Common RCM Challenges Providers Face in 2025

- Updated Date Oct 1, 2025

- Revenue Cycle Management

- Follow

Here’s the hard truth. Most revenue loss in 2025 is not one big problem. It is a handful of small misses that happen every day. A fee schedule that was never updated. An MRI was done before prior authorization was cleared. A claim sent with the wrong POS. Each miss looks minor. Together, they slow cash and boost write-offs.

This guide lays out the 12 real mistakes providers are making right now and how to fix them fast. No jargon. Plain steps you can use in morning huddles and staff checklists. We will focus on work you already do, like eligibility, prior auth, coding updates, and claim edits, so you can tighten the process without blowing up the schedule.

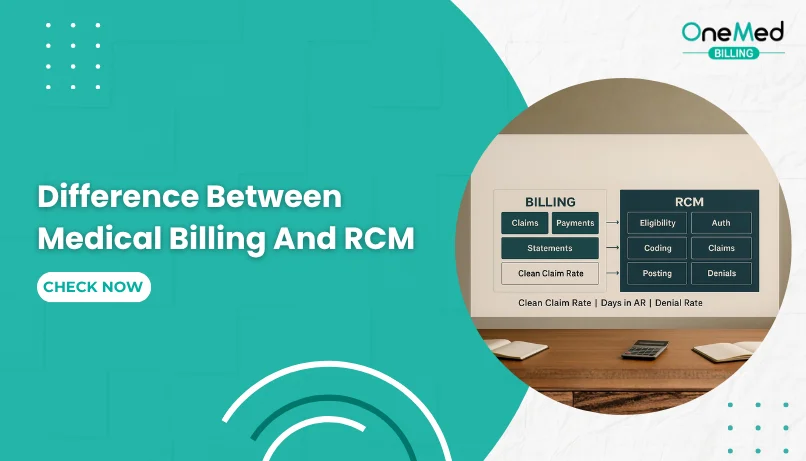

What is Revenue Cycle Management?

Revenue cycle management is the step-by-step process providers use to turn a visit into a correct, on-time payment. It follows the visit from the first appointment all the way to a zero balance. The goal is simple, send a clean claim that the payor can pay without back-and-forth, and make the patient’s part clear and easy to pay.

Think of it in three stages. Before care, your team confirms who the patient is, checks eligibility and benefits, looks for any referral or prior authorization, and gives a simple cost estimate or collects a copay. Duriang care, the record is clear, charges are captured, the right diagnosis code is linked to the right service code, and needed modifiers are added. After care, the claim is coded and scrubbed, sent to the payor, the payment posts by ERA and EFT, any denial is fixed, and the remaining patient balance is billed with an easy way to pay online.

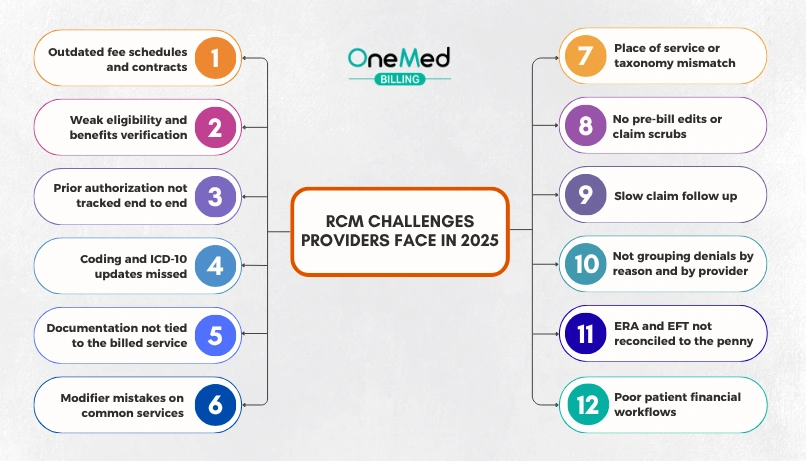

The most common RCM Challenges Providers Face in 2025

Small misses are costing real money this year. New code updates, tighter prior authorization, and changing payor edits mean more denials and slow cash if workflows are not current. Below is a quick list of the biggest challenges providers see every day, with simple fixes you can apply right away.

1. Outdated fee schedules and contracts

This problem is simple. Your billing system still uses last year’s prices or old contract rates. The payor then prices your claims to those old numbers, so you get paid less than you should. The loss often shows up as small CO-45 write-offs on many claims, which look routine but add up fast.

How to solve this:

- Load the current year's fee schedule and each payor’s contract rates with the right effective dates.

