billing.

Providers: Ensure the services they provide are billed correctly and reimbursed.

Payers (insurance companies, Medicare, Medicaid): Use codes to decide coverage, approve claims, and calculate payments.

Because coding is tied directly to payment and compliance, accuracy is critical. A small mistake can lead to claim denials, delayed revenue, or even allegations of fraud. For example:

- HIPAA requires all healthcare transactions to follow standardized coding systems.

- CMS (Centers for Medicare & Medicaid Services) audits providers regularly to ensure correct billing.

- OIG (Office of Inspector General) investigates cases where coding errors may point to fraud or abuse, such as upcoding or unbundling.

The risks are real. According to CMS, 30–40% of medical claims are submitted with errors due to coding mistakes, leading to billions in lost revenue and compliance headaches each year (CMS Coding Guidelines).

That’s why medical coding is often called the backbone of revenue cycle management (RCM). It not only determines how quickly providers get paid but also protects practices from compliance risks and regulatory penalties.

Types of Medical Codes

In medical billing, different code sets are used to describe a patient’s condition, the services they received, and any supplies or medications involved. Each set has its own purpose, and using them correctly is key for accurate claims and smooth reimbursements.

1. CPT Codes

CPT, or Current Procedural Terminology, is used to record the procedures and services a provider performs. For example, a CPT code might show whether a patient had a routine check-up, a diagnostic test, or surgery. Since these codes are closely tied to diagnosis, knowing the difference between CPT and ICD codes is important to avoid mismatched claims.

2. ICD-10 Codes

ICD-10 stands for the International Classification of Diseases, 10th Edition. These codes describe the patient’s condition or reason for the visit. For instance, ICD-10 codes cover things like diabetes, high blood pressure, or fractures. When combined with CPT codes, they help prove medical necessity, which is why understanding the difference between CPT and ICD codes is so critical in billing.

3. HCPCS and G-Codes

The Healthcare Common Procedure Coding System (HCPCS) is used for services and supplies that CPT doesn’t cover, such as ambulance rides, wheelchairs, or certain Medicare screenings.

Within HCPCS, there’s a group called G-codes in medical terms that applies to services like therapy, preventive care, and telehealth visits. Since Medicare relies heavily on these codes, providers need to know how G-codes are applied to avoid denials.

4. J-Codes

J-codes are a subset of HCPCS used for billing drugs and biologics. They cover treatments such as chemotherapy, injections, and other specialty medications given in a clinical setting. Because these drugs are expensive, correct use of J-codes in medical billing ensures providers receive proper reimbursement and patients don’t face coverage issues.

Common Challenges in Medical Coding

1. Upcoding and Unbundling

These are two of the most common compliance risks in coding. Upcoding in medical billing happens when a provider reports a higher-level service than what was actually performed, while unbundling means billing separately for services that should be grouped under one code. Both practices can inflate reimbursement and often result in audits, penalties, or denied claims. Because the rules can be confusing, many practices fall into these errors without realizing the compliance risks involved.

2. Frequent ICD-10 Updates

ICD-10 is a massive code set that undergoes regular updates. Each year, new codes are added, old ones are removed, and descriptions are revised. If coders fail to keep up with these changes, they risk using outdated or invalid codes. This often leads to claim denials and unnecessary delays in payment.

3. Lack of Training and Documentation

Coders depend heavily on clear, complete provider documentation. When notes are missing details or use vague language, coding accuracy drops. Even experienced coders can make errors without proper

records. Ongoing training for both coders and providers is essential to keep accuracy levels high and reduce preventable mistakes.

4. Complex Payer Rules

Insurance companies don’t all follow the same standards. Medicare may require one coding approach, while private payers expect something different. These variations create confusion and make coding more time-consuming. Understanding the unique rules for each payer takes expertise and attention to detail, which many practices find challenging.

Examples of Coding Errors

Example 1

Even small coding mistakes can disrupt the revenue cycle. One common issue is when CPT and ICD-10 codes don’t match. If the diagnosis doesn’t support the procedure billed, payers often deny the claim. For instance, submitting a surgical code without a related diagnosis creates a red flag and delays payment.

Example 2

Another frequent problem is upcoding or unbundling. Upcoding happens when a service is reported at a higher level than what was performed, while unbundling means billing services separately that should have been grouped together. Both errors not only cause denials but can also raise compliance concerns. Practices that don’t fully understand upcoding in medical billing or unbundling in medical billing often run into these issues.

Example 3

Using outdated or invalid codes is another source of claim rejection. Since code sets are updated regularly, submitting an old CPT or ICD-10 code almost guarantees a denial. Incomplete documentation adds to the problem. Even when the code is correct, if the provider’s notes don’t support it, payers may refuse reimbursement.

