What Is Verification Of Benefits (VOB) in Medical Billing?

- Updated Date Feb 10, 2026

- Medical Billing

- Follow

Many claim denials and payment delays can be traced back to incomplete or missed verification of benefits to confirm insurance coverage before services are provided. Issues such as inactive policies, unmet deductibles, incorrect plan information, or missing prior authorizations often surface only after claims are submitted, when they are more difficult and time-consuming to resolve.

Verification of Benefits (VOB) is a core front-end revenue cycle function that confirms patient eligibility, coverage details, and payer requirements before care is delivered. When VOB is performed consistently, it allows billing and clinical teams to identify coverage limitations early, secure required authorizations, and document financial responsibility accurately.

This blog is written for healthcare providers, billing teams, practice managers, and revenue cycle professionals who are responsible for integrating benefit verification into daily operations. It outlines how a structured VOB workflow supports accurate eligibility checks, reduces downstream claim rework, and helps practices manage reimbursement risk more effectively.

What is VOB in Medical Billing?

Verification of Benefits (VOB) in medical billing is the process of confirming a patient’s insurance eligibility, covered services, and financial responsibility before care is delivered. It helps providers submit accurate claims and avoid denials related to coverage or authorization issues. VOB is typically performed during scheduling or registration and serves as a key front-end step in the revenue cycle.

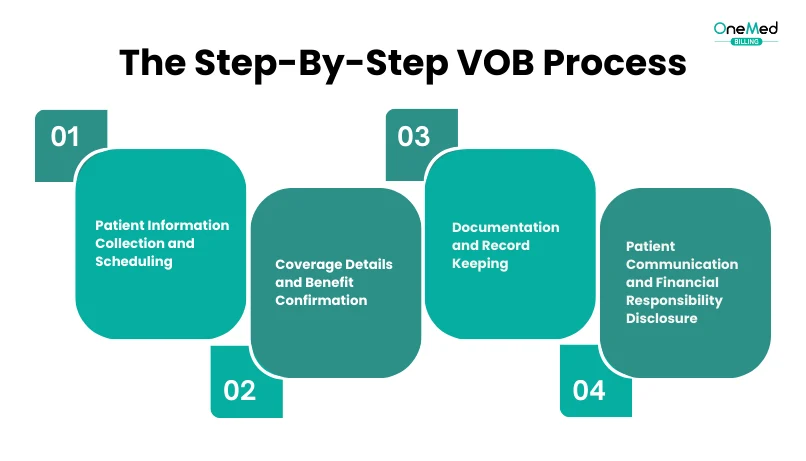

Step-by-Step Verification of Benefits (VOB) Process

The VOB process is all about making sure a patient’s insurance benefits are checked and confirmed before services are provided.

1. Patient Information Collection and Scheduling

The VOB process begins with collecting complete patient demographics and insurance details, name, date of birth, address, carrier, policy number, group number, and plan type, during scheduling. This should be done 48 - 72 hours before the appointment to allow time for verification. Many practices use standardized forms or scripts to ensure accuracy, since errors at this stage can directly impact the success of the entire VOB process.

2. Coverage Details and Benefit Confirmation

The VOB process requires confirming that the patient’s insurance is active and covers the planned services.

Critical information to verify includes:

• Deductible amounts and whether they have been met for the current benefit period

• Co-payment amounts required at the time of service

• Co-insurance percentages that determine patient financial responsibility

• Coverage limits for specific services or treatments

• Pre-authorization requirements for planned procedures or services

• In-network versus out-of-network benefits and associated cost differences

Completing this step gives a clear picture of patient responsibility and prevents billing surprises, ensuring accurate financial communication before services are rendered. Critical information to verify includes:

3. Documentation and Record Keeping

Proper documentation represents a crucial component of the medical billing VOB process. Healthcare providers must meticulously record all verified information in the patient's medical records for future reference and claim submission purposes.

Essential documentation elements include:

• Date and time of verification to establish when benefits were confirmed

• Name of insurance representative who provided the verification information

• Confirmation number or reference number for the verification call

• Detailed coverage information, including deductibles, co-pays, and co-insurance amounts

• Pre-authorization requirements and any obtained authorization numbers

• Coverage limitations or exclusions that may affect treatment decisions

Accurate documentation serves as evidence for insurance claims and helps resolve any future billing disputes or payment delays. This information also provides a reference point for staff members who may need to follow up on claims or address patient inquiries about their financial responsibilities.

4. Patient Communication and Financial Responsibility Disclosure

The final step in the healthcare insurance verification process involves clear communication with patients about their verified benefits and financial obligations. Healthcare providers must inform patients about their coverage details, including deductibles that haven't been met, co-payment amounts due at the time of service, and any co-insurance responsibilities.