- Keep your charges above the allowed amounts so payment is never capped by your charge.

- Update site-of-service and modifier rate differences, since these change often.

- Run an allowed-versus-paid report with a 1 - 2 percent alert to catch short pays.

- Reprice the last 30 days of top CPTs and appeal clear underpayments.

- Assign one owner to refresh fees and contracts on a set schedule and after any payor notice.

2. Weak eligibility and benefits verification

Incomplete eligibility and benefits checks let claims fail before they start. The plan may be inactive, the deductible not met, a referral missing, or the provider out of network. The result is simple, the claim pays to the patient's responsibility or denies, and you spend weeks chasing a balance that could have been prevented.

How to solve this:

- Verify eligibility for every visit, not just new patients, especially after the new plan year.

- Capture the essentials, plan effective dates, deductible met, out-of-pocket remaining, copay, and coinsurance.

- Check referral and prior authorization needs for the service, imaging, lab, or DME.

- Confirm in-network status for the rendering provider, facility, lab, and imaging center.

- Note benefit limits, for example, visits per year, therapy caps, frequency rules.

- Save a screenshot or reference number from the payer portal and attach it to the encounter.

- If there is secondary insurance, confirm coordination of benefits and which plan is primary.

- Give a simple estimate and collect copays or deposits up front when allowed.

3. Prior authorization is not tracked end-to-end

Prior authorization breaks down when requests start late, key details are missing, status is not checked, or the test is done before approval. Approvals can also expire or cover the wrong CPT, provider, place of service, or number of units. The result is denied claims, rescheduled care, and unhappy patients.

How to solve this:

- Keep one worklist for all auths with fields for service, CPT, diagnosis, payor, status, dates, units, reference number, and notes.

- Start the auth at scheduling for high-risk services and attach the needed clinicals up front.

- Set simple timers, submit in 24 hours, check status in 48 hours, and escalate by day 5.

- Record when an auth is not required and save the payor source or reference number.

- Track start and end dates and units so nothing is done on an expired or over-unit auth.

- Add a hard stop for scheduling, do not perform services that require auth until approved, unless documented as urgent.

- At billing, make sure the auth number is on the claim and the billed CPT, provider, and place of service match the approval.

- Rework any no-auth or wrong-auth denial within 48 hours and add the cause to a simple monthly report.

4. Coding and ICD-10 updates were missed

Using retired or nonspecific ICD-10 codes after the annual October 1 update triggers edits and denials. Common misses include picking an old code from favorites, choosing unspecified when a specific code exists, skipping laterality or stage, or missing new combination codes. Claims are rejected at the clearinghouses or payors, cash slows, and rework goes up. Results vary because top clearinghouses differ in edit depth, payer connectivity, and reporting.

How to solve this:

- Load the current ICD-10-CM (and PCS if you bill inpatient) every October 1.

- Remove retired codes from favorites, templates, and picklists in your EHR and billing tools.

- Add new or revised codes to quick-pick lists for high-volume diagnoses.

- Turn on pre-bill edits that flag invalid, unspecified, or missing laterality after the update.

- Provide a 15-minute huddle on key changes for your top specialties.

- Use a simple crosswalk: old code → new code, with examples your team sees daily.

- Test a small batch of claims with the new codes before full submission.

- Monitor denials weekly in October and November, and fix any pattern at the source.

5. Documentation not tied to the billed service

Notes that do not show why the service was needed or how the diagnosis supports it lead to medical necessity denials. Common misses include leaving out laterality, stage, site, or timing, and failing to connect the diagnosis to the exact test or treatment performed.

How to solve this:

- Add one clear line in the note: “We performed [service] because [diagnosis] caused [symptom or risk] today.”

- Include key details the code expects, laterality, acute or chronic, stage, site, and any complications.

- Make the plan match the service billed, list the test, procedure, or med by name and CPT if possible.

- Attach or reference supporting records, labs, imaging, consult notes, and prior auth approval.

- Use smart phrases that prompt the “because” sentence and required details for your top 10 services.

- Run a pre-bill edit that flags diagnosis and service mismatches and missing specificity.

- For repeat services, document the change or ongoing need, not just “follow up.”

- Ensure the diagnosis and modifiers on the claim mirror the language in the note.