Example 4

Finally, some practices fall into the trap of undercoding, billing for a lower-level service than what was actually delivered. While this doesn’t cause denials, it consistently reduces reimbursement and leads to revenue loss over time.

Common Medical Coding Mistakes

1. Upcoding: This happens when a provider bills for a more complex or expensive service than what was actually performed. For example, coding a regular office visit as a comprehensive consultation. While it may seem like a way to increase revenue, it’s considered fraudulent, puts the practice at risk of audits, and often results in hefty penalties or clawbacks from payers.

2. Undercoding: The opposite of upcoding, this occurs when providers bill for a less complex service than what was delivered. Many practices do this unintentionally to avoid audits, but it leads to significant revenue loss over time. It also creates an inaccurate patient record, which can affect quality reporting and future care decisions.

3. Unbundling: Instead of using one comprehensive code for a bundled set of procedures, services are billed separately. For example, billing for each step of a surgery individually rather than using the correct bundled surgical code. Payers closely watch for this error, and it can result in claim denials, compliance violations, and even fraud investigations.

4. Outdated codes: Medical coding systems like ICD-10 and CPT are updated every year. If providers or coders continue using codes that have been deleted or replaced, claims will be rejected right away. This not only delays payments but also increases administrative workload since claims must be corrected and resubmitted.

5. Poor documentation: Coders rely heavily on provider notes to assign the correct codes. If documentation is vague, incomplete, or missing key details, coding errors are almost guaranteed. This can lead to denials, underpayment, or even compliance risks if the coding doesn’t match the clinical record.

6. Ignoring payer rules: Each payer, whether it’s Medicare or a private insurer, has its own policies and coding requirements. Not following these rules such as missing prior authorizations or failing to use specific modifiers, often leads to delays or outright denials, creating cash flow problems for the practice.

Impact of Incorrect Coding on RCM

Mistakes in coding can disrupt the revenue cycle at every stage. A single wrong code might cause a denial, delay payment, or reduce reimbursement. Over time, these errors can quietly drain a practice’s revenue and create frustration for both staff and patients.

Payers closely monitor coding accuracy, and repeated mistakes can trigger audits or even raise fraud concerns. To fully understand how incorrect coding impacts the revenue cycle, providers need to consider both the financial side and the compliance risks it creates.

Best Practices for Accurate Medical Coding

Accurate coding is essential for keeping the revenue cycle healthy. Even small mistakes can lead to denials, compliance issues, and lost revenue. These practices help reduce errors and keep claims moving smoothly:

Regular Coder Training

Coding rules and payer requirements change frequently. Regular training ensures coders stay up to date with the latest ICD-10 updates, CPT revisions, and compliance guidelines. Teams that receive ongoing education are better prepared to submit accurate claims and reduce costly denials.

Use of Coding Software and AI Assistance

Technology can support coders by checking for mismatched codes, flagging errors, and speeding up the process. While it doesn’t replace skilled coders, software and AI tools act as a safety net that improves accuracy and helps avoid preventable mistakes.

Routine Internal Audits

Audits allow practices to catch errors before they cause bigger problems. By reviewing claims regularly, providers can identify trends like undercoding or documentation gaps and make corrections early. This keeps claims cleaner and compliance stronger.

Linking Documentation to Billing

Coders depend on clear and complete provider notes. When documentation is vague or incomplete, errors become more likely. Strong communication between providers and billing staff ensures the information entered at the front end supports accurate coding and clean claim submission.

When to Outsource Medical Coding

Managing coding in-house isn’t always practical for every practice. Signs that it may be time to outsource include frequent claim denials, staff shortages, or a growing backlog of charts waiting to be coded. These issues can slow down reimbursements and put extra stress on administrative teams.

There are clear signs that outsourcing may be the smarter option:

1. Frequent Claim Denials

If claims are often rejected because of coding errors, it’s a sign the team may be struggling to keep up with the latest guidelines. High denial rates don’t just delay payments, they also create extra rework that slows down the entire revenue cycle.

2. Staffing Shortages

Hiring and retaining certified coders can be difficult, especially for small or mid-sized practices. When there aren’t enough staff members to handle the workload, claims pile up, errors increase, and payments are delayed.

3. Backlog of Charts

A growing backlog of uncoded charts is another red flag. The longer it takes to code and submit claims, the longer providers have to wait for reimbursement. Delays also make it harder to track the financial health of the practice in real time.