This communication should occur before the patient's appointment, allowing them time to make informed decisions about their healthcare. Patients should receive information about:

• Upfront costs they will be responsible for at the time of service

• Estimated out-of-pocket expenses based on planned treatments

• Pre-authorization status and any requirements that must be met

• Payment options available for their portion of the costs

• Alternative treatment options if cost is a concern

This clarity enables patients to budget appropriately and make informed healthcare decisions while ensuring providers can collect patient portions efficiently during the visit.

What Does Verification of Benefits Include?

Verification of Benefits (VOB) is a detailed review of a patient’s insurance plan to determine coverage eligibility, financial responsibility, and billing requirements before services are provided. It goes beyond confirming that insurance is active.

A complete verification of benefits typically includes:

- Patient eligibility confirmation to ensure the policy is active on the date of service

- Covered services review to confirm whether planned procedures, visits, or treatments are included under the patient’s plan

- Deductible status, including total deductible amounts and how much has been met

- Copayment and coinsurance details applicable to the specific service

- Out-of-pocket maximums and remaining patient responsibility

- Referral and prior authorization requirements, if applicable

- Network status of the provider, facility, and rendering clinician

- Plan limitations or exclusions, such as visit caps or frequency limits

Accurate verification allows practices to determine whether services are reimbursable and identify potential patient responsibility before care is delivered.

When Should Verification of Benefits Be Done?

Verification of benefits should be performed before services are rendered, not after claims are submitted. Timing is critical, as insurance coverage, deductibles, and benefit terms can change without notice.

Ideally, verification begins at the time of appointment scheduling. Early verification allows staff to identify coverage issues, authorization requirements, or patient responsibility concerns before the date of service. This is especially important for new patients, high-cost procedures, and specialty services.

Verification should also be completed:

- Prior to initial patient visits

- Before procedures, surgeries, or diagnostic testing

- When a patient reports new or updated insurance coverage

- At the beginning of a new calendar or benefit year

- Before recurring or ongoing treatment plans

In some cases, verification must be repeated closer to the date of service, particularly if there is a long gap between scheduling and treatment. This ensures that coverage remains active and that deductible or benefit changes are accounted for.

Importance of Verification of Benefits (VOB) in Healthcare Operations

Verification of Benefits (VOB) plays a key role in healthcare operations by ensuring insurance coverage is confirmed before services are provided. When benefits are verified in advance, practices can reduce billing disruptions, communicate financial responsibility clearly, and support timely reimbursement. A consistent VOB process helps align clinical services with payer requirements and revenue cycle workflows.

Reducing claim denials and billing errors

Verification of benefits serves as a critical first line of defense against claim denials by confirming patient insurance coverage details before services are rendered. When VOB is performed accurately, it significantly reduces the risk of denied claims by catching issues such as inactive policies, coverage exclusions, and preauthorization requirements upfront. This proactive approach helps healthcare providers submit claims correctly the first time, minimizing administrative burden and preventing costly billing errors.

Ensuring accurate reimbursement and cash flow

A strong VOB process directly impacts healthcare operations by improving cash flow and reducing revenue cycle delays. By verifying coverage terms, deductibles, copays, and coinsurance rates before treatment, providers can ensure accurate billing and faster reimbursements. This verification process eliminates the need to resubmit claims due to coverage issues, thereby streamlining the revenue cycle and maintaining consistent financial performance for healthcare practices.

Providing cost transparency for patients

VOB enables healthcare providers to communicate clear financial expectations to patients before services are delivered. By verifying benefits upfront, patients receive accurate information about their coverage, potential out-of-pocket costs, and any required authorizations. This transparency builds patient trust, reduces billing surprises, and improves overall patient satisfaction while ensuring patients can make informed decisions about their healthcare.

Maintaining compliance with insurance policies

Effective VOB implementation ensures healthcare providers remain compliant with varying insurance policy requirements and payor rules. The verification process confirms specific coverage details, exclusions, and authorization requirements for different services, helping providers avoid compliance issues that could result in claim denials or regulatory problems. This systematic approach to benefit verification supports adherence to insurance policies and maintains proper documentation for audit purposes.

What Happens If Verification of Benefits Is Not Done?

When verification of benefits is not performed or is done inaccurately, billing issues often surface later in the revenue cycle, when they are more difficult and costly to resolve.

One of the most common outcomes is claim denial due to inactive coverage, non-covered services, or missing authorization requirements. These denials require time-consuming rework, appeals, and follow-up, which delays payment and increases administrative costs.

Without verification, practices may also discover after the fact that services were provided out-of-network, resulting in reduced reimbursement or no payment at all. In these cases, the financial burden may shift to the patient, leading to disputes, dissatisfaction, and collection challenges.

Additional consequences include:

- Delayed reimbursements due to corrected or resubmitted claims

- Increased write-offs for services that cannot be billed retroactively

- Higher staff workload related to appeals and patient inquiries

- Reduced cash flow predictability

Over time, consistently skipping or underperforming verification can weaken payer relationships and negatively impact the overall efficiency of the revenue cycle.