6. Modifier mistakes on common services

Claims deny or pay less when the wrong modifier is used or a needed one is missing. Common trouble spots include E/M with a same-day procedure without 25, procedures that hit an NCCI edit without 59 (or the more specific XS, XE, XP, XU), missing TC or 26 on tests, wrong or missing RT/LT or 50 for bilateral work, and E/M during a surgical global period without 24 or 57. Telehealth also trips teams up when 95 or the correct POS is not used, and hospice lines miss GV or GW when needed.

How to solve this:

- Build a short “top modifiers” list for your common services: 25, 59 (or XS/XE/XP/XU), 24, 57, 51, 50, RT/LT, TC/26, 76/77, 91, 95, GV, GW.

- Turn on pre-bill edits that flag NCCI pairs needing 59/XS and E/M with procedures needing 25.

- Map telehealth rules by payor, which CPTs need 95, and which POS to use.

- Use templates that prompt global-period checks and add 24 or 57 when the note supports it.

- For imaging and tests, set defaults for TC (technical) and 26 (professional) based on who performs and who interprets.

- Require side and laterality, add RT/LT or 50 when it is truly bilateral, not units x2.

- For hospice, decide related vs unrelated, then add GV or GW as needed, and CC 07 on UB-04 for unrelated facility care.

- Audit 10 charts per provider monthly for correct modifiers and close the loop with a one-page tip sheet.

7. Place of service or taxonomy mismatch

Claims get reduced or denied when the place of service on the claim does not match where care happened, or when the NPI taxonomy on the claim does not match how the provider is enrolled. Example, billing POS 11 office for a procedure done in an ASC, or using a family medicine taxonomy for a claim that should use cardiology. Payors read these fields to price the claim and to check if the provider is allowed to bill that service in that setting.

How to solve this:

- Set a default POS for each location and visit type in your billing system and lock it to the scheduler.

- Map POS to service type, office, telehealth, outpatient hospital, ASC, inpatient, and emergency.

- Keep a master list of each provider’s NPI, taxonomy, and enrolled locations. Match claims to that list.

- For telehealth, use the payer’s required POS and add 95 only when rules say so.

- Run a pre-bill edit that flags POS and taxonomy mismatches, for example, POS 11 with a facility-only code.

- Validate that rendering, billing, and location all align with enrollment and contracts.

- Audit a small sample weekly to confirm that paid POS and taxonomy match what you sent.

8. No pre-bill edits or claim scrubs

Claims that leave your system without automated checks come back as rejections and denials. Common misses include wrong place of service, missing prior authorization, diagnosis and procedure that do not match, bad modifiers, expired ICD codes, missing NPI, or no CLIA tag on waived labs. Each error slows cash and creates extra rework.

How to solve this:

- Turn on required-field checks at charge capture and claim creation, NPI, taxonomy, POS, referring provider, location, diagnosis, and units.

- Build scrub rules for high-risk items, eligibility verified today, prior authorization on flagged CPTs, diagnosis specificity and ICD-10 effective date, NCCI pairs that need 59 or XS, E/M with procedures that need 25, global period edits for 24 or 57, and telehealth POS with 95 when required.

- Add specialty rules, CLIA and QW for waived labs, TC or 26 for imaging, RT/LT or 50 for laterality and bilateral, GV or GW for hospice, and Condition Code 07 for unrelated facility care.

- Use payer-specific edits in your clearinghouse, keep a simple payer matrix, and stop submission when a required element is missing.

- Start small, apply the scrub to your top 20 CPTs, and expand once error rates fall.

- Show clear error messages that name the fix, so staff can correct in one step.

- Track first-pass yield, scrub hit rate, and average days to fix. Review the top five failed edits every week.

- Assign one owner to update rules after code changes, contract updates, or new payer notices.

9. Slow claim follow-up

Claims stall when nobody checks status soon after submission, reads payer replies, or sends requested records on time. 277 messages sit unread, portal notes go unseen, and timely filing or appeal windows slip. Cash gets stuck in A/R, small fixes take months, and write-offs grow.

How to solve this:

- Create a daily follow-up queue by age and dollar: 7, 14, 21, 30 days, then every 15 days.

- Send 276 inquiries and read 277 replies. Log what the payer asked for and the next action.

- Check payer portals twice a week. Respond to medical records or info requests within 48 hours.

- Prioritize high-dollar and near-deadline claims. Set alerts for timely filing and appeal cutoffs.

- Use standard scripts and templates for status calls, reconsiderations, and appeals.

- Work denials by reason code first, not alphabetically. Fix the root cause before resubmitting.

- Track three metrics weekly: days in A/R, percent over 90 days, and follow-up cycle time.

- Assign a clear owner for each payer. Hold short huddles to clear blockers and escalate fast.