4. Rising Costs of In-House Operations

Maintaining an in-house coding team comes with costs like salaries, benefits, training, and software. For many practices, outsourcing can be more cost-effective because it eliminates overhead while providing access to skilled professionals.

5. Compliance Concerns

Coding regulations change frequently. If the team struggles to stay updated with ICD-10 revisions, CPT changes, or payer-specific requirements, the risk of compliance issues increases. Outsourcing helps practices stay aligned with the latest standards and reduce audit risks.

6. Need for Faster Turnaround

Timely coding is essential for timely payment. If claims are taking too long to move from chart to submission, outsourcing can speed up the process and keep revenue flowing consistently.

Many providers turn to professional medical coding services when they want greater accuracy, fewer denials, and a more efficient revenue cycle.

Future Trends in Medical Coding

Medical coding is evolving quickly as healthcare becomes more technology-driven and focused on value-based outcomes. Practices that stay ahead of these shifts can reduce errors, stay compliant, and keep their revenue cycle running smoothly.

AI and Automation Are Transforming Medical Coding

AI tools like computer-assisted coding (CAC) are already being used by large hospital systems to speed up coding and reduce mistakes. Companies such as Optum and 3M have built AI-powered systems that analyze documentation and suggest codes. An AHIMA survey found that over 40% of big health systems now use these tools, showing how automation is becoming part of everyday coding.

EHR Systems Are Now Embedding Coding Features

Coders used to work outside the EHR, pulling information manually. Now, platforms like Epic and Cerner include coding tools directly in the workflow. This makes it easier to connect documentation with coding, reduces duplicate entry, and supports more accurate claims. CMS’ push for interoperability rules has also made EHR-based coding much smoother.

Value-Based Care Is Changing Coding Priorities

With CMS programs like Value-Based Purchasing and MIPS, payments are linked to outcomes, not just services. Coders now have to capture details that reflect patient complexity and quality of care. This shift means coding plays a direct role in how providers are reimbursed and scored for performance.

ICD and CPT Code Updates Are Happening Every Year

Every October, CMS releases updates to ICD-10, and the AMA updates CPT annually. For example, ICD-10 added more than 1,000 new codes in 2023. If coders aren’t keeping up, claims can get denied. Staying current with these updates is now a must for avoiding payment delays.

Conclusion

Medical coding is the backbone of billing and reimbursement. When codes are applied accurately, they create a clear link between providers, patients, and payers. This ensures claims are processed without unnecessary delays and revenue moves through the cycle as it should. Strong coding not only reduces denials and compliance risks but also gives practices the confidence to focus on delivering quality patient care.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What are medical coding guidelines?

Official rules that tell you how to pick and order ICD-10-CM, CPT, and HCPCS codes from the medical record. They also include NCCI edits and payer policies so claims are accurate and compliant.

What are common medical coding errors?

Using outdated or vague codes, diagnosis–procedure mismatch, wrong or missing modifiers, unbundling, upcoding or undercoding, wrong place of service, and documentation that does not support the code level.

What is the 4 step coding process?

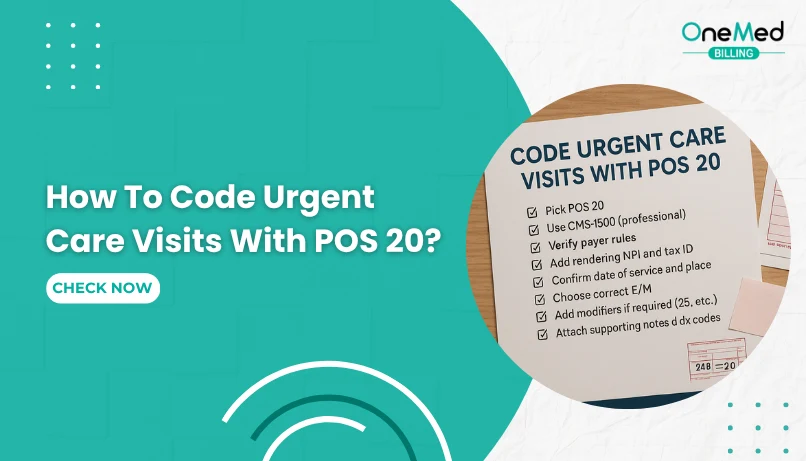

Review the note and confirm diagnoses and services Select ICD-10-CM, CPT, and HCPCS with full specificity Apply coding rules and NCCI edits, and add needed modifiers Validate against payer policy and submit for

What is an example of medical coding?

Sore throat visit: ICD-10-CM J02.9 (acute pharyngitis, unspecified), CPT 99213 for the office visit, and CPT 87880 for a rapid strep test (add QW if performed under a CLIA-waived certificate).