Integration with Other Medical Billing Components

A. Electronic Remittance Advice (ERA) coordination

VOB medical billing seamlessly coordinates with Electronic Remittance Advice systems to ensure accurate payment processing. When verification of benefits identifies specific coverage details, deductibles, and co-insurance amounts, this information directly supports ERA matching processes. Healthcare providers can cross-reference verified benefit amounts with actual remittance data, enabling faster reconciliation and identifying discrepancies between expected and received payments. This integration streamlines revenue cycle management by providing real-time visibility into payment accuracy.

B. Explanation of Benefits (EOB) alignment

Healthcare insurance verification through VOB creates a foundation for proper EOB alignment by establishing baseline coverage expectations before service delivery. The verification process captures essential benefit details, including copays, deductibles, and coverage limits, which directly correspond to EOB reporting. When patient eligibility verification is performed thoroughly, EOB statements reflect accurate benefit calculations, reducing patient confusion and billing disputes. This alignment ensures that both providers and patients receive consistent information regarding coverage and financial responsibilities.

C. Pre-authorization requirement management

The medical billing VOB process integrates closely with pre-authorization workflows to prevent claim denials and service delays. During verification of benefits, staff identify specific services requiring prior approval and document authorization requirements in patient records. This integration enables proactive authorization requests before scheduled appointments, ensuring compliance with payor policies. Healthcare revenue cycle management benefits significantly when VOB systems automatically flag authorization needs, reducing administrative burden and preventing costly service denials due to missing approvals.

D. Claims submission accuracy enhancement

VOB healthcare integration directly enhances claims submission accuracy by providing verified coverage information before billing processes begin. Medical billing verification ensures that submitted claims contain accurate policy numbers, coverage effective dates, and benefit limitations. When verification of benefits is properly integrated with billing systems, claims processors can validate service coverage against verified benefits, reducing rejection rates. This systematic approach to insurance benefits verification minimizes coding errors and improves first-pass claim acceptance rates, ultimately accelerating reimbursement cycles.

Best Practices for Effective VOB Management

Good VOB management comes down to doing the basics right. When benefits are checked carefully and on time, providers avoid payment delays, patients know what to expect, and the billing process runs much smoothly.

1. Implementing Standardized Workflows

Effective VOB management starts with clear and consistent workflows. Standardized procedures for contacting payors, collecting details, documenting information, and communicating with patients help reduce errors and delays.

2. Leveraging Technology and Automation

Integrating VOB systems with EHR and medical billing software makes the process faster and more accurate. Automated checks reduce repetitive tasks, and payer portals provide quick verification so staff can spend more time with patients.

3. Staff Training and Certification

Trained billing staff are essential for accurate VOB. Ongoing education and certifications keep teams updated on payor rules and industry changes, lowering the risk of costly mistakes.

4. Clear Communication Protocols

Providers should explain deductibles, copays, and pre-authorization requirements upfront. Transparent communication with both patients and insurers prevents disputes and builds trust.

5. Comprehensive Documentation

Every verification must be carefully documented, including confirmation numbers, rep names, and coverage limits. Proper records speed up reimbursements and support appeals if needed.

6. Stronger Revenue Cycle Performance

Accurate VOB catches issues like inactive policies or missing authorizations early. This reduces denials, streamlines claims, and keeps revenue cycles running smoothly.

7. Improved Patient Satisfaction

When patients know their financial responsibility before treatment, it eliminates surprise bills. This transparency strengthens trust and supports better long-term relationships.

Conclusion

Verification of Benefits stands as a cornerstone of successful healthcare revenue cycle management, directly impacting both operational efficiency and patient satisfaction. Through proper VOB implementation, healthcare providers can significantly reduce claim denials, eliminate billing disputes, and ensure transparent financial communication with patients. The process requires careful attention to timing, accurate documentation, and clear communication protocols to maximize its effectiveness.

Healthcare organizations that prioritize VOB as part of their comprehensive billing strategy position themselves for improved cash flow, reduced administrative burden, and enhanced patient relationships. By following established best practices, leveraging technology solutions, and maintaining rigorous verification workflows, providers can transform this critical process from a potential challenge into a competitive advantage. The investment in proper VOB procedures ultimately delivers measurable returns through decreased denials, faster reimbursements, and stronger provider-patient trust.

Frequently Asked Questions

Find quick answers to common questions about this topic, explained simply and clearly.

What does VOB mean in healthcare?

VOB, or Verification of Benefits, is the process of confirming a patient’s insurance coverage, benefits, and requirements before treatment. It ensures providers know what services are covered and what costs the patient may owe.

What is the VOB process?

The VOB process involves checking insurance coverage, confirming active eligibility, reviewing benefits such as co-pays and deductibles, and identifying prior authorization needs before a patient’s visit.

Why is verification of benefits important in healthcare?

Verification of benefits is important because it prevents claim denials, reduces payment delays, and ensures patients understand their financial responsibility before care begins.

Can verification of benefits be automated?

Yes. Many practices use software or clearinghouse tools that integrate with EHR systems to automate benefit verification, while still reviewing complex or high-risk cases manually.