10. Not grouping denials by reason and by provider

When denials are handled in date order, the same mistakes keep coming back. One provider keeps missing 59 on imaging pairs that hit an NCCI edit. Since no one group denials by reason and provider, the pattern is invisible and revenue leaks every week.

How to solve this:

- Build a simple dashboard that groups denials by reason code and provider. Start with the top five reasons.

- Assign an owner for each top reason to write a one page fix and update the workflow.

- Send each provider a short monthly “miss list” with two or three quick tips.

- Add pre bill edits that catch the pattern next time, for example, flag imaging pairs that need 59 or XS.

- Close the loop with a five minute huddle, show the numbers, and confirm the fix worked.

- Track denial rate, recovery rate, and days to resolve, week over week.

11. ERA and EFT not reconciled to the penny

Money hits the bank by EFT and the ERA explains what each claim line paid. When you post totals without matching the ERA line by line, small misses hide. Underpayments look like normal CO-45 adjustments, takebacks get mixed in, a few lines never post, and a month later the numbers do not add up.

How to solve this:

- Post from the 835 ERA line by line, not by total.

- Match every EFT deposit to the same-day ERA total and to the posted total. The variance should be $0.00.

- Record PLB takebacks and offsets as their own entries, not as write-offs on random claims.

- Use contract rates to flag underpayments and send appeals when the payor pays below allowed.

- Track secondary balances before closing a claim. Do not push the gap to the patient.

- Run a daily cash reconciliation report, EFT total = ERA total = posted total, then fix any difference the same day.

- Keep a small variance work queue for missing lines, duplicate posts, or banking fees. Clear it within 48 hours.

- Separate duties, one person posts cash, another reconciles, and a lead audits a small sample weekly.

- At month end, tie your payment totals to the accounting system and confirm A/R moved the right way.

- Watch three metrics: percent of ERAs posted same day, number of open variances, and underpayment rate.

12. Poor patient financial workflows

When costs are not explained up front, bills are slow, or paying is hard, patients delay or dispute balances. Missing good faith estimates, unclear statements, no online payment link, and no payment plans turn small balances into bad debt. Staff time goes to phone calls instead of care.

How to solve this:

- Give a simple good faith estimate for self-pay and out-of-network, and an out-of-pocket estimate for insured patients before the visit.

- Explain benefits in plain words, deductible, copay, and coinsurance, plus what the plan is likely to pay.

- Collect copays and reasonable deposits for high-cost services after the estimate is reviewed.

- Use a one-page statement, show visit date, service, total charge, plan paid, contractual adjustment, and patient owes. Add a QR code or short link to pay online.

- Offer easy payment options, card on file, online portal, mobile wallet, and interest-free payment plans.

- Send friendly text or email reminders with the balance and a direct pay link.

- Keep a clear financial assistance and hardship policy. Do not balance bill when rules prohibit it.

- For out-of-network services, use the required consent forms and keep them in the chart.

- Train staff to explain EOB vs bill and what to do if the plan pays less than expected.

- Refund overpayments within 30 days and document the action.

- Track basics each week, statement-to-payment days, percent paid online, dispute rate, and patient A/R over 90 days.

Conclusion

You can improve your Revenue Cycle in 2025, start with small, steady fixes. Update fee schedules, verify eligibility every time, track prior authorization from request to approval, and keep ICD-10 and modifiers current. Scrub claims before they go out, follow up fast, and reconcile ERA and EFT to the penny. Make costs clear for patients and give them simple ways to pay. These steps cut denials, speed cash, and reduce rework.

Pick two problems from this list and fix them this week. Measure the change, then add the next two. A short weekly huddle, a clean checklist, and clear ownership will keep your revenue cycle moving in the right direction. If you do not manage your revenue cycle in-house, you can outsource these tasks to a professional medical billing company that works to your policies and provides clear, regular reports.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What are the three most common mistakes on a claim that will cause denials?

No prior authorization; eligibility not active for the date of service; diagnosis–procedure mismatch or missing required modifiers (25, 59, XS).

What is the most common rejection in medical billing?

Invalid patient or insurance data at the clearinghouse, usually a wrong member ID, DOB, plan selection, or missing NPI.

What are the three things that make a strong claim?

Verified coverage and requirements; codes and modifiers that match the note with the right POS; complete data, including NPIs, taxonomy, and auth number.

What are the registration errors that affect the revenue cycle?

Wrong name or DOB; incorrect plan or member ID and COB order; missing referral or required consent and bad contact